UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2011

Commission File No. 000-22490

FORWARD AIR CORPORATION

(Exact name of registrant as specified in its charter)

|

| |

Tennessee | 62-1120025 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

430 Airport Road | |

Greeneville, Tennessee | 37745 |

(Address of principal executive offices) | (Zip Code) |

(423) 636-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Common Stock, $0.01 par value | The NASDAQ Stock Market LLC |

(Title of class) | (Name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting Company o |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes o No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2011 was approximately $981,986,700 based upon the $33.79 closing price of the stock as reported on The NASDAQ Stock Market LLC on that date. For purposes of this computation, all directors and executive officers of the registrant are assumed to be affiliates. This assumption is not a conclusive determination for purposes other than this calculation.

The number of shares outstanding of the registrant’s common stock, $0.01 par value per share as of February 20, 2012 was 28,686,932.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the 2012 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

|

| | |

Table of Contents |

| | |

| Forward Air Corporation | Page Number |

| |

Part I. | | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 1B. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

Part II. | | |

| | |

Item 5. | | |

| | |

Item 6. | | |

| | |

Item 7. | | |

| | |

Item 7A. | | |

| | |

Item 8. | | |

| | |

Item 9. | | |

| | |

Item 9A. | | |

| | |

Item 9B. | | |

| | |

Part III. | | |

| | |

Item 10. | | |

| | |

Item 11. | | |

| | |

Item 12. | | |

| | |

Item 13. | | |

| | |

Item 14. | | |

| | |

Part IV. | | |

| | |

Item 15. | | |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

Introductory Note

This Annual Report on Form 10-K for the fiscal year ended December 31, 2011 (this “Form 10-K”) contains “forward-looking statements,” as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are statements other than historical information or statements of current condition and relate to future events or our future financial performance. Some forward-looking statements may be identified by use of such terms as “believes,” “anticipates,” “intends,” “plans,” “estimates,” “projects” or “expects.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The following is a list of factors, among others, that could cause actual results to differ materially from those contemplated by the forward-looking statements: economic factors such as recessions, inflation, higher interest rates and downturns in customer business cycles, our inability to maintain our historical growth rate because of a decreased volume of freight or decreased average revenue per pound of freight moving through our network, increasing competition and pricing pressure, surplus inventories, loss of a major customer, the creditworthiness of our customers and their ability to pay for services rendered, our ability to secure terminal facilities in desirable locations at reasonable rates, the inability of our information systems to handle an increased volume of freight moving through our network, changes in fuel prices, claims for property damage, personal injuries or workers’ compensation, employment matters including rising health care costs, enforcement of and changes in governmental regulations, environmental and tax matters, the handling of hazardous materials, the availability and compensation of qualified independent owner-operators and freight handlers needed to serve our transportation needs and our inability to successfully integrate acquisitions. As a result of the foregoing, no assurance can be given as to future financial condition, cash flows or results of operations. Except as required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Part I

Item 1. Business

We were formed as a corporation under the laws of the State of Tennessee on October 23, 1981. Our operations can be broadly classified into two principal segments: Forward Air, Inc. (“Forward Air”) and Forward Air Solutions, Inc. (“FASI”).

Through our Forward Air segment, we are a leading provider of time-definite surface transportation and related logistics services to the North American expedited ground freight market. We offer our customers local pick-up and delivery (Forward Air Complete™) and scheduled surface transportation of cargo as a cost-effective, reliable alternative to air transportation. We transport cargo that must be delivered at a specific time but is less time-sensitive than traditional air freight. This type of cargo is frequently referred to in the transportation industry as deferred air freight. We operate our Forward Air segment through a network of terminals located on or near airports in 85 cities in the United States and Canada, including a central sorting facility in Columbus, Ohio and 12 regional hubs serving key markets. We also offer our customers an array of logistics and other services including: expedited full truckload (“TLX”); dedicated fleets; warehousing; customs brokerage; and shipment consolidation, deconsolidation and handling.

Through our Forward Air segment, we market our airport-to-airport services primarily to freight forwarders, integrated air cargo carriers, and passenger and cargo airlines. To serve this market, we offer customers a high level of service with a focus on on-time, damage-free deliveries. We serve our customers by locating our terminals on or near airports and maintaining regularly scheduled transportation service between major cities. We either receive shipments at our terminals or if instructed to do so pick up shipments directly from our customers. We then transport the freight by truck (i) directly to the destination terminal; (ii) to our Columbus, Ohio central sorting facility; or (iii) to one of our 12 regional hubs, where they are unloaded, sorted and reloaded. After reloading the shipments, we deliver them to the terminals nearest their destinations and then, if requested by the customer, on to a final designated site. We ship freight directly between terminals when justified by the tonnage volume.

During 2011, approximately 23.9% of the freight we handled was for overnight delivery, approximately 61.3% was for delivery within two to three days and the balance was for delivery in four or more days. We generally do not market our airport-to-airport services directly to shippers (where such services might compete with our freight forwarder customers). Also, because we do not place significant size or weight restrictions on airport-to-airport shipments, we generally do not compete directly with integrated air cargo carriers such as United Parcel Service and Federal Express in the overnight delivery of small parcels. In 2011, Forward Air’s five largest customers accounted for approximately 25.1% of Forward Air’s operating revenue and no single customer accounted for more than 10.0% of Forward Air’s operating revenue.

We continue to develop and implement complimentary services to the airport-to-airport network. Our complimentary services including TLX full truckload; dedicated fleets; local pick-up and delivery; warehousing; customs brokerage; and shipment

consolidation, deconsolidation and handling are critical to helping meet the changing needs of our customers and for efficiently using the people and resources of our airport-to-airport network.

Through our FASI segment, which we formed in July 2007, we provide pool distribution services throughout the Mid-Atlantic, Southeast, Midwest and Southwest continental United States. Pool distribution involves managing high-frequency, last mile handling and distribution of time-sensitive product to numerous destinations in specific geographic regions. Our primary customers for pool distribution are regional and nationwide distributors and specialty retailers, such as mall, strip mall and outlet-based retail chains. We service these customers through a network of terminals and service centers located in 19 cities. FASI’s four largest customers accounted for approximately 77.9% of FASI’s 2011 operating revenue, but revenues from these four customers did not exceed 10.0% of our consolidated revenue. No other customers accounted for more than 10.0% of FASI’s operating revenue.

Our Industry

As businesses minimize inventory levels, close regional and local distribution centers, perform manufacturing and assembly operations in multiple locations and distribute their products through multiple channels, they have an increased need for expedited or time-definite delivery services. Expedited or time-definite shipments are those shipments for which the customer requires delivery the next day or within two to three days, usually by a specified time or within a specified time window.

Shippers with expedited or time-definite delivery requirements have several principal alternatives to transport freight: freight forwarders; integrated air cargo carriers; less-than-truckload carriers; full truckload carriers, and passenger and cargo airlines.

Although expedited or time-definite freight is often transported by aircraft, freight forwarders and shippers often elect to arrange for its transportation by truck, especially for shipments requiring delivery within two to three days. Generally, the cost of shipping freight, especially heavy freight, by truck is substantially less than shipping by aircraft. We believe there are several trends that are increasing demand for lower-cost truck transportation of expedited freight. These trends include:

| |

• | Freight forwarders obtain requests for shipments from customers, make arrangements for transportation of the cargo by a third-party carrier and usually arrange for both delivery from the shipper to the carrier and from the carrier to the recipient. |

| |

• | Integrated air cargo carriers provide pick-up and delivery services primarily using their own fleet of trucks and provide transportation services generally using their own fleet of aircraft. |

| |

• | Less-than-truckload carriers also provide pick-up and delivery services through their own fleet of trucks. These carriers operate terminals where a single shipment is unloaded, sorted and reloaded multiple times. This additional handling increases transit time, handling costs and the likelihood of cargo damage or theft. |

| |

• | Full truckload carriers provide transportation services generally using their own fleet of trucks. A freight forwarder or shipper must have a shipment of sufficient size to justify the cost of a full truckload. These cost benefit concerns can inhibit the flexibility often required by freight forwarders or shippers. |

| |

• | Passenger or cargo airlines provide airport-to-airport service, but have limited cargo space and generally accept only shipments weighing less than 150 pounds. |

Competitive Advantages

We believe that the following competitive advantages are critical to our success in both our Forward Air and FASI segments:

| |

• | Focus on Specific Freight Markets. Our Forward Air segment focuses on providing time-definite surface transportation and related logistics services to the North American expedited ground freight market. Our FASI segment focuses on providing high-quality pool distribution services to retailers and nationwide distributors of retail products. This focused approach enables us to provide a higher level of service in a more cost-effective manner than our competitors. |

| |

• | Expansive Network of Terminals and Sorting Facilities. We have developed a network of Forward Air terminals and sorting facilities throughout the United States and Canada located on or near airports. We believe it would be difficult for a competitor to duplicate our Forward Air network with the expertise and strategic facility locations we have acquired without expending significant capital and management resources. Our expansive Forward Air network enables us to provide regularly scheduled service between most markets with low levels of freight damage or loss, all at rates which in general are significantly below air freight rates. |

We have established a FASI network of terminals and service centers throughout the Mid-Atlantic, Southeast, Midwest and Southwest continental United States. The pool distribution market is very fragmented and our competition primarily consists of regional and local providers. We believe that through our network of FASI terminals and service locations we can offer our pool distribution customers comprehensive, high-quality, consistent service across the majority of the continental United States.

| |

• | Concentrated Marketing Strategy. Forward Air provides our expedited ground freight services mainly to freight forwarders, integrated air cargo carriers, and passenger and cargo airlines rather than directly serving shippers. Forward Air does not place significant size or weight restrictions on shipments and, therefore, it does not compete with delivery services such as United Parcel Service and Federal Express in the overnight small parcel market. We believe that Forward Air customers prefer to purchase their transportation services from us because, among other reasons, we generally do not market Forward Air’s services to their shipper customers and, therefore, do not compete directly with them for customers. |

FASI provides pool distribution services primarily to regional and nationwide distributors and specialty retailers, such as mall, strip mall and outlet-based retail chains.

| |

• | Superior Service Offerings. Forward Air’s published expedited ground freight schedule for transit times with specific cut-off and arrival times generally provides Forward Air customers with the predictability they need. In addition, our network of Forward Air terminals allows us to offer our customers later cut-off times, a higher percentage of direct shipments (which reduces damage and shortens transit times) and earlier delivery times than most of our competitors. Our network of FASI terminals allows us the opportunity to provide precision deliveries to a wider range of locations than most pool distribution providers with increased on-time performance. The recession of 2008 and 2009 resulted in reduced inventory levels and increased shippers' need for reliable, expedited delivery. We believe the trend of minimal inventories and increased expedited shipping will continue, and that our network of terminals and expedited capabilities put us in an excellent position to benefit from these trends. |

| |

• | Flexible Business Model. Rather than owning and operating our own fleet of trucks, Forward Air purchases most of its transportation requirements from owner-operators or truckload carriers. This allows Forward Air to respond quickly to changing demands and opportunities in our industry and to generate higher returns on assets because of the lower capital requirements. |

Due to the nature of pool distribution services, FASI utilizes a higher percentage of Company-employed drivers and Company-owned equipment than Forward Air. However, as the conditions of individual markets and requirements of our customers allow, we are increasing the usage of owner-operators in our pool distribution business.

| |

• | Comprehensive Logistic and Other Service Offerings. Through our two segments we offer an array of logistic and other services including: TLX, pick-up and delivery (Forward Air Complete™), dedicated fleet, warehousing, customs brokerage and shipment consolidation and handling. These services are an essential part of many of our customers’ transportation needs and are not offered by many of our competitors. We are able to provide these services utilizing existing infrastructure and thereby earning additional revenue without incurring significant additional fixed costs. |

| |

• | Leading Technology Platform. We are committed to using information technology to improve our operations. Through improved information technology, we believe we can increase the volume of freight we handle in our networks, improve visibility of shipment information and reduce our operating costs. Our technology allows us to provide our customers with electronic bookings and real-time tracking and tracing of shipments while in our network, complete shipment history, proof of delivery, estimated charges and electronic bill presentment. We continue to enhance our systems to permit us and our customers to access vital information through both the Internet and electronic data interchange. We have continued to invest in information technology to the benefit of our customers and our business processes. |

| |

• | Strong Balance Sheet and Availability of Funding. Our asset-light business model and strong market position in the expedited ground freight market provides the foundation for operations that have produced excellent cash flow from operations even in challenging conditions. Our strong balance sheet can also be a competitive advantage. Our competitors, particularly in the pool distribution market, are mainly regional and local operations and may struggle to maintain operations in the current economic environment. The threat of financial instability may encourage new and existing customers to use a more financially secure transportation provider, such as FASI. |

Growth Strategy

Our growth strategy is to take advantage of our competitive strengths in order to increase our profits and shareholder returns. Our goal is to use our established networks as the base from which to expand and launch new services that will allow us to grow in any economic environment. Principal components of our efforts include:

| |

• | Increase Freight Volume from Existing Customers. Many of our customers currently use us for only a portion of their overall transportation needs. We believe we can increase freight volumes from existing customers by offering more comprehensive services that address all of the customer’s transportation needs, such as Forward Air Complete™, our direct to door pick-up and delivery service. By offering additional services that can be integrated with our existing services, we believe we will attract additional business from existing customers. |

| |

• | Develop New Customers. We continue to actively market our services to potential new customers. In our Forward Air segment, we believe freight forwarders will continue to move away from integrated air cargo carriers because those carriers charge higher rates, and away from less-than-truckload carriers because those carriers provide less reliable service and compete for the same customers as do the freight forwarders. In addition, we believe Forward Air’s comprehensive North American network and related logistics services are attractive to domestic and international airlines. Forward Air Complete™ can also help attract business from new customers who require pick-up and delivery for their shipments. In our pool distribution business, we are emphasizing the development of relationships with customers who have peak volume seasons outside of the traditional fourth quarter spike in order to stabilize FASI’s earnings throughout the calendar year. We are currently targeting customers from industries such as hospitality, healthcare, lawn and garden and publishing. We continue to evaluate plans to expand FASI’s terminal footprint by opening FASI operations in select Forward Air terminals. We believe the utilization of existing Forward Air terminals will allow us to increase our FASI revenues with minimal addition of fixed costs. |

| |

• | Improve Efficiency of Our Transportation Network. We constantly seek to improve the efficiency of our networks. Regional hubs and direct shuttles improve Forward Air’s efficiency by reducing the number of miles freight must be transported and the number of times freight must be handled and sorted. As the volume of freight between key markets increases, we intend to continue to add direct shuttles. Since 2006, we have constructed or expanded terminals in key gateway cities. With these expanded facilities, we believe we have the necessary space to grow our business in key gateway cities and to offer additional services. We are working to improve our FASI operations by increasing the efficiencies of our daily and weekly transportation routes and the cartons handled per hour on our docks. We are constantly looking to improve FASI route efficiencies by consolidating loads and utilizing owner-operators when available. We are investing in conveyor systems for certain FASI terminals to increase the productivity of our cargo handlers. Finally, we are actively looking to reduce or eliminate the number of duplicate facilities in cities which have both Forward Air and FASI terminals. We have combined Forward Air and FASI facilities in Dallas/Fort Worth, Texas, Des Moines, Iowa, Denver, Colorado, Kansas City, Missouri, Nashville, Tennessee, Richmond, Virginia and Tulsa, Oklahoma, and will continue this process in upcoming years as the expiration of leases and business volumes allow. In addition, FASI is providing agent station services to Forward Air in Albuquerque, New Mexico and Montgomery, Alabama. |

| |

• | Expand Logistics and Other Services. We continue to expand our logistics and other services to increase revenue and improve utilization of our terminal facilities and labor force. Because of the timing of the arrival and departure of cargo, our facilities are under-utilized during certain portions of the day, allowing us to add logistics services without significantly increasing our costs. Therefore, we have added a number of logistic services in the past few years, such as TLX, dedicated fleet, warehousing, customs brokerage and shipment consolidation and handling services. These services directly benefit our existing customers and increase our ability to attract new customers, particularly those customers that cannot justify providing the services directly. These services are not offered by many transportation providers with whom we compete and are attractive to customers who prefer to use one provider for all of their transportation needs. |

| |

• | Expand Pool Distribution Services and Integrate with our Forward Air Services. In addition to increasing our revenue from traditional pool distribution services, we are working to expand FASI’s customer base beyond retail and to integrate our Forward Air and FASI service offerings. Through this process, we are able to offer customers linehaul or truckload services, with handling and sorting at the origin and destination terminal, and final distribution to one or many locations utilizing FASI pool distribution and Forward Air Complete™. |

| |

• | Enhance Information Systems. We are committed to the continued development and enhancement of our information systems in ways that will continue to provide us competitive service advantages and increased productivity. We believe our enhanced systems have and will assist us in capitalizing on new business opportunities with existing customers and developing relationships with new customers. |

| |

• | Pursue Strategic Acquisitions. We continue to evaluate acquisitions that can increase our penetration of a geographic area, add new customers, add new business verticals, increase freight volume and add new service offerings. In addition, we expect to explore acquisitions that may enable us to offer additional services. Since our inception, we have acquired certain assets and liabilities of 12 businesses that met one or more of these criteria. |

Operations

We operate in two reportable segments, based on differences in the services provided: Forward Air and FASI. Through Forward Air, we are a leading provider of time-definite transportation and related logistics services to the North American expedited ground freight market. Forward Air’s activities can be broadly classified into three categories of services: airport-to-airport, logistics and other.

Through our FASI segment, we provide pool distribution services throughout the Mid-Atlantic, Southeast, Midwest and Southwest continental United States. Pool distribution involves managing high-frequency handling and distribution of time-sensitive product to numerous destinations in specific geographic regions.

Forward Air

Airport-to-airport

We receive freight from freight forwarders, integrated air cargo carriers and passenger and cargo airlines at our terminals, which are located on or near airports in the United States and Canada. We also pick up freight from customers at designated locations via our Forward Air Complete™ service. We consolidate and transport these shipments by truck through our network to our terminals nearest the ultimate destinations of the shipments. We operate regularly scheduled service to and from each of our terminals through our Columbus, Ohio central sorting facility, through one of our 12 regional hubs or, as volumes require, direct point-to-point service. We also operate regularly scheduled shuttle service directly between terminals where the volume of freight warrants bypassing the Columbus, Ohio central sorting facility or a regional hub. When a shipment arrives at our terminal nearest its destination, the customer arranges for the shipment to be picked up and delivered to its final destination, or we, in the alternative, through our Forward Air Complete™ service, deliver the freight for the customer to its final destination.

Terminals

Our airport-to-airport network consists of terminals located in the following 85 cities:

|

| | | | | | |

City | | Airport Served | | City | | Airport Served |

Albany, NY | | ALB | | Louisville, KY | | SDF |

Albuquerque, NM*** | | ABQ | | Memphis, TN | | MEM |

Allentown, PA* | | ABE | | McAllen, TX | | MFE |

Atlanta, GA | | ATL | | Miami, FL | | MIA |

Austin, TX | | AUS | | Milwaukee, WI | | MKE |

Baltimore, MD | | BWI | | Minneapolis, MN | | MSP |

Baton Rouge, LA* | | BTR | | Mobile, AL* | | MOB |

Birmingham, AL* | | BHM | | Moline, IA | | MLI |

Blountville, TN* | | TRI | | Montgomery, AL*** | | MGM |

Boston, MA | | BOS | | Nashville, TN** | | BNA |

Buffalo, NY | | BUF | | Newark, NJ | | EWR |

Burlington, IA | | BRL | | Newburgh, NY | | SWF |

Cedar Rapids, IA | | CID | | New Orleans, LA | | MSY |

Charleston, SC | | CHS | | New York, NY | | JFK |

Charlotte, NC | | CLT | | Norfolk, VA | | ORF |

Chicago, IL | | ORD | | Oklahoma City, OK | | OKC |

Cincinnati, OH | | CVG | | Omaha, NE | | OMA |

Cleveland, OH | | CLE | | Orlando, FL | | MCO |

Columbia, SC* | | CAE | | Pensacola, FL* | | PNS |

Columbus, OH | | CMH | | Philadelphia, PA | | PHL |

Corpus Christi, TX* | | CRP | | Phoenix, AZ | | PHX |

Dallas/Ft. Worth, TX** | | DFW | | Pittsburgh, PA | | PIT |

Dayton, OH* | | DAY | | Portland, OR | | PDX |

Denver, CO** | | DEN | | Raleigh, NC | | RDU |

Des Moines, IA** | | DSM | | Richmond, VA** | | RIC |

Detroit, MI | | DTW | | Rochester, NY | | ROC |

El Paso, TX | | ELP | | Sacramento, CA | | SMF |

Grand Rapids, MI* | | GRR | | Salt Lake City, UT | | SLC |

Greensboro, NC | | GSO | | San Antonio, TX | | SAT |

Greenville, SC | | GSP | | San Diego, CA | | SAN |

Hartford, CT | | BDL | | San Francisco, CA | | SFO |

Harrisburg, PA | | MDT | | Seattle, WA | | SEA |

Houston, TX | | IAH | | Shreveport, LA* | | SHV |

Huntsville, AL* | | HSV | | St. Louis, MO | | STL |

Indianapolis, IN | | IND | | Syracuse, NY | | SYR |

Jacksonville, FL | | JAX | | Tampa, FL | | TPA |

Kansas City, MO** | | MCI | | Toledo, OH* | | TOL |

Knoxville, TN* | | TYS | | Tucson, AZ* | | TUS |

Lafayette, LA* | | LFT | | Tulsa, OK** | | TUL |

Laredo, TX | | LRD | | Washington, DC | | IAD |

Las Vegas, NV | | LAS | | Montreal, Canada* | | YUL |

Little Rock, AR* | | LIT | | Toronto, Canada | | YYZ |

Los Angeles, CA | | LAX | | | | |

* Denotes an independent agent location.

** Denotes a location with combined Forward Air and FASI operations.

*** Denotes an agent location operated by FASI.

Independent agents and FASI operate 18 and 2 of our Forward Air locations, respectively. These locations typically handle lower volumes of freight relative to our Company-operated facilities.

Direct Service and Regional Hubs

We operate direct terminal-to-terminal services and regional overnight service between terminals where justified by freight volumes. We currently provide regional overnight service to many of the markets within our network. Direct service allows us to provide quicker scheduled service at a lower cost because it allows us to minimize out-of-route miles and eliminate the added time and cost of handling the freight at our central or regional hub sorting facilities. Direct shipments also reduce the likelihood of damage because of reduced handling and sorting of the freight. As we continue to increase volume between various terminals, we intend to add other direct services. Where warranted by sufficient volume in a region, we utilize larger terminals as regional sorting hubs, which allow us to bypass our Columbus, Ohio central sorting facility. These regional hubs improve our operating efficiency and enhance customer service. We operate regional hubs in Atlanta, Charlotte, Chicago, Dallas/Ft. Worth, Denver, Kansas City, Los Angeles, New Orleans, Newark, Newburgh, Orlando, and Sacramento.

Shipments

The average weekly volume of freight moving through our network was approximately 34.0 million pounds per week in 2011. During 2011, our average shipment weighed approximately 717 pounds and shipment sizes ranged from small boxes weighing only a few pounds to large shipments of several thousand pounds. Although we impose no significant size or weight restrictions, we focus our marketing and price structure on shipments of 200 pounds or more. As a result, we typically do not directly compete with integrated air cargo carriers in the overnight delivery of small parcels. The table below summarizes the average weekly volume of freight moving through our network for each year since 1997.

|

| |

| Average Weekly |

| Volume in Pounds |

Year | (In millions) |

1997 | 12.4 |

1998 | 15.4 |

1999 | 19.4 |

2000 | 24.0 |

2001 | 24.3 |

2002 | 24.5 |

2003 | 25.3 |

2004 | 28.7 |

2005 | 31.2 |

2006 | 32.2 |

2007 | 32.8 |

2008 | 34.2 |

2009 | 28.5 |

2010 | 32.6 |

2011 | 34.0 |

Logistics and Other Services

Our customers increasingly demand more than the movement of freight from their transportation providers. To meet these demands, we continually seek ways to customize our logistics services and add new services. Logistics and other services increase our profit margins by increasing our revenue without corresponding increases in our fixed costs, as airport-to-airport assets and resources are primarily used to provide the logistics and other services.

Our logistics and other services allow customers to access the following services from a single source:

| |

• | expedited full truckload, or TLX; |

| |

• | customs brokerage, such as assistance with U.S. Customs and Border Protection (“U.S. Customs”) procedures for both import and export shipments; |

| |

• | warehousing, dock and office space; |

| |

• | hotshot or ad-hoc ultra expedited services; and |

| |

• | shipment consolidation and handling, such as shipment build-up and break-down and reconsolidation of air or ocean pallets or containers. |

These services are critical to many of our freight forwarder customers that do not provide logistics services themselves or that prefer to use one provider for all of their surface transportation needs.

Revenue and purchased transportation for our TLX and dedicated fleet services are largely determined by the number of miles driven. The table below summarizes the average miles driven per week to support our logistics services since 2003:

|

| |

| Average Weekly Miles |

Year | (In thousands) |

2003 | 211 |

2004 | 259 |

2005 | 248 |

2006 | 331 |

2007 | 529 |

2008 | 676 |

2009 | 672 |

2010 | 788 |

2011 | 876 |

Forward Air Solutions (FASI)

Pool Distribution

Through our FASI segment we provide pool distribution services through a network of terminals and service locations in 19 cities throughout the Mid-Atlantic, Southeast, Midwest and Southwest continental United States. Pool distribution involves managing high-frequency handling and distribution of time-sensitive product to numerous destinations in specific geographic regions. Our primary customers for this product are regional and nationwide distributors and retailers, such as mall, strip mall and outlet-based retail chains. However, in order to reduce the seasonal volatility of FASI’s revenue, we are focused on diversifying the FASI customer base to include customers from industries such as hospitality, health care, lawn and garden and publishing.

Our pool distribution network consists of terminals and service locations in the following 19 cities:

|

| |

City |

Albuquerque, NM*** | Lakeland, FL |

Atlanta, GA | Las Vegas, NV |

Baltimore, MD | Miami, FL |

Charlotte, NC | Montgomery, AL*** |

Dallas/Ft. Worth, TX** | Nashville, TN** |

Denver, CO** | Raleigh, NC |

Des Moines, IA** | Richmond, VA** |

Houston, TX | San Antonio, TX |

Jacksonville, FL | Tulsa, OK** |

Kansas City, MO** | |

** Denotes a location with combined Forward Air and FASI operations.

*** Denotes a location that provides agent station services to Forward Air.

Customers and Marketing

Our Forward Air wholesale customer base is primarily comprised of freight forwarders, integrated air cargo carriers and passenger and cargo airlines. Our freight forwarder customers vary in size from small, independent, single facility companies to large, international logistics companies such as SEKO Worldwide, AIT Worldwide Logistics, Expeditors International of Washington, Associated Global, UPS Supply Chain Solutions and Pilot Air Freight. Because we deliver dependable service, integrated air cargo carriers such as UPS Cargo and DHL Worldwide Express use our network to provide overflow capacity and other services, including shipment of bigger packages and pallet-loaded cargo. Our passenger and cargo airline customers include British Airways, United Airlines and Delta.

Our FASI pool distribution customers are primarily comprised of national and regional retailers and distributors, such as The Limited, The Marmaxx Group, The GAP, and Aeropostale. However, in order to reduce the seasonal volatility of FASI’s revenue, we are focused on diversifying the FASI customer base to include customers from industries such as hospitality, health care, lawn and garden and publishing.

We market all our services through a sales and marketing staff located in major markets of the United States. Senior management also is actively involved in sales and marketing at the national account level and supports local sales initiatives. We also participate in air cargo and retail trade shows and advertise our services through direct mail programs and through the Internet via www.forwardair.com and www.forwardairsolutions.com. The information contained on our websites are not part of this filing and are therefore not incorporated by reference unless such information is otherwise specifically referenced elsewhere in this report.

Technology and Information Systems

Our technology allows us to provide our customers with real-time tracking and tracing of shipments throughout the transportation process, complete shipment history, proof of delivery, estimated charges and electronic bill presentment. In addition, our customers are able to electronically transmit bookings to us from their own networks and schedule transportation and obtain tracking and tracing information. We continue to develop and enhance our systems to permit our customers to obtain this information both through the Internet and through electronic data interchange.

We continue to enhance our operational applications and website service offerings in our continuing effort to automate and improve our operations. Our Forward Air Complete™ website coordinates activities between our customers, operations personnel and external service providers. We believe that our systems, websites and other technical enhancements will assist us in capitalizing on new business opportunities and could encourage customers to increase the volume of freight they send through our network.

We continued to make significant investments in technology for FASI. We continued our development of FASI driven enhancements to our existing Forward Air applications. These enhancements, collectively known as FASTRACS, is designed specifically to meet the retail distribution business demands, and makes use of the most modern wireless technologies available. FASTRACS was implemented in 2010 for a select group of customers and is being designed so as to be the primary technology platform for all future customers.

Purchased Transportation

We contract for most of our Forward Air transportation services on a per mile basis from owner-operators. FASI also utilizes owner-operators for its transportation services, but also relies on Company-employed drivers. The owner-operators own, operate and maintain their own tractors and employ their own drivers. Our freight handlers load and unload our trailers and vehicles for hauling by owner-operators between our terminals.

We seek to establish long-term relationships with owner-operators to assure dependable service and availability. Historically, we have experienced significantly higher than industry average retention of owner-operators. We have established specific guidelines relating to safety records, driving experience and personal evaluations that we use to select our owner-operators. To enhance our relationship with the owner-operators, our per mile rates are generally above prevailing market rates. In addition, we typically offer our owner-operators and their drivers a consistent work schedule. Usually, schedules are between the same two cities or along a consistent route, improving quality of work life for the owner-operators and their drivers and, in turn, increasing driver retention.

As a result of efforts to expand our logistics and other services, seasonal demands and volume surges in particular markets, we also purchase transportation from other surface transportation providers to handle overflow volume. Of the $223.0 million incurred for purchased transportation during 2011, we purchased 62.5% from owner-operators and 37.5% from other surface transportation providers.

Competition

The expedited ground freight and pool distribution segments of the transportation industry are highly competitive and very fragmented. Our Forward Air and FASI competitors primarily include national and regional truckload and less-than-truckload carriers. To a lesser extent, Forward Air also competes with integrated air cargo carriers and passenger and cargo airlines.

We believe competition is based primarily on service, on-time delivery, flexibility and reliability, as well as rates. We offer our Forward Air services at rates that generally are significantly below the charge to transport the same shipment to the same destination by air. We believe Forward Air has an advantage over less-than-truckload carriers because Forward Air delivers faster, more reliable service between many cities. We believe FASI has an advantage over its competitors due to its presence in several regions across the continental United States allowing us to provide consistent, high-quality service to our customers regardless of location.

Seasonality

Historically, our operating results have been subject to seasonal trends when measured on a quarterly basis. The first quarter has traditionally been the weakest and the third and fourth quarters have traditionally been the strongest. Typically, this pattern has been the result of factors such as economic conditions, customer demand, weather and national holidays. Additionally, a significant portion of our revenue is derived from customers whose business levels are impacted by the economy. The impact of seasonal trends is more pronounced on our pool distribution business. The pool distribution business is seasonal and operating revenues and results tend to improve in the third and fourth quarters compared to the first and second quarters.

Employees

As of December 31, 2011, we had 1,955 full-time employees, 591 of whom were freight handlers. Also, as of that date, we had an additional 1,181 part-time employees, of whom the majority were freight handlers. None of our employees are covered by a collective bargaining agreement. We recognize that our workforce, including our freight handlers, is one of our most valuable assets. The recruitment, training and retention of qualified employees is essential to support our continued growth and to meet the service requirements of our customers.

Risk Management and Litigation

Under U.S. Department of Transportation (“DOT”) regulations, we are liable for property damage and personal injuries caused by owner-operators and Company-employed drivers while they are operating on our behalf. We currently maintain liability insurance coverage that we believe is adequate to cover third-party claims. We have a self-insured retention of $0.5 million per occurrence for vehicle and general liability claims. We may also be subject to claims for workers’ compensation. We maintain workers’ compensation insurance coverage that we believe is adequate to cover such claims. We have a self-insured retention of approximately $0.3 million for each such claim, except in Ohio, where we are a qualified self-insured entity with an approximately $0.4 million self-insured retention. We could incur claims in excess of our policy limits or incur claims not covered by our insurance.

From time to time, we are a party to litigation arising in the normal course of our business, most of which involve claims for personal injury, property damage related to the transportation and handling of freight, or workers’ compensation. We do not believe that any of these pending actions, individually or in the aggregate, will have a material adverse effect on our business, financial condition or results of operations.

Regulation

The DOT and various state and federal agencies have been granted broad powers over our business. These entities generally regulate such activities as authorization to engage in property brokerage and motor carrier operations, safety and financial reporting. We are licensed through our subsidiaries by the DOT as a motor carrier and as a property broker to arrange for the transportation of freight by truck. Our domestic customs brokerage operations are licensed by U.S. Customs. We are subject to similar regulation in Canada.

Service Marks

Through one of our subsidiaries, we hold federal trademark registrations or applications for federal trademark registration, associated with the following service marks: Forward Air, Inc. ®, North America’s Most Complete Roadfeeder Network ®, Forward Air ™, Forward Air Solutions ®, Forward Air TLX™, and Forward Air Complete ™. These marks are of significant value to our business.

Website Access

We file reports with the Securities and Exchange Commission (the “SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports from time to time. We are an electronic filer and the SEC maintains an Internet site at www.sec.gov that contains these reports and other information filed electronically. We make available free of charge through our website our Code of Business Conduct and Ethics and our reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Our website addresses are www.forwardair.com and www.forwardairsolutions.com. Please note that these website addresses are provided as an inactive textual reference only. The information provided on the website is not part of this report, and is therefore not incorporated by reference unless such information is otherwise specifically referenced elsewhere in this report.

Item 1A. Risk Factors

In addition to the other information in this Form 10-K and other documents we have filed with the SEC from time to time, the following factors should be carefully considered in evaluating our business. Such factors could affect results and cause results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, us. Some or all of these factors may apply to our business.

Severe economic downturns like the recession experienced in 2008 and 2009 can result in weaker demand for ground transportation services, which may have a significant negative impact on our results of operations.

During 2008 and 2009, we experienced significantly weaker demand for our airport-to-airport and pool distribution services as a result of the severe downturn in the economy. We began to experience weakening demand late in 2008, and this weakness continued throughout most of 2009. During the time in question, we adjusted the size of our owner-operator fleet and reduced employee headcount to compensate for the drop in demand. If the economic downturn persisted or worsened, demand for our services may have continued to weaken. No assurance can be given that reductions in owner-operators and employees or other steps we may take during similar times in the future will be adequate to offset the effects of reduced demand. If we experience another economic downturn it may have a negative impact on our results of operations.

Our business is subject to general economic and business factors that are largely out of our control, any of which could have a material adverse effect on our results of operations.

Our business is dependent upon a number of factors that may have a material adverse effect on the results of our operations, many of which are beyond our control. These factors include increases or rapid fluctuations in fuel prices, capacity in the trucking industry, insurance premiums, self-insured retention levels and difficulty in attracting and retaining qualified owner-operators and freight handlers. Our profitability would decline if we were unable to anticipate and react to increases in our operating costs, including purchased transportation and labor, or decreases in the amount of revenue per pound of freight shipped through our system. As a result of competitive factors, we may be unable to raise our prices to meet increases in our operating costs, which could result in a material adverse effect on our business, results of operations and financial condition.

Economic conditions may adversely affect our customers and the amount of freight available for transport. This may require us to lower our rates, and this may also result in lower volumes of freight flowing through our network. Customers encountering adverse economic conditions represent a greater potential for loss, and we may be required to increase our reserve for bad-debt losses.

Our results of operations may be affected by seasonal factors. Volumes of freight tend to be lower in the first quarter after the winter holiday season. In addition, it is not possible to predict the short or long-term effects of any geopolitical events on the economy or on consumer confidence in the United States, or their impact, if any, on our future results of operations.

In order to grow our business, we will need to increase the volume and revenue per pound of the freight shipped through our networks.

Our growth depends in significant part on our ability to increase the amount and revenue per pound of freight shipped through our networks. The amount of freight shipped through our networks and our revenue per pound depend on numerous factors, many of which are beyond our control, such as economic conditions and our competitors’ pricing. Therefore, we cannot guarantee that the amount of freight shipped or the revenue per pound we realize on that freight will increase or even remain at current levels. If we fail to increase the volume of the freight shipped through our networks or the revenue per pound of the freight shipped, we may be unable to maintain or increase our profitability.

Our rates, overall revenue and expenses are subject to volatility.

Our rates are subject to change based on competitive pricing and market factors. Our overall transportation rates consist of base transportation and fuel surcharge rates. Our base transportation rates exclude fuel surcharges and are set based on numerous factors such as length of haul, freight class and weight per shipment. The base rates are subject to change based on competitive pricing pressures and market factors. Most of our competitors impose fuel surcharges, but there is no industry standard for the calculation of fuel surcharge rates. Our fuel surcharge rates are set weekly based on the national average for fuel prices as published by the U.S. Department of Energy (“DOE”) and our fuel surcharge table. Historically, we have not adjusted our method for determining fuel surcharge rates.

Our net fuel surcharge revenue is the result of our fuel surcharge rates and the tonnage transiting our networks. The fuel surcharge revenue is then netted with the fuel surcharge we pay to our owner-operators and third party transportation providers. Fluctuations in tonnage levels, related load factors, and fuel prices may subject us to volatility in our net fuel surcharge revenue. This potential volatility in net fuel surcharge revenue may adversely impact our overall revenue, base transportation revenue plus net fuel surcharge revenue, and results of operations.

Because a portion of our network costs are fixed, we will be adversely affected by any decrease in the volume or revenue per pound of freight shipped through our networks.

Our operations, particularly our networks of hubs and terminals, represent substantial fixed costs. As a result, any decline in the volume or revenue per pound of freight we handle may have an adverse effect on our operating margin and our results of operations. Typically, Forward Air does not have contracts with its customers. FASI does have contracts with its customers but these contracts typically have terms allowing cancellation within 30 to 60 days. As a result, we cannot guarantee that our current customers will continue to utilize our services or that they will continue at the same levels. The actual shippers of the freight moved through our networks include various manufacturers, distributors and/or retailers of electronics, clothing, telecommunications equipment, machine parts, trade show exhibit materials and medical equipment. Adverse business conditions affecting these shippers or adverse general economic conditions are likely to cause a decline in the volume of freight shipped through our networks.

We operate in highly competitive and fragmented segments of our industry, and our business will suffer if we are unable to adequately address downward pricing pressures and other factors that may adversely affect our operations and profitability.

The segments of the freight transportation industry we participate in are highly competitive, very fragmented and historically have few barriers to entry. Our principal competitors include national and regional truckload and less-than-truckload carriers. To a lesser extent, we also compete with integrated air cargo carriers and passenger airlines. Our competition ranges from small operators that compete within a limited geographic area to companies with substantially greater financial and other resources, including greater freight capacity. We also face competition from freight forwarders who decide to establish their own networks to transport expedited ground freight. We believe competition is based primarily on service, on-time delivery, flexibility and reliability, as well as rates. Many of our competitors periodically reduce their rates to gain business, especially during times of economic decline. In the past several years, several of our competitors have reduced their rates to unusually low levels that we believe are unsustainable in the long-term, but that may materially adversely affect our business in the short-term. These competitors may cause a decrease in our volume of freight, require us to lower the prices we charge for our services and adversely affect both our growth prospects and profitability.

Claims for property damage, personal injuries or workers’ compensation and related expenses could significantly reduce our earnings.

Under DOT regulations, we are liable for property damage and personal injuries caused by owner-operators and Company-employed drivers while they are operating on our behalf. We currently maintain liability insurance coverage that we believe is

adequate to cover third-party claims. We have a self-insured retention of $0.5 million per occurrence for vehicle and general liability claims. We may also be subject to claims for workers’ compensation. We maintain workers’ compensation insurance coverage that we believe is adequate to cover such claims. We have a self-insured retention of approximately $0.3 million for each such claim, except in Ohio, where we are a qualified self-insured entity with an approximately $0.4 million self-insured retention. We could incur claims in excess of our policy limits or incur claims not covered by our insurance. Any claims beyond the limits or scope of our insurance coverage may have a material adverse effect on us. Because we do not carry “stop loss” insurance, a significant increase in the number of claims that we must cover under our self-insurance retainage could adversely affect our profitability. In addition, we may be unable to maintain insurance coverage at a reasonable cost or in sufficient amounts or scope to protect us against losses.

We have grown and may grow, in part, through acquisitions, which involve various risks, and we may not be able to identify or acquire companies consistent with our growth strategy or successfully integrate acquired businesses into our operations.

We have grown through acquisitions, and we intend to pursue opportunities to expand our business by acquiring other companies in the future. Acquisitions involve risks, including those relating to:

| |

• | identification of appropriate acquisition candidates; |

| |

• | negotiation of acquisitions on favorable terms and valuations; |

| |

• | integration of acquired businesses and personnel; |

| |

• | implementation of proper business and accounting controls; |

| |

• | ability to obtain financing, on favorable terms or at all; |

| |

• | diversion of management attention; |

| |

• | retention of employees and customers; |

| |

• | potential erosion of operating profits as new acquisitions may be unable to achieve profitability comparable with our core airport-to-airport business, and |

| |

• | detrimental issues not discovered during due diligence. |

Acquisitions also may affect our short-term cash flow and net income as we expend funds, potentially increase indebtedness and incur additional expenses. If we are not able to identify or acquire companies consistent with our growth strategy, or if we fail to successfully integrate any acquired companies into our operations, we may not achieve anticipated increases in revenue, cost savings and economies of scale, our operating results may actually decline and acquired goodwill may become impaired.

We could be required to record a material non-cash charge to income if our recorded intangible assets or goodwill are determined to be impaired.

We have $26.7 million of recorded net definite-lived intangible assets on our consolidated balance sheet at December 31, 2011. Our definite-lived intangible assets primarily represent the value of customer relationships and non-compete agreements that were recorded in conjunction with our various acquisitions. We review our long-lived assets, such as our definite-lived intangible assets, for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Impairment is recognized on these assets when the sum of undiscounted estimated cash flows expected to result from the use of the asset is less than the carrying value. If such measurement indicates an impairment, we would be required to record a non-cash impairment charge to our consolidated statement of income in the amount that the carrying value of these assets exceed the estimated fair value of the assets.

We also have recorded goodwill of $43.3 million on our consolidated balance sheet at December 31, 2011. Goodwill is assessed for impairment annually (or more frequently if circumstances indicate possible impairment) for each of our reporting units. This assessment includes comparing the fair value of each reporting unit to the carrying value of the assets assigned to each reporting unit. If the carrying value of the reporting unit was to exceed our estimated fair value of the reporting unit, we would then be required to estimate the fair value of the individual assets and liabilities within the reporting unit to ascertain the amount of fair value of goodwill and any potential impairment. If we determine that our fair value of goodwill is less than the related book value, we could be required to record a non-cash impairment charge to our consolidated statement of income, which could have a material adverse effect on our earnings. During 2009, we determined there were indicators of potential impairment of the goodwill assigned to the FASI segment. This determination was based on the continuing economic recession, declines in current

market valuations and FASI operating losses in excess of expectations. As a result, we performed an interim impairment test in accordance with our accounting policy discussed above as of March 31, 2009. Based on the results of the interim impairment test, we concluded that an impairment loss was probable and could be reasonably estimated. Consequently, we recorded a non-cash goodwill impairment charge of $7.0 million related to the FASI segment during 2009.

The estimation of fair value related to the impairment test for goodwill is particularly sensitive to projected financial information used in the calculations. Earnings estimated to be generated by our Forward Air segment are expected to continue supporting the carrying value of its goodwill. The FASI segment is currently facing the challenges of building, expanding and diversifying its revenue base. If FASI’s efforts are significantly delayed, future estimates of projected financial information may be reduced, and the Company may be required to record an impairment charge against the carrying value of FASI’s goodwill.

We may have difficulty effectively managing our growth, which could adversely affect our results of operations.

Our growth plans will place significant demands on our management and operating personnel. Our ability to manage our future growth effectively will require us to regularly enhance our operating and management information systems and to continue to attract, retain, train, motivate and manage key employees. If we are unable to manage our growth effectively, our business, results of operations and financial condition may be adversely affected.

If we fail to maintain and enhance our information technology systems, we may lose orders and customers or incur costs beyond expectations.

We must maintain and enhance our information technology systems to remain competitive and effectively handle higher volumes of freight through our network. We expect customers to continue to demand more sophisticated, fully integrated information systems from their transportation providers. If we are unable to maintain and enhance our information systems to handle our freight volumes and meet the demands of our customers, our business and results of operations will be adversely affected. If our information systems are unable to handle higher freight volumes and increased logistics services, our service levels and operating efficiency may decline. This may lead to a loss of customers and a decline in the volume of freight we receive from customers.

Our information technology systems are subject to risks that we cannot control.

Our information technology systems are dependent upon global communications providers, web browsers, telephone systems and other aspects of the Internet infrastructure that have experienced significant system failures and electrical outages in the past. While we take measures to ensure our major systems have redundant capabilities, our systems are susceptible to outages from fire, floods, power loss, telecommunications failures, break-ins, cyber-attacks and similar events. Despite our implementation of network security measures, our servers are vulnerable to computer viruses, break-ins and similar disruptions from unauthorized tampering with our computer systems. The occurrence of any of these events could disrupt or damage our information technology systems and hamper our internal operations, our ability to provide services to our customers and the ability of our customers to access our information technology systems. A material network breach in the security of our information technology systems could include the theft of our intellectual property or trade secrets. To the extent that any disruptions or security breach results in a loss or damage to our data, or in inappropriate disclosure of confidential information, it could cause significant damage to our reputation, affect our relationships with our customers, reduce the demand for our services, lead to claims against us and ultimately harm our business. In addition, we may be required to incur significant costs to protect against damage caused by these disruptions or security breaches in the future.

If we have difficulty attracting and retaining owner-operators or freight handlers, our results of operations could be adversely affected.

We depend on owner-operators for most of our transportation needs. In 2011, owner-operators provided 62.5% of our purchased transportation. Competition for owner-operators is intense, and sometimes there are shortages of available owner-operators. In addition, we need a large number of freight handlers to operate our business efficiently. During periods of low unemployment in the areas where our terminals are located, we may have difficulty hiring and retaining a sufficient number of freight handlers. If we have difficulty attracting and retaining enough qualified owner-operators or freight handlers, we may be forced to increase wages and benefits, which would increase our operating costs. This difficulty may also impede our ability to maintain our delivery schedules, which could make our service less competitive and force us to curtail our planned growth. If our labor costs increase, we may be unable to offset the increased labor costs by increasing rates without adversely affecting our business. As a result, our profitability may be reduced.

A determination by regulators that our independent owner-operators are employees rather than independent contractors could expose us to various liabilities and additional costs.

At times, the Internal Revenue Service, the Department of Labor and state authorities have asserted that owner-operators are “employees,” rather than “independent contractors.” One or more governmental authorities may challenge our position that the owner-operators we use are not our employees. A determination by regulators that our independent owner-operators are employees rather than independent contractors could expose us to various liabilities and additional costs including, but not limited to, employment-related expenses such as workers’ compensation insurance coverage and reimbursement of work-related expenses.

We operate in a regulated industry, and increased costs of compliance with, or liability for violation of, existing or future regulations could have a material adverse effect on our business.

The DOT and various state and federal agencies have been granted broad regulatory powers over our business, and we are licensed by the DOT and U.S. Customs. If we fail to comply with any applicable regulations, our licenses may be revoked or we could be subject to substantial fines or penalties and to civil and criminal liability.

The transportation industry is subject to legislative and regulatory changes that can affect the economics of our business by requiring changes in operating practices or influencing the demand for, and the cost of providing, transportation services. Heightened security concerns may continue to result in increased regulations, including the implementation of various security measures, checkpoints or travel restrictions on trucks.

In addition, there may be changes in applicable federal or state tax or other laws or interpretations of those laws. If this happens, we may incur additional taxes, as well as higher workers’ compensation and employee benefit costs, and possibly penalties and interest for prior periods. This could have an adverse effect on our results of operations.

We are subject to various environmental laws and regulations, and costs of compliance with, or liabilities for violations of, existing or future laws and regulations could significantly increase our costs of doing business.

Our operations are subject to environmental laws and regulations dealing with, among other things, the handling of hazardous materials and discharge and retention of stormwater. We operate in industrial areas, where truck terminals and other industrial activities are located, and where groundwater or other forms of environmental contamination may have occurred. Our operations involve the risks of fuel spillage, environmental damage, and hazardous waste disposal, among others. If we are involved in a spill or other accident involving hazardous substances, or if we are found to be in violation of applicable environmental laws or regulations, it could significantly increase our cost of doing business. Under specific environmental laws and regulations, we could be held responsible for all of the costs relating to any contamination at our past or present terminals and at third-party waste disposal sites. If we fail to comply with applicable environmental laws and regulations, we could be subject to substantial fines or penalties and to civil and criminal liability.

In addition, as global warming issues become more prevalent, federal and local governments and our customers are beginning to respond to these issues. This increased focus on sustainability may result in new regulations and customer requirements that could negatively affect us. This could cause us to incur additional direct costs or to make changes to our operations in order to comply with any new regulations and customer requirements, as well as increased indirect costs or loss of revenue resulting from, among other things, our customers incurring additional compliance costs that affect our costs and revenues. We could also lose revenue if our customers divert business from us because we haven’t complied with their sustainability requirements. These costs, changes and loss of revenue could have a material adverse affect on our business, financial condition and results of operations.

We are dependent on our senior management team, and the loss of any such personnel could materially and adversely affect our business.

Our future performance depends, in significant part, upon the continued service of our senior management team. We cannot be certain that we can retain these employees. The loss of the services of one or more of these or other key personnel could have a material adverse effect on our business, operating results and financial condition. We must continue to develop and retain a core group of management personnel and address issues of succession planning if we are to realize our goal of growing our business. We cannot be certain that we will be able to do so.

If our employees were to unionize, our operating costs would likely increase.

None of our employees are currently represented by a collective bargaining agreement. However, we have no assurance that our employees will not unionize in the future, which could increase our operating costs and force us to alter our operating methods. This could have a material adverse effect on our operating results.

Our charter and bylaws and provisions of Tennessee law could discourage or prevent a takeover that may be considered favorable.

Our charter and bylaws and provisions of Tennessee law may discourage, delay or prevent a merger, acquisition or change in control that may be considered favorable. These provisions could also discourage proxy contests and make it more difficult for shareholders to elect directors and take other corporate actions. Among other things, these provisions:

| |

• | authorize us to issue preferred stock, the terms of which may be determined at the sole discretion of our Board of Directors and may adversely affect the voting or economic rights of our shareholders; and |

| |

• | establish advance notice requirements for nominations for election to the Board of Directors and for proposing matters that can be acted on by shareholders at a meeting. |

Our charter and bylaws and provisions of Tennessee law may discourage transactions that otherwise could provide for the payment of a premium over prevailing market prices for our Common Stock, $0.01 par value per share, and also could limit the price that investors are willing to pay in the future for shares of our Common Stock.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Properties and Equipment

Management believes that we have adequate facilities for conducting our business, including properties owned and leased. Management further believes that in the event replacement property is needed, it will be available on terms and at costs substantially similar to the terms and costs experienced by competitors within the transportation industry.

We lease our 37,500 square foot headquarters in Greeneville, Tennessee from the Greeneville-Greene County Airport Authority. The initial lease term ended in 2006 and has two ten-year and one five-year renewal options. During 2007, we renewed the lease through 2016.

We own our Columbus, Ohio central sorting facility. The expanded Columbus, Ohio facility is 125,000 square feet with 168 trailer doors. This premier facility can unload, sort and load upwards of 3.7 million pounds in five hours. In addition to the expansion, we process-engineered the freight sorting in the expanded building to improve handling efficiencies. The benefits include reductions in the distance each shipment moves in the building to speed up the transfer process, less handling of freight to further improve service integrity and flexibility to operate multiple sorts at the same time.

We also own facilities near Dallas/Fort Worth, Texas, Chicago, Illinois and Atlanta, Georgia. The Dallas/Fort Worth, Texas facility has over 216,000 square feet with 134 trailer doors and approximately 28,000 square feet of office space. The Chicago, Illinois facility is over 125,000 square feet with 110 trailer doors and over 10,000 square feet of office space. The Atlanta, Georgia facility is over 142,000 square feet with 118 trailer doors and approximately 12,000 square feet of office space.

We lease and maintain 72 additional terminals, including our pool distribution terminals, located in major cities throughout the United States and Canada. Lease terms for these terminals are typically for three to five years. The remaining 18 terminals are agent stations operated by independent agents who handle freight for us on a commission basis.

We own the majority of trailers we use to move freight through our networks. Substantially all of our trailers are 53’ long, some of which have specialized roller bed equipment required to serve air cargo industry customers. At December 31, 2011, we had 2,560 owned trailers in our fleet with an average age of approximately 5.5 years. In addition, at December 31, 2011, we also had 53 leased trailers in our fleet.

At December 31, 2011, we had 419 owned tractors and straight trucks in our fleet, with an average age of approximately 4.2 years. In addition, at December 31, 2011, we also had 64 leased tractors and straight trucks in our fleet.

Item 3. Legal Proceedings

From time to time, we are a party to ordinary, routine litigation incidental to and arising in the normal course of our business, most of which involve claims for personal injury, property damage related to the transportation and handling of freight, or workers’ compensation. We do not believe that any of these pending actions, individually or in the aggregate, will have a material adverse effect on our business, financial condition, results of operations or cash flow.

Item 4. Mine Safety Disclosures

Not applicable.

Part II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Our Common Stock trades on The NASDAQ Global Select Stock Market™ under the symbol “FWRD.” The following table sets forth the high and low sales prices for Common Stock as reported by The NASDAQ Global Select Stock Market™ for each full quarterly period within the two most recent fiscal years.

|

| | | | | | | | | | | | |

2011 | | High | | Low | | Dividends |

First Quarter | | $ | 32.30 |

| | $ | 26.34 |

| | $ | 0.07 |

|

Second Quarter | | 35.53 |

| | 29.76 |

| | 0.07 |

|

Third Quarter | | 36.32 |

| | 23.70 |

| | 0.07 |

|

Fourth Quarter | | 34.19 |

| | 24.10 |

| | 0.07 |

|

| | | | | | |

2010 | | High | | Low | | Dividends |

First Quarter | | $ | 27.37 |

| | $ | 21.92 |

| | $ | 0.07 |

|

Second Quarter | | 30.30 |

| | 25.29 |

| | 0.07 |

|

Third Quarter | | 29.91 |

| | 22.39 |

| | 0.07 |

|

Fourth Quarter | | 30.16 |

| | 24.63 |

| | 0.07 |

|

There were approximately 446 shareholders of record of our Common Stock as of January 18, 2012.

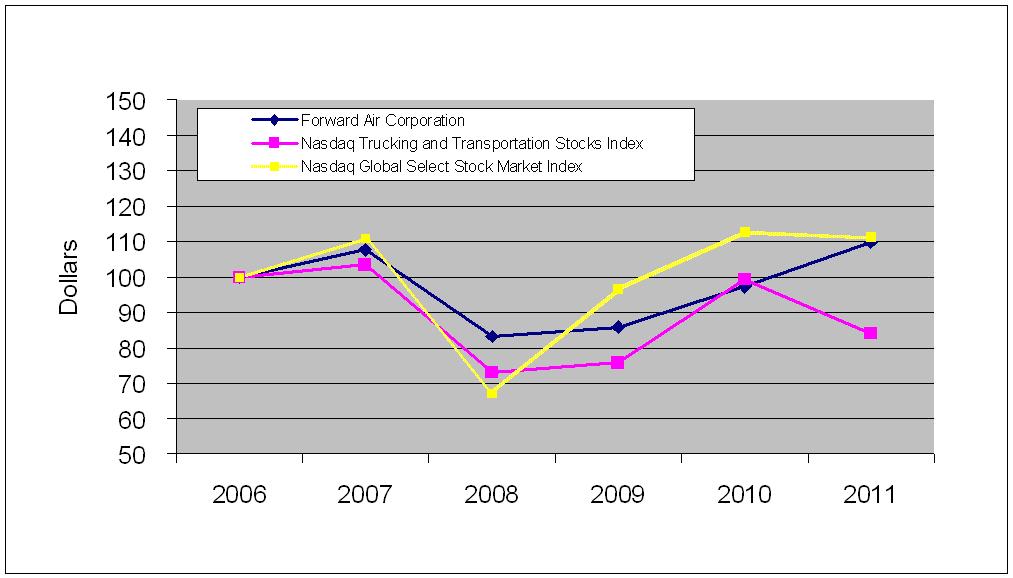

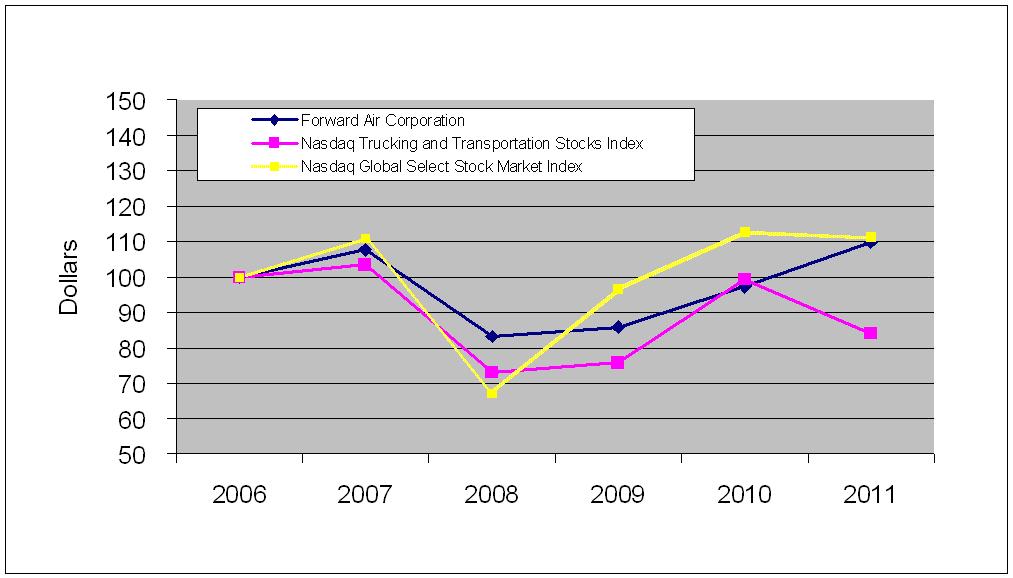

Subsequent to December 31, 2011, our Board of Directors declared a cash dividend of $0.07 per share that will be paid on March 23, 2012 to shareholders of record at the close of business on March 8, 2012. We expect to continue to pay regular quarterly cash dividends, though each subsequent quarterly dividend is subject to review and approval by the Board of Directors.