|

Tennessee

|

62-1120025

|

|

|

(State

or other jurisdiction

of

incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

|

430

Airport Road

|

||

|

Greeneville,

Tennessee

|

37745

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

Common

Stock, $0.01 par value

|

The

NASDAQ Stock Market LLC

|

|

|

(Title

of class)

|

(Name

of exchange on which registered)

|

|

Table

of Contents

|

||

|

Forward

Air Corporation

|

||

|

Page

|

||

|

Number

|

||

|

Part

I.

|

||

|

Item

1.

|

Business

|

3

|

|

Item

1A.

|

Risk Factors

|

13

|

|

Item

1B.

|

Unresolved Staff Comments

|

17

|

|

Item

2.

|

Properties

|

17

|

|

Item

3.

|

Legal Proceedings

|

18

|

|

Item

4.

|

Submission of Matters to a Vote of Security

Holders

|

18

|

|

Part

II.

|

||

|

Item

5.

|

Market for Registrant's Common Equity, Related

Shareholder Matters and Issuer Purchases of Equity Securities

|

19

|

|

Item

6.

|

Selected Financial Data

|

21

|

|

Item

7.

|

Management's Discussion and Analysis of Financial

Condition and Results of Operations

|

21

|

|

Item

7A.

|

Quantitative and Qualitative Disclosures About

Market Risk

|

44

|

|

Item

8.

|

Financial Statements and Supplementary

Data

|

44

|

|

Item

9.

|

Changes in and Disagreements with Accountants on

Accounting and Financial Disclosure

|

44

|

|

Item

9A.

|

Controls and Procedures

|

44

|

|

Item

9B.

|

Other Information

|

47

|

|

Part

III.

|

||

|

Item

10.

|

Directors, Executive Officers and Corporate

Governance

|

47

|

|

Item

11.

|

Executive Compensation

|

47

|

|

Item

12.

|

Security Ownership of Certain Beneficial Owners

and Management and Related Shareholder Matters

|

47

|

|

Item

13.

|

Certain Relationships and Related Transactions,

and Director Independence

|

47

|

|

Item

14.

|

Principal Accounting Fees and

Services

|

47

|

|

Part

IV.

|

||

|

Item

15.

|

Exhibits, Financial Statement

Schedules

|

47

|

|

Signatures

|

48

|

|

|

Index to Financial

Statements

|

F2

|

|

|

Financial Statement

Schedule

|

S1

|

|

|

Exhibit Index

|

||

|

Business

|

|

·

|

Freight

forwarders obtain requests for shipments from customers, make arrangements

for transportation of the cargo by a third-party carrier and usually

arrange for both delivery from the shipper to the carrier and from the

carrier to the recipient.

|

|

·

|

Integrated

air cargo carriers provide pick-up and delivery services primarily using

their own fleet of trucks and provide transportation services generally

using their own fleet of aircraft.

|

|

·

|

Less-than-truckload

carriers also provide pick-up and delivery services through their own

fleet of trucks. These carriers operate terminals where a single shipment

is unloaded, sorted and reloaded multiple times. This

additional handling increases transit time, handling costs and the

likelihood of cargo damage.

|

|

·

|

Full

truckload carriers provide transportation services generally using their

own fleet of trucks. A freight forwarder or shipper must have a

shipment of sufficient size to justify the cost of a full

truckload. These cost benefit concerns can inhibit the

flexibility often required by freight forwarders or

shippers.

|

|

·

|

Passenger

or cargo airlines provide airport-to-airport service, but have limited

cargo space and generally accept only shipments weighing less than 150

pounds.

|

|

·

|

Focus on Specific Freight

Markets. Our Forward Air segment focuses on providing time-definite

surface transportation and related logistics services to the deferred air

cargo industry. Our FASI segment focuses on providing

high-quality pool distribution services to retailers and nationwide

distributors of retail products. This focused approach enables

us to provide a higher level of service in a more cost-effective manner

than our competitors.

|

|

·

|

Expansive Network of Terminals

and Sorting Facilities. We have built a network of Forward Air

terminals and sorting facilities throughout the United States and Canada

located on or near airports. We believe it would be difficult for a

competitor to duplicate our Forward Air network without the expertise and

strategic facility locations we have acquired and without expending

significant capital and management resources. Our expansive Forward Air

network enables us to provide regularly scheduled service between most

markets with low levels of freight damage or loss, all at rates generally

significantly below air freight

rates.

|

|

·

|

Concentrated Marketing

Strategy. Forward Air provides our deferred air freight

services mainly to air freight forwarders, integrated air cargo carriers,

and passenger and cargo airlines rather than directly serving shippers.

Forward Air does not place significant size or weight restrictions on

shipments and, therefore, it does not compete with delivery services such

as United Parcel Service and Federal Express in the overnight small parcel

market. We believe that Forward Air customers prefer to purchase their

transportation services from us because, among other reasons, we generally

do not market Forward Air’s services to their shipper customers and,

therefore, do not compete directly with them for

customers.

|

|

·

|

Superior Service

Offerings. Forward Air’s published deferred air freight

schedule for transit times with specific cut-off and arrival times

generally provides Forward Air customers with the predictability they

need. In addition, our network of Forward Air terminals allows us to offer

our customers later cut-off times, a higher percentage of direct shipments

(which reduces damage and shortens transit times) and earlier delivery

times than most of our competitors.

|

|

·

|

Flexible Business

Model. Rather than owning and operating our own fleet of trucks,

Forward Air purchases most of its transportation requirements from

owner-operators or truckload carriers. This allows Forward Air to respond

quickly to changing demands and opportunities in our industry and to

generate higher returns on assets because of the lower capital

requirements.

|

|

·

|

Comprehensive Logistic and

Other Service Offerings. Forward Air offers an array of logistic

and other services including: TLX, pick-up and delivery (Forward Air

Complete™), dedicated fleet, warehousing, customs brokerage and shipment

consolidation and handling. These services are an essential part

of many of our Forward Air customers’ transportation needs and are

not offered by many of our competitors. Forward Air is able to

provide these services utilizing existing infrastructure and thereby able

to earn additional revenue without incurring significant additional fixed

costs.

|

|

·

|

Leading Technology

Platform. We are committed to using information technology to

improve our Forward Air and FASI operations. Through improved

information technology, we believe we can increase the volume of freight

we handle in our networks, improve visibility of shipment information and

reduce our operating costs. Our Forward Air technology allows us to

provide our customers with electronic bookings and real-time tracking and

tracing of shipments while in our network, complete shipment history,

proof of delivery, estimated charges and electronic bill presentment. We

continue to enhance our Forward Air systems to permit us and our customers

to access vital information through both the Internet and electronic data

interchange. We have continued to invest in information

technology to the benefit of our customers and our business processes. The

primary example of this continued development is our Terminal Automation

Program (“TAP”), a wireless application utilized in all our Forward Air

terminals. The system enables individual operators to perform virtually

all data entry from our terminal floor locations. The system provides

immediate shipment updates, resulting in increased shipment accuracy and

improved data timeliness. The TAP system not only reduces operational

manpower, but also improves our on-time performance. Additionally, in

order to support our Forward Air Complete service offering, we developed

and installed a web-based system, which coordinates activities between our

customers, operations personnel and external service

providers.

|

|

·

|

Strong Balance Sheet and

Availability of Funding. Our asset-light business model

and strong market position in the deferred air freight market provides the

foundation for operations that produce excellent cash flow from operations

even in challenging conditions. Our strong balance sheet can

also be a competitive advantage. Our competitors, particularly

in the pool distribution market, are mainly regional and local operations

and may struggle to maintain operations in the current economic

environment. The threat of financial instability may encourage

new and existing customers to use a more financially secure transportation

provider, such as FASI.

|

|

·

|

Increase Freight Volume from

Existing Customers. Many of our customers currently use Forward Air

and FASI for only a portion of their overall transportation

needs. We believe we can increase freight volumes from existing

customers by offering more comprehensive services that address all of the

customer’s transportation needs, such as Forward Air Complete, our direct

to door pick-up and delivery service. By offering additional

services that can be integrated with our existing business, we believe we

will attract additional business from existing

customers.

|

|

·

|

Develop New

Customers. We continue to actively market our Forward Air and FASI

services to potential new customers. In our deferred air freight business,

we believe air freight forwarders may move away from integrated air cargo

carriers because those carriers charge higher rates, and away from

less-than-truckload carriers because those carriers provide less reliable

service and compete for the same customers as do the air freight

forwarders. In addition, we believe Forward Air’s comprehensive

North American network and related logistics services are attractive to

domestic and international airlines. Forward Air Complete™ can

also help attract business from new customers who require pick-up and

delivery for their shipments. In our pool distribution

business, we are emphasizing the development of relationships with

retailers who have peak volume seasons outside of the traditional fourth

quarter spike in order to help stabilize FASI’s earnings throughout the

calendar year. Further, by expanding our network of FASI

terminals, we believe we can attract new customers and new business from

existing customers by offering our services across multiple regions of the

continental United States. During the upcoming years, we plan

on expanding FASI’s terminal footprint by opening FASI operations in

select Forward Air terminals. We believe the utilization of

existing Forward Air terminals will allow us to increase our FASI revenues

with minimal addition of fixed

costs.

|

|

·

|

Improve Efficiency of Our

Transportation Network. We constantly seek to improve the

efficiency of our airport-to-airport and FASI networks. Regional hubs and

direct shuttles improve Forward Air’s efficiency by reducing the number of

miles freight must be transported and the number of times freight must be

handled and sorted. As the volume of freight between key markets

increases, we intend to continue to add direct shuttles. Since 2007, we

completed the purchase or construction of three new facilities in Chicago,

Illinois, Atlanta, Georgia and Dallas/Fort Worth, Texas. In

2006, we also completed the expansion of our national hub in Columbus,

Ohio. With these new and expanded facilities, we believe we will

have the necessary space to grow our business in key gateway cities and to

offer additional services. We can improve our FASI operations

by increasing the efficiencies of our daily and weekly routes and the

cartons handled per hour on our docks. We are constantly

looking to improve our route efficiencies by consolidating loads and

utilizing owner-operators when available. We are investing in

conveyor systems for certain FASI terminals to increase the productivity

of our cargo handlers. Finally, we are actively looking to

reduce or eliminate the number of duplicate facilities in cities which

have both Forward Air and FASI terminals. We have combined

Forward Air and FASI facilities in Des Moines, Iowa, Denver, Colorado,

Kansas City, Missouri, Nashville, TN and Richmond, Virginia, and will

continue this process in upcoming years as the expiration of leases and

business volumes allow.

|

|

·

|

Expand Logistics and

Other Services. We continue to expand our logistics and other

services to increase revenue and improve utilization of our Forward Air

terminal facilities and labor force. Because of the timing of the arrival

and departure of cargo, our Forward Air facilities are under-utilized

during certain portions of the day, allowing us to add logistics services

without significantly increasing our costs. Therefore, we have added a

number of Forward Air logistic services in the past few years, such as

TLX, dedicated fleet, warehousing, customs brokerage and shipment

consolidation and handling services. These services directly benefit our

existing customers and increase our ability to attract new customers,

particularly those air freight forwarders that cannot justify providing

the services directly. These services are not offered by many

transportation providers with whom we compete and are attractive to

customers who prefer to use one provider for all of their transportation

needs.

|

|

·

|

Expand Pool Distribution

Services and Integrate with our Forward Air Services. In addition

to increasing our revenue from traditional pool distribution services, we

are working to integrate our Forward Air and FASI service

offerings. Through this process we are able to offer customers

linehaul or truckload services, with handling and sorting at the origin

and destination terminal, and final distribution to one or many locations

utilizing FASI pool distribution and Forward Air

Complete™.

|

|

·

|

Enhance Information

Systems. We are committed to the continued development and

enhancement of our information systems in ways that will continue to

provide us competitive service advantages and increased productivity. We

believe our enhanced systems have and will assist us in capitalizing on

new business opportunities with existing customers and developing

relationships with new customers.

|

|

·

|

Pursue Strategic

Acquisitions. We continue to evaluate acquisitions that can

increase our penetration of a geographic area, add new customers, add new

business verticals, increase freight volume and add new service

offerings. In addition, we expect to explore acquisitions that

may enable us to offer additional services. Since our

inception, we have acquired certain assets and liabilities of

12 businesses that met one or more of these

criteria. During 2008 and 2007, we acquired certain assets and

liabilities of four companies that met these

criteria.

|

|

Ø

|

In

July 2007, we acquired certain assets and liabilities of USAC which

provided the base from which we launched our FASI pool distribution

services.

|

|

Ø

|

In

December 2007, we acquired certain assets and liabilities of Black Hawk

Freight Services, Inc. (“Black Hawk”) which increased the penetration

of our Forward Air airport-to-airport network in the

Midwest.

|

|

Ø

|

In

March 2008, we acquired certain assets and liabilities of Pinch Holdings,

Inc. and its related company AFTCO Enterprises, Inc. and certain of their

respective wholly-owned subsidiaries (“Pinch”). Pinch was a

privately-held provider of pool distribution, airport-to-airport,

truckload, custom, and cartage services primarily to the Southwestern

continental United States. This acquisition gave FASI a

presence primarily in Texas and strengthens the position of our Forward

Air network in the Southwest United

States.

|

|

Ø

|

In

September 2008, we acquired certain assets and liabilities of Service

Express, Inc. (“Service Express”). The acquisition of Service

Express, a privately-held provider of pool distribution services, helped

us expand FASI’s geographic footprint in the Mid-Atlantic and Southeastern

continental United

States.

|

|

City

|

Airport

Served

|

City

|

Airport

Served

|

|||

|

Albany,

NY

|

ALB

|

Louisville,

KY

|

SDF

|

|||

|

Albuquerque,

NM***

|

ABQ

|

Memphis,

TN

|

MEM

|

|||

|

Allentown,

PA*

|

ABE

|

McAllen,

TX

|

MFE

|

|||

|

Atlanta,

GA

|

ATL

|

Miami,

FL

|

MIA

|

|||

|

Austin,

TX

|

AUS

|

Milwaukee,

WI

|

MKE

|

|||

|

Baltimore,

MD

|

BWI

|

Minneapolis,

MN

|

MSP

|

|||

|

Baton

Rouge, LA*

|

BTR

|

Mobile,

AL*

|

MOB

|

|||

|

Birmingham,

AL*

|

BHM

|

Moline,

IA

|

MLI

|

|||

|

Blountville,

TN*

|

TRI

|

Montgomery,

AL***

|

MGM

|

|||

|

Boston,

MA

|

BOS

|

Nashville,

TN**

|

BNA

|

|||

|

Buffalo,

NY

|

BUF

|

Newark,

NJ

|

EWR

|

|||

|

Burlington,

IA

|

BRL

|

Newburgh,

NY

|

SWF

|

|||

|

Cedar

Rapids, IA

|

CID

|

New

Orleans, LA

|

MSY

|

|||

|

Charleston,

SC

|

CHS

|

New

York, NY

|

JFK

|

|||

|

Charlotte,

NC

|

CLT

|

Norfolk,

VA

|

ORF

|

|||

|

Chicago,

IL

|

ORD

|

Oklahoma

City, OK

|

OKC

|

|||

|

Cincinnati,

OH

|

CVG

|

Omaha,

NE

|

OMA

|

|||

|

Cleveland,

OH

|

CLE

|

Orlando,

FL

|

MCO

|

|||

|

Columbia,

SC*

|

CAE

|

Pensacola,

FL*

|

PNS

|

|||

|

Columbus,

OH

|

CMH

|

Philadelphia,

PA

|

PHL

|

|||

|

Corpus

Christi, TX*

|

CRP

|

Phoenix,

AZ

|

PHX

|

|||

|

Dallas/Ft.

Worth, TX

|

DFW

|

Pittsburgh,

PA

|

PIT

|

|||

|

Dayton,

OH*

|

DAY

|

Portland,

OR

|

PDX

|

|||

|

Denver,

CO**

|

DEN

|

Raleigh,

NC

|

RDU

|

|||

|

Des

Moines, IA**

|

DSM

|

Richmond,

VA**

|

RIC

|

|||

|

Detroit,

MI

|

DTW

|

Rochester,

NY

|

ROC

|

|||

|

El

Paso, TX

|

ELP

|

Sacramento,

CA

|

SMF

|

|||

|

Greensboro,

NC

|

GSO

|

Salt

Lake City, UT

|

SLC

|

|||

|

Greenville,

SC

|

GSP

|

San

Antonio, TX

|

SAT

|

|||

|

Hartford,

CT

|

BDL

|

San

Diego, CA

|

SAN

|

|||

|

Harrisburg,

PA

|

MDT

|

San

Francisco, CA

|

SFO

|

|||

|

Houston,

TX

|

IAH

|

Seattle,

WA

|

SEA

|

|||

|

Huntsville,

AL*

|

HSV

|

Shreveport,

LA*

|

SHV

|

|||

|

Indianapolis,

IN

|

IND

|

St.

Louis, MO

|

STL

|

|||

|

Jacksonville,

FL

|

JAX

|

Syracuse,

NY

|

SYR

|

|||

|

Kansas

City, MO**

|

MCI

|

Tampa,

FL

|

TPA

|

|||

|

Knoxville,

TN*

|

TYS

|

Toledo,

OH*

|

TOL

|

|||

|

Lafayette,

LA*

|

LFT

|

Tucson,

AZ*

|

TUS

|

|||

|

Laredo,

TX

|

LRD

|

Tulsa,

OK

|

TUL

|

|||

|

Las

Vegas, NV

|

LAS

|

Washington,

DC

|

IAD

|

|||

|

Little

Rock, AR*

|

LIT

|

Montreal,

Canada*

|

YUL

|

|||

|

Los

Angeles, CA

|

LAX

|

Toronto,

Canada

|

YYZ

|

|

Average

Weekly

|

||

|

Volume

in Pounds

|

||

|

Year

|

(In

millions)

|

|

|

1990

|

1.2

|

|

|

1991

|

1.4

|

|

|

1992

|

2.3

|

|

|

1993

|

3.8

|

|

|

1994

|

7.4

|

|

|

1995

|

8.5

|

|

|

1996

|

10.5

|

|

|

1997

|

12.4

|

|

|

1998

|

15.4

|

|

|

1999

|

19.4

|

|

|

2000

|

24.0

|

|

|

2001

|

24.3

|

|

|

2002

|

24.5

|

|

|

2003

|

25.3

|

|

|

2004

|

28.7

|

|

|

2005

|

31.2

|

|

|

2006

|

32.2

|

|

|

2007

|

32.8

|

|

|

2008

|

34.2

|

|

|

2009

|

28.5

|

|

·

|

expedited

truckload brokerage, or TLX;

|

|

·

|

dedicated

fleets;

|

|

·

|

customs

brokerage, such as assistance with U.S. Customs and Border Protection

(“U.S. Customs”) procedures for both import and export

shipments;

|

|

·

|

warehousing,

dock and office space;

|

|

·

|

drayage

and intermodal;

|

|

·

|

hotshot

or ad-hoc ultra expedited services;

and

|

|

·

|

shipment

consolidation and handling, such as shipment build-up and break-down and

reconsolidation of air or ocean pallets or

containers.

|

|

Average

Weekly Miles

|

||

|

Year

|

(In

thousands)

|

|

|

2003

|

211

|

|

|

2004

|

259

|

|

|

2005

|

248

|

|

|

2006

|

331

|

|

|

2007

|

529

|

|

|

2008

|

676

|

|

|

2009

|

672

|

|

City

|

|

|

Albuquerque,

NM***

|

Kansas

City, MO**

|

|

Atlanta,

GA

|

Lakeland,

FL

|

|

Baltimore,

MD

|

Las

Vegas, NV

|

|

Charlotte,

NC

|

Miami,

FL

|

|

Dallas/Ft.

Worth, TX

|

Montgomery,

AL***

|

|

Denver,

CO**

|

Nashville,

TN**

|

|

Des

Moines, IA**

|

Richmond,

VA**

|

|

Greensboro,

NC

|

San

Antonio, TX

|

|

Houston,

TX

|

Tulsa,

OK

|

|

Jacksonville,

FL

|

|

|

Item

1A.

|

Risk

Factors

|

|

·

|

identification

of appropriate acquisition

candidates;

|

|

·

|

negotiation

of acquisitions on favorable terms and

valuations;

|

|

·

|

integration

of acquired businesses and

personnel;

|

|

·

|

implementation

of proper business and accounting

controls;

|

|

·

|

ability

to obtain financing, on favorable terms or at

all;

|

|

·

|

diversion

of management attention;

|

|

·

|

retention

of employees and customers;

|

|

·

|

unexpected

liabilities;

|

|

·

|

potential

erosion of operating profits as new acquisitions may be unable to achieve

profitability comparable with our core airport-to-airport business,

and

|

|

·

|

detrimental

issues not discovered during due

diligence.

|

|

·

|

authorize

us to issue preferred stock, the terms of which may be determined at the

sole discretion of our Board of Directors and may adversely

affect the voting or economic rights of our shareholders;

and

|

|

·

|

establish

advance notice requirements for nominations for election to the Board of

Directors and for proposing matters that can be acted on by shareholders

at a meeting.

|

|

Item

1B.

|

Unresolved

Staff Comments

|

|

Item

2.

|

|

Item

3.

|

Legal

Proceedings

|

|

Name

|

Age

|

Position

|

||

|

Bruce

A. Campbell

|

58

|

President

and Chief Executive Officer

|

||

|

Rodney

L. Bell

|

47

|

Chief

Financial Officer, Senior Vice President and Treasurer

|

||

|

Craig

A. Drum

|

54

|

Senior

Vice President, Sales

|

||

|

Matthew

J. Jewell

|

43

|

Executive

Vice President, Chief Legal Officer and Secretary

|

||

|

Chris

C. Ruble

|

47

|

Executive

Vice President, Operations

|

|

Market

for Registrant’s Common Equity, Related Shareholder Matters and Issuer

Purchases of Equity Securities

|

|

2009

|

High

|

Low

|

Dividends

|

||||||

|

First

Quarter

|

$ | 24.66 | $ | 13.80 | $ | 0.07 | |||

|

Second

Quarter

|

24.60 | 13.48 | 0.07 | ||||||

|

Third

Quarter

|

25.39 | 19.73 | 0.07 | ||||||

|

Fourth

Quarter

|

26.29 | 20.32 | 0.07 | ||||||

|

2008

|

High

|

Low

|

Dividends

|

||||||

|

First

Quarter

|

$ | 36.86 | $ | 25.55 | $ | 0.07 | |||

|

Second

Quarter

|

39.09 | 32.54 | 0.07 | ||||||

|

Third

Quarter

|

38.58 | 25.77 | 0.07 | ||||||

|

Fourth

Quarter

|

28.16 | 17.31 | 0.07 | ||||||

|

Equity

Compensation Plan Information

|

|||||||

|

Plan

Category

|

Number

of Securities to be Issued upon Exercise of Outstanding Options, Warrants

and Rights

|

Weighted-Average

Exercise Price of Outstanding Options, Warrants and Rights

|

Number

of Securities Remaining Available for Future Issuance Under Equity

Compensation Plans

|

||||

|

|

(a)

|

(b)

|

|||||

|

Equity

Compensation Plans Approved by Shareholders

|

3,191,254

|

$

|

26

|

3,437,416

|

|||

|

Equity

Compensation Plans Not Approved by Shareholders

|

--

|

--

|

--

|

||||

|

Total

|

3,191,254

|

$

|

26

|

3,437,416

|

|||

|

(a)

|

Excludes

purchase rights accruing under the ESPP, which has an original

shareholder-approved reserve of 500,000 shares. Under the ESPP, each

eligible employee may purchase up to 2,000 shares of Common Stock at

semi-annual intervals each year at a purchase price per share equal to

90.0% of the lower of the fair market value of the Common Stock at close

of (i) the first trading day of an option period or (ii) the last trading

day of an option period.

|

|

(b)

|

Includes

shares available for future issuance under the ESPP. As of December 31,

2009, an aggregate of 447,232 shares of Common Stock were available for

issuance under the ESPP.

|

|

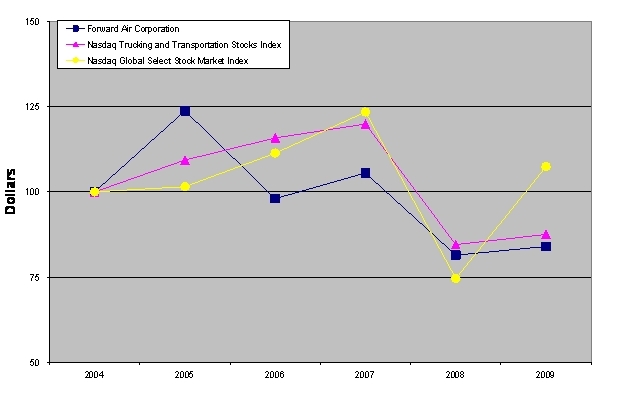

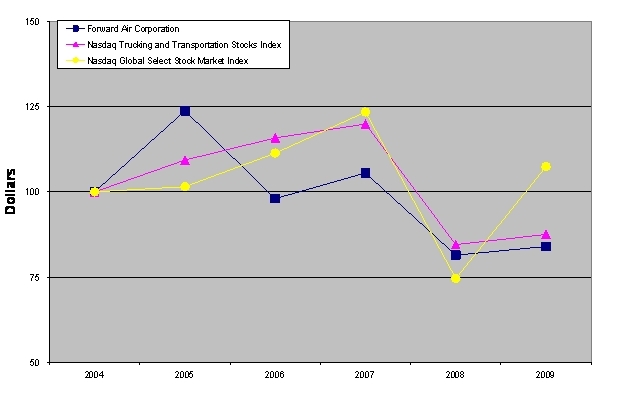

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

||||||

|

Forward

Air Corporation

|

100

|

124

|

98

|

106

|

81

|

84

|

|||||

|

Nasdaq

Trucking and Transportation Stocks Index

|

100

|

109

|

116

|

120

|

85

|

88

|

|||||

|

Nasdaq

Global Select Stock Market Index

|

100

|

102

|

111

|

123

|

75

|

107

|

|

Selected

Financial Data

|

|

Year

ended

|

|||||||||||||||||||

|

December

31,

|

December

31,

|

December

31,

|

December

31,

|

December

31,

|

|||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

(In

thousands, except per share data)

|

|||||||||||||||||||

|

Income

Statement Data:

|

|||||||||||||||||||

|

Operating

revenue

|

$ | 417,410 | $ | 474,436 | $ | 392,737 | $ | 352,758 | $ | 320,934 | |||||||||

|

Income

from operations

|

18,550 | 70,285 | 71,048 | 75,396 | 67,437 | ||||||||||||||

|

Operating

margin (1)

|

4.4 | % | 14.8 | % | 18.1 | % | 21.4 | % | 21.0 | % | |||||||||

|

Net

income

|

9,802 | 42,542 | 44,925 | 48,923 | 44,909 | ||||||||||||||

|

Net

income per share:

|

|||||||||||||||||||

|

Basic

|

$ | 0.34 | $ | 1.48 | $ | 1.52 | $ | 1.57 | $ | 1.41 | |||||||||

|

Diluted

|

$ | 0.34 | $ | 1.47 | $ | 1.50 | $ | 1.55 | $ | 1.39 | |||||||||

|

Cash

dividends declared per common share

|

$ | 0.28 | $ | 0.28 | $ | 0.28 | $ | 0.28 | $ | 0.24 | |||||||||

|

Balance

Sheet Data (at end of period):

|

|||||||||||||||||||

|

Total

assets

|

$ | 316,730 | $ | 307,527 | $ | 241,884 | $ | 213,014 | $ | 212,600 | |||||||||

|

Long-term

obligations, net of current portion

|

52,169 | 53,035 | 31,486 | 796 | 837 | ||||||||||||||

|

Shareholders'

equity

|

224,507 | 216,434 | 171,733 | 185,227 | 178,816 | ||||||||||||||

|

(1)

Income from operations as a percentage of operating

revenue

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

|

Year

ended

|

|||||||||||||||

|

December

31,

|

December

31,

|

Percent

|

|||||||||||||

|

2009

|

2008

|

Change

|

Change

|

||||||||||||

|

Operating

revenue

|

$ | 417.4 | $ | 474.4 | $ | (57.0 | ) | (12.0 | ) | % | |||||

|

Operating

expenses:

|

|||||||||||||||

|

Purchased

transportation

|

174.4 | 189.0 | (14.6 | ) | (7.7 | ) | |||||||||

|

Salaries,

wages, and employee benefits

|

118.8 | 116.5 | 2.3 | 2.0 | |||||||||||

|

Operating

leases

|

27.3 | 24.4 | 2.9 | 11.9 | |||||||||||

|

Depreciation

and amortization

|

19.7 | 16.6 | 3.1 | 18.7 | |||||||||||

|

Insurance

and claims

|

9.7 | 8.1 | 1.6 | 19.8 | |||||||||||

|

Fuel

expense

|

7.3 | 11.5 | (4.2 | ) | (36.5 | ) | |||||||||

|

Other

operating expenses

|

34.4 | 38.0 | (3.6 | ) | (9.5 | ) | |||||||||

|

Impairment

of goodwill

|

7.2 | -- | 7.2 | 100.0 | |||||||||||

|

Total

operating expenses

|

398.8 | 404.1 | (5.3 | ) | (1.3 | ) | |||||||||

|

Income

from operations

|

18.6 | 70.3 | (51.7 | ) | (73.5 | ) | |||||||||

|

Other

income (expense):

|

|||||||||||||||

|

Interest

expense

|

(0.7 | ) | (1.2 | ) | 0.5 | (41.7 | ) | ||||||||

|

Other,

net

|

0.1 | 0.3 | (0.2 | ) | (66.7 | ) | |||||||||

|

Total

other (expense) income

|

(0.6 | ) | (0.9 | ) | 0.3 | (33.3 | ) | ||||||||

|

Income

before income taxes

|

18.0 | 69.4 | (51.4 | ) | (74.1 | ) | |||||||||

|

Income

taxes

|

8.2 | 26.9 | (18.7 | ) | (69.5 | ) | |||||||||

|

Net

income

|

$ | 9.8 | $ | 42.5 | $ | (32.7 | ) | (76.9 | ) | % | |||||

|

Year

ended

|

|||||||||||||||||||||

|

December

31,

|

Percent

of

|

December

31,

|

Percent

of

|

Percent

|

|||||||||||||||||

|

2009

|

Revenue

|

2008

|

Revenue

|

Change

|

Change

|

||||||||||||||||

|

Operating

revenue

|

|||||||||||||||||||||

|

Forward

Air

|

$

|

346.3

|

83.0

|

%

|

$

|

421.2

|

88.8

|

%

|

$

|

(74.9

|

)

|

(17.8

|

)

|

%

|

|||||||

|

FASI

|

72.5

|

17.4

|

55.3

|

11.6

|

17.2

|

31.1

|

|||||||||||||||

|

Intercompany

Eliminations

|

(1.4

|

)

|

(0.4

|

)

|

(2.1

|

)

|

(0.4

|

)

|

0.7

|

(33.3

|

)

|

||||||||||

|

Total

|

417.4

|

100.0

|

474.4

|

100.0

|

(57.0

|

)

|

(12.0

|

)

|

|||||||||||||

|

Purchased

transportation

|

|||||||||||||||||||||

|

Forward

Air

|

160.3

|

46.3

|

179.9

|

42.7

|

(19.6

|

)

|

(10.9

|

)

|

|||||||||||||

|

FASI

|

15.4

|

21.2

|

11.2

|

20.2

|

4.2

|

37.5

|

|||||||||||||||

|

Intercompany

Eliminations

|

(1.3

|

)

|

92.9

|

(2.1

|

)

|

100.0

|

0.8

|

(38.1

|

)

|

||||||||||||

|

Total

|

174.4

|

41.8

|

189.0

|

39.9

|

(14.6

|

)

|

(7.7

|

)

|

|||||||||||||

|

Salaries,

wages and employee benefits

|

|||||||||||||||||||||

|

Forward

Air

|

85.7

|

24.7

|

92.5

|

22.0

|

(6.8

|

)

|

(7.4

|

)

|

|||||||||||||

|

FASI

|

33.1

|

45.6

|

24.0

|

43.4

|

9.1

|

37.9

|

|||||||||||||||

|

Total

|

118.8

|

28.5

|

116.5

|

24.6

|

2.3

|

2.0

|

|||||||||||||||

|

Operating

leases

|

|||||||||||||||||||||

|

Forward

Air

|

18.7

|

5.4

|

18.5

|

4.4

|

0.2

|

1.1

|

|||||||||||||||

|

FASI

|

8.6

|

11.9

|

5.9

|

10.7

|

2.7

|

45.8

|

|||||||||||||||

|

Total

|

27.3

|

6.5

|

24.4

|

5.1

|

2.9

|

11.9

|

|||||||||||||||

|

Depreciation

and amortization

|

|||||||||||||||||||||

|

Forward

Air

|

16.1

|

4.6

|

14.4

|

3.4

|

1.7

|

11.8

|

|||||||||||||||

|

FASI

|

3.6

|

5.0

|

2.2

|

4.0

|

1.4

|

63.6

|

|||||||||||||||

|

Total

|

19.7

|

4.7

|

16.6

|

3.5

|

3.1

|

18.7

|

|||||||||||||||

|

Insurance

and claims

|

|||||||||||||||||||||

|

Forward

Air

|

7.6

|

2.2

|

7.3

|

1.7

|

0.3

|

4.1

|

|||||||||||||||

|

FASI

|

2.1

|

2.9

|

0.8

|

1.4

|

1.3

|

162.5

|

|||||||||||||||

|

Total

|

9.7

|

2.3

|

8.1

|

1.7

|

1.6

|

19.8

|

|||||||||||||||

|

Fuel

expense

|

|||||||||||||||||||||

|

Forward

Air

|

3.1

|

0.9

|

5.8

|

1.4

|

(2.7

|

)

|

(46.6

|

)

|

|||||||||||||

|

FASI

|

4.2

|

5.8

|

5.7

|

10.3

|

(1.5

|

)

|

(26.3

|

)

|

|||||||||||||

|

Total

|

7.3

|

1.8

|

11.5

|

2.4

|

(4.2

|

)

|

(36.5

|

)

|

|||||||||||||

|

Other

operating expenses

|

|||||||||||||||||||||

|

Forward

Air

|

27.7

|

8.0

|

32.1

|

7.6

|

(4.4

|

)

|

(13.7

|

)

|

|||||||||||||

|

FASI

|

6.8

|

9.4

|

5.9

|

10.7

|

0.9

|

15.3

|

|||||||||||||||

|

Intercompany

Eliminations

|

(0.1

|

)

|

7.1

|

--

|

--

|

(0.1

|

)

|

100.0

|

|||||||||||||

|

Total

|

34.4

|

8.3

|

38.0

|

8.0

|

(3.6

|

)

|

(9.5

|

)

|

|||||||||||||

|

Impairment

of goodwill and

other intangible assets

|

|||||||||||||||||||||

|

Forward

Air

|

0.2

|

0.1

|

--

|

--

|

0.2

|

100.0

|

|||||||||||||||

|

FASI

|

7.0

|

9.6

|

--

|

--

|

7.0

|

100.0

|

|||||||||||||||

|

Total

|

7.2

|

1.7

|

--

|

--

|

7.2

|

100.0

|

|||||||||||||||

|

Income

(loss) from operations

|

|||||||||||||||||||||

|

Forward

Air

|

26.9

|

7.8

|

70.7

|

16.8

|

(43.8

|

)

|

(62.0

|

)

|

|||||||||||||

|

FASI

|

(8.3

|

)

|

(11.4

|

)

|

(0.4

|

)

|

(0.7

|

)

|

(7.9

|

)

|

1,975.0

|

||||||||||

|

Total

|

$

|

18.6

|

4.4

|

%

|

$

|

70.3

|

14.8

|

%

|

$

|

(51.7

|

)

|

(73.5

|

)

|

%

|

|||||||

|

Percent

of

|

Percent

of

|

Percent

|

|||||||||||||||||

| 2009 |

Revenue

|

2008

|

Revenue

|

Change

|

Change

|

||||||||||||||

|

Forward

Air revenue

|

|||||||||||||||||||

|

Airport-to-airport

|

$

|

268.8

|

77.6

|

%

|

$

|

336.2

|

79.8

|

%

|

$

|

(67.4

|

)

|

(20.0

|

)

|

%

|

|||||

|

Logistics

|

54.4

|

15.7

|

59.9

|

14.2

|

(5.5

|

)

|

(9.2

|

)

|

|||||||||||

|

Other

|

23.1

|

6.7

|

25.1

|

6.0

|

(2.0

|

)

|

(8.0

|

)

|

|||||||||||

|

Total

|

$

|

346.3

|

100.0

|

%

|

$

|

421.2

|

100.0

|

%

|

$

|

(74.9

|

)

|

(17.8

|

)

|

%

|

|||||

|

Forward

Air purchased transportation

|

|||||||||||||||||||

|

Airport-to-airport

|

$

|

112.8

|

42.0

|

%

|

$

|

128.9

|

38.3

|

%

|

$

|

(16.1

|

)

|

(12.5

|

)

|

%

|

|||||

|

Logistics

|

42.2

|

77.6

|

44.5

|

74.3

|

(2.3

|

)

|

(5.2

|

)

|

|||||||||||

|

Other

|

5.3

|

22.9

|

6.5

|

25.9

|

(1.2

|

)

|

(18.5

|

)

|

|||||||||||

|

Total

|

$

|

160.3

|

46.3

|

%

|

$

|

179.9

|

42.7

|

%

|

$

|

(19.6

|

)

|

(10.9

|

)

|

%

|

|||||

|

Year

ended

|

|||||||||||||||

|

December

31,

|

December

31,

|

Percent

|

|||||||||||||

|

2008

|

2007

|

Change

|

Change

|

||||||||||||

|

Operating

revenue

|

$ | 474.4 | $ | 392.7 | $ | 81.7 | 20.8 | % | |||||||

|

Operating

expenses:

|

|||||||||||||||

|

Purchased

transportation

|

189.0 | 164.4 | 24.6 | 15.0 | |||||||||||

|

Salaries,

wages, and employee benefits

|

116.5 | 88.8 | 27.7 | 31.2 | |||||||||||

|

Operating

leases

|

24.4 | 16.8 | 7.6 | 45.2 | |||||||||||

|

Depreciation

and amortization

|

16.6 | 10.9 | 5.7 | 52.3 | |||||||||||

|

Insurance

and claims

|

8.1 | 7.7 | 0.4 | 5.2 | |||||||||||

|

Fuel

expense

|

11.5 | 2.4 | 9.1 | 379.2 | |||||||||||

|

Other

operating expenses

|

38.0 | 30.7 | 7.3 | 23.8 | |||||||||||

|

Total

operating expenses

|

404.1 | 321.7 | 82.4 | 25.6 | |||||||||||

|

Income

from operations

|

70.3 | 71.0 | (0.7 | ) | (1.0 | ) | |||||||||

|

Other

income (expense):

|

|||||||||||||||

|

Interest

expense

|

(1.2 | ) | (0.5 | ) | (0.7 | ) | 140.0 | ||||||||

|

Other,

net

|

0.3 | 1.8 | (1.5 | ) | (83.3 | ) | |||||||||

|

Total

other (expense) income

|

(0.9 | ) | 1.3 | (2.2 | ) | (169.2 | ) | ||||||||

|

Income

before income taxes

|

69.4 | 72.3 | (2.9 | ) | (4.0 | ) | |||||||||

|

Income

taxes

|

26.9 | 27.4 | (0.5 | ) | (1.8 | ) | |||||||||

|

Net

income

|

$ | 42.5 | $ | 44.9 | $ | (2.4 | ) | (5.3 | ) | % | |||||

|

Year

ended

|

|||||||||||||||||||||

|

December

31,

|

Percent

of

|

December

31,

|

Percent

of

|

Percent

|

|||||||||||||||||

|

2008

|

Revenue

|

2007

|

Revenue

|

Change

|

Change

|

||||||||||||||||

|

Operating

revenue

|

|||||||||||||||||||||

|

Forward

Air

|

$

|

421.2

|

88.8

|

%

|

$

|

376.8

|

95.9

|

%

|

$

|

44.4

|

11.8

|

%

|

|||||||||

|

FASI

|

55.3

|

11.6

|

16.0

|

4.1

|

39.3

|

245.6

|

|||||||||||||||

|

Intercompany

Eliminations

|

(2.1

|

)

|

(0.4

|

)

|

(0.1

|

)

|

--

|

(2.0

|

)

|

2,000.0

|

|||||||||||

|

Total

|

474.4

|

100.0

|

392.7

|

100.0

|

81.7

|

20.8

|

|||||||||||||||

|

Purchased

transportation

|

|||||||||||||||||||||

|

Forward

Air

|

179.9

|

42.7

|

162.4

|

43.1

|

17.5

|

10.8

|

|||||||||||||||

|

FASI

|

11.2

|

20.2

|

2.1

|

13.1

|

9.1

|

433.3

|

|||||||||||||||

|

Intercompany

Eliminations

|

(2.1

|

)

|

100.0

|

(0.1

|

)

|

100.0

|

(2.0

|

)

|

2,000.0

|

||||||||||||

|

Total

|

189.0

|

39.9

|

164.4

|

41.9

|

24.6

|

15.0

|

|||||||||||||||

|

Salaries,

wages and employee benefits

|

|||||||||||||||||||||

|

Forward

Air

|

92.5

|

22.0

|

82.0

|

21.8

|

10.5

|

12.8

|

|||||||||||||||

|

FASI

|

24.0

|

43.4

|

6.8

|

42.5

|

17.2

|

252.9

|

|||||||||||||||

|

Total

|

116.5

|

24.6

|

88.8

|

22.6

|

27.7

|

31.2

|

|||||||||||||||

|

Operating

leases

|

|||||||||||||||||||||

|

Forward

Air

|

18.5

|

4.4

|

15.8

|

4.2

|

2.7

|

17.1

|

|||||||||||||||

|

FASI

|

5.9

|

10.7

|

1.0

|

6.3

|

4.9

|

490.0

|

|||||||||||||||

|

Total

|

24.4

|

5.1

|

16.8

|

4.3

|

7.6

|

45.2

|

|||||||||||||||

|

Depreciation

and amortization

|

|||||||||||||||||||||

|

Forward

Air

|

14.4

|

3.4

|

10.4

|

2.8

|

4.0

|

38.5

|

|||||||||||||||

|

FASI

|

2.2

|

4.0

|

0.5

|

3.1

|

1.7

|

340.0

|

|||||||||||||||

|

Total

|

16.6

|

3.5

|

10.9

|

2.8

|

5.7

|

52.3

|

|||||||||||||||

|

Insurance

and claims

|

|||||||||||||||||||||

|

Forward

Air

|

7.3

|

1.7

|

7.2

|

1.9

|

0.1

|

1.4

|

|||||||||||||||

|

FASI

|

0.8

|

1.4

|

0.5

|

3.1

|

0.3

|

60.0

|

|||||||||||||||

|

Total

|

8.1

|

1.7

|

7.7

|

1.9

|

0.4

|

5.2

|

|||||||||||||||

|

Fuel

expense

|

|||||||||||||||||||||

|

Forward

Air

|

5.8

|

1.4

|

1.3

|

0.3

|

4.5

|

346.2

|

|||||||||||||||

|

FASI

|

5.7

|

10.3

|

1.1

|

6.9

|

4.6

|

418.2

|

|||||||||||||||

|

Total

|

11.5

|

2.4

|

2.4

|

0.6

|

9.1

|

379.2

|

|||||||||||||||

|

Other

operating expenses

|

|||||||||||||||||||||

|

Forward

Air

|

32.1

|

7.6

|

29.0

|

7.7

|

3.1

|

10.7

|

|||||||||||||||

|

FASI

|

5.9

|

10.7

|

1.7

|

10.6

|

4.2

|

247.1

|

|||||||||||||||

|

Total

|

38.0

|

8.0

|

30.7

|

7.8

|

7.3

|

23.8

|

|||||||||||||||

|

Income

(loss) from operations

|

|||||||||||||||||||||

|

Forward

Air

|

70.7

|

16.8

|

68.7

|

18.2

|

2.0

|

2.9

|

|||||||||||||||

|

FASI

|

(0.4

|

)

|

(0.7

|

)

|

2.3

|

14.4

|

(2.7

|

)

|

(117.4

|

)

|

|||||||||||

|

Total

|

$

|

70.3

|

14.8

|

%

|

$

|

71.0

|

18.1

|

%

|

$

|

(0.7

|

)

|

(1.0

|

)

|

%

|

|||||||

|

Percent

of

|

Percent

of

|

Percent

|

|||||||||||||||

|

2008

|

Revenue

|

2007

|

Revenue

|

Change

|

Change

|

||||||||||||

|

Forward

Air revenue

|

|||||||||||||||||

|

Airport-to-airport

|

$

|

336.2

|

79.8

|

%

|

$

|

313.2

|

83.1

|

%

|

$

|

23.0

|

7.3

|

%

|

|||||

|

Logistics

|

59.9

|

14.2

|

42.7

|

11.3

|

17.2

|

40.3

|

|||||||||||

|

Other

|

25.1

|

6.0

|

20.9

|

5.6

|

4.2

|

20.1

|

|||||||||||

|

Total

|

$

|

421.2

|

100.0

|

%

|

$

|

376.8

|

100.0

|

%

|

$

|

44.4

|

11.8

|

%

|

|||||

|

Forward

Air purchased transportation

|

|||||||||||||||||

|

Airport-to-airport

|

$

|

128.9

|

38.3

|

%

|

$

|

123.7

|

39.5

|

%

|

$

|

5.2

|

4.2

|

%

|

|||||

|

Logistics

|

44.5

|

74.3

|

32.7

|

76.6

|

11.8

|

36.1

|

|||||||||||

|

Other

|

6.5

|

25.9

|

6.0

|

28.7

|

0.5

|

8.3

|

|||||||||||

|

Total

|

$

|

179.9

|

42.7

|

%

|

$

|

162.4

|

43.1

|

%

|

$

|

17.5

|

10.8

|

%

|

|||||

|

Contractual

Obligations

|

Payment

Due Period

|

||||||||||||||

|

2015

and

|

|||||||||||||||

|

Total

|

2010

|

2011-2012

|

2013-2014

|

Thereafter

|

|||||||||||

|

Capital

lease obligations

|

$

|

3,518

|

$

|

1,041

|

$

|

1,468

|

$

|

536

|

$

|

473

|

|||||

|

Other

long-term debt

|

21

|

21

|

--

|

--

|

--

|

||||||||||

|

Operating

leases

|

69,189

|

18,961

|

25,065

|

13,318

|

11,845

|

||||||||||

|

Senior

credit facility

|

50,000

|

--

|

50,000

|

--

|

--

|

||||||||||

|

Total

contractual cash obligations

|

$

|

122,728

|

$

|

20,023

|

$

|

76,533

|

$

|

13,854

|

$

|

12,318

|

|||||

|

Item

9A.

|

|

/s/

Ernst & Young LLP

|

|

|

Nashville,

Tennessee

|

|

|

February

24, 2010

|

|

Item

9B.

|

Other

Information

|

|

Item

11.

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Shareholder Matters

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

|

Item

14.

|

Principal

Accounting Fees and Services

|

|

Exhibits,

Financial Statement Schedules

|

|

(a)(1)

and (2)

|

List

of Financial Statements and Financial Statement

Schedules.

|

|

(a)(3)

|

List

of Exhibits.

|

|

(b)

|

Exhibits.

|

|

(c)

|

Financial

Statement Schedules.

|

|

Forward

Air Corporation

|

|||

|

Date:

February 24, 2010

|

By:

|

/s/

Rodney L. Bell

|

|

|

Rodney

L. Bell

|

|||

|

Chief

Financial Officer, Senior Vice President

|

|||

|

and

Treasurer (Principal Financial Officer)

|

|||

|

By:

|

/s/

Michael P. McLean

|

||

|

Michael

P. McLean

|

|||

|

Chief

Accounting Officer, Vice President

|

|||

|

and

Controller (Principal Accounting

Officer)

|

|||

|

Signature

|

Title

|

Date

|

||

|

/s/

Bruce A. Campbell

|

Chairman,

President and Chief Executive

|

February

24, 2010

|

||

|

Bruce

A. Campbell

|

Officer

(Principal Executive Officer)

|

|||

|

/s/

Rodney L. Bell

|

Chief

Financial Officer, Senior Vice President

|

February

24, 2010

|

||

|

Rodney

L. Bell

|

and

Treasurer ( Principal Financial Officer)

|

|||

|

/s/

Michael P. McLean

|

Chief

Accounting Officer, Vice President and

|

February

24, 2010

|

||

|

Michael

P. McLean

|

Controller

(Principal Accounting Officer)

|

|||

|

/s/

G. Michael Lynch

|

Lead

Director

|

February

24, 2010

|

||

|

G.

Michael Lynch

|

||||

|

/s/

C. Robert Campbell

|

Director

|

February

24, 2010

|

||

|

C.

Robert Campbell

|

||||

|

/s/

Richard W. Hanselman

|

Director

|

February

24, 2010

|

||

|

Richard

W. Hanselman

|

||||

|

/s/

C. John Langley, Jr.

|

Director

|

February

24, 2010

|

||

|

C.

John Langley, Jr.

|

||||

|

/s/

Tracy A. Leinbach

|

Director

|

February

24, 2010

|

||

|

Tracy

A. Leinbach

|

||||

|

/s/

Ray A. Mundy

|

Director

|

February

24, 2010

|

||

|

Ray

A. Mundy

|

||||

|

/s/

Gary L. Paxton

|

Director

|

February

24, 2010

|

||

|

Gary

L. Paxton

|

|

Page

No.

|

|

|

Report of Ernst & Young LLP, Independent

Registered Public Accounting Firm

|

F-3

|

|

Consolidated Balance Sheets — December 31, 2009

and 2008

|

F-4

|

|

Consolidated Statements of Income — Years Ended

December 31, 2009, 2008 and 2007

|

F-6

|

|

Consolidated Statements of Shareholders’ Equity —

Years Ended December 31, 2009, 2008

and 2007

|

F-7

|

|

Consolidated Statements of Cash Flows — Years

Ended December 31, 2009, 2008 and 2007

|

F-8

|

|

Notes to Consolidated Financial Statements —

December 31, 2009

|

F-9

|

|

Schedule

II - Valuation and Qualifying Accounts

|

S-1

|

|

/s/

Ernst & Young LLP

|

|

|

Nashville,

Tennessee

|

|

|

February

24, 2010

|

|

Consolidated

Balance Sheets

|

|||||

|

(Dollars

in thousands)

|

|||||

|

December

31,

|

December

31,

|

||||

|

2009

|

2008

|

||||

|

Assets

|

|||||

|

Current

assets:

|

|||||

|

Cash

|

$ | 42,035 | $ | 22,093 | |

|

Accounts

receivable, less allowance of $1,919 in 2009 and $2,531 in

2008

|

55,720 | 57,206 | |||

|

Income

taxes receivable

|

-- | 3,427 | |||

|

Inventories

|

938 | 669 | |||

|

Prepaid

expenses and other current assets

|

5,272 | 6,089 | |||

|

Deferred

income taxes

|

3,261 | 2,105 | |||

|

Total

current assets

|

107,226 | 91,589 | |||

|

Property

and equipment:

|

|||||

|

Land

|

16,928 | 16,928 | |||

|

Buildings

|

68,444 | 39,895 | |||

|

Equipment

|

111,728 | 107,983 | |||

|

Leasehold

improvements

|

5,243 | 5,049 | |||

|

Construction

in progress

|

2,373 | 16,522 | |||

|

Total

property and equipment

|

204,716 | 186,377 | |||

|

Less

accumulated depreciation and amortization

|

75,990 | 63,401 | |||

|

Net

property and equipment

|

128,726 | 122,976 | |||

|

Goodwill

and other acquired intangibles:

|

|||||

|

Goodwill

|

43,332 | 50,230 | |||

|

Other

acquired intangibles, net of accumulated amortization of $12,281 in 2009

and $8,103 in 2008

|

35,849 | 40,708 | |||

|

Total

net goodwill and other acquired intangibles

|

79,181 | 90,938 | |||

|

Other

assets

|

1,597 | 2,024 | |||

|

Total

assets

|

$ | 316,730 | $ | 307,527 | |

|

Consolidated

Balance Sheets (continued)

|

|||||

|

(Dollars

in thousands)

|

|||||

|

December

31,

|

December

31,

|

||||

|

2009

|

2008

|

||||

|

Liabilities

and Shareholders’ Equity

|

|||||

|

Current

liabilities:

|

|||||

|

Accounts

payable

|

$ | 10,333 | $ | 11,633 | |

|

Accrued

payroll and related items

|

5,394 | 3,652 | |||

|

Insurance

and claims accruals

|

5,622 | 4,620 | |||

|

Payables

to owner-operators

|

3,603 | 2,563 | |||

|

Collections

on behalf of customers

|

697 | 612 | |||

|

Other

accrued expenses

|

1,791 | 1,480 | |||

|

Income

taxes payable

|

1,424 | -- | |||

|

Current

portion of capital lease obligations

|

898 | 1,455 | |||

|

Current

portion of long-term debt

|

21 | 147 | |||

|

Total

current liabilities

|

29,783 | 26,162 | |||

|

Capital

lease obligations, less current portion

|

2,169 | 3,014 | |||

|

Long-term

debt, less current portion

|

50,000 | 50,021 | |||

|

Other

long-term liabilities

|

4,485 | 3,055 | |||

|

Deferred

income taxes

|

5,786 | 8,841 | |||

|

Commitments

and contingencies (Note 9)

|

|||||

|

Shareholders’

equity:

|

|||||

|

Preferred

stock, $0.01 par value

|

|||||

|

Authorized

shares - 5,000,000

|

|||||

|

No

shares issued

|

-- | -- | |||

|

Common

stock, $0.01 par value

|

|||||

|

Authorized

shares – 50,000,000

|

|||||

|

Issued

and outstanding shares – 28,950,391 in 2009 and 28,893,850

in 2008

|

290 | 289 | |||

|

Additional

paid-in capital

|

16,631 | 10,249 | |||

|

Retained

earnings

|

207,586 | 205,896 | |||

|

Total

shareholders’ equity

|

224,507 | 216,434 | |||

|

Total

liabilities and shareholders’ equity

|

$ | 316,730 | $ | 307,527 | |

|

Consolidated

Statements of Income

|

|||||||||||

|

(In

thousands, except per share data)

|

|||||||||||

|

Year

ended

|

|||||||||||

|

December

31,

|

December

31,

|

December

31,

|

|||||||||

|

2009

|

2008

|

2007

|

|||||||||

|

Operating

revenue:

|

|||||||||||

|

Forward

Air

|

|||||||||||

|

Airport-to-airport

|

$ | 268,245 | $ | 334,860 | $ | 313,162 | |||||

|

Logistics

|

54,067 | 59,290 | 42,626 | ||||||||

|

Other

|

23,076 | 25,133 | 20,923 | ||||||||

|

Forward

Air Solutions

|

|||||||||||

|

Pool

distribution

|

72,022 | 55,153 | 16,026 | ||||||||

|

Total

operating revenue

|

417,410 | 474,436 | 392,737 | ||||||||

|

Operating

expenses:

|

|||||||||||

|

Purchased

transportation

|

|||||||||||

|

Forward

Air

|

|||||||||||

|

Airport-to-airport

|

112,516 | 128,785 | 123,658 | ||||||||

|

Logistics

|

42,188 | 44,560 | 32,727 | ||||||||

|

Other

|

5,234 | 6,425 | 6,049 | ||||||||

|

Forward

Air Solutions

|

|||||||||||

|

Pool

distribution

|

14,490 | 9,315 | 2,003 | ||||||||

|

Total

purchased transportation

|

174,428 | 189,085 | 164,437 | ||||||||

|

Salaries,

wages and employee benefits

|

118,804 | 116,504 | 88,803 | ||||||||

|

Operating

leases

|

27,294 | 24,403 | 16,761 | ||||||||

|

Depreciation

and amortization

|

19,722 | 16,615 | 10,824 | ||||||||

|

Insurance

and claims

|

9,719 | 8,099 | 7,685 | ||||||||

|

Fuel

expense

|

7,312 | 11,465 | 2,421 | ||||||||

|

Other

operating expenses

|

34,424 | 37,980 | 30,758 | ||||||||

|

Impairment

of goodwill and other intangible assets

|

7,157 | -- | -- | ||||||||

|

Total

operating expenses

|

398,860 | 404,151 | 321,689 | ||||||||

|

Income

from operations

|

18,550 | 70,285 | 71,048 | ||||||||

|

Other

income (expense):

|

|||||||||||

|

Interest

expense

|

(670 | ) | (1,236 | ) | (491 | ) | |||||

|

Other,

net

|

69 | 362 | 1,756 | ||||||||

|

Total

other (expense) income

|

(601 | ) | (874 | ) | 1,265 | ||||||

|

Income

before income taxes

|

17,949 | 69,411 | 72,313 | ||||||||

|

Income

taxes

|

8,147 | 26,869 | 27,388 | ||||||||

|

Net

income

|

$ | 9,802 | $ | 42,542 | $ | 44,925 | |||||

|

Net

income per share:

|

|||||||||||

|

Basic

|

$ | 0.34 | $ | 1.48 | $ | 1.52 | |||||

|

Diluted

|

$ | 0.34 | $ | 1.47 | $ | 1.50 | |||||

|

Weighted

average shares outstanding:

|

|||||||||||

|

Basic

|

28,928 | 28,808 | 29,609 | ||||||||

|

Diluted

|

28,993 | 29,025 | 29,962 | ||||||||

|

Dividends

per share:

|

$ | 0.28 | $ | 0.28 | $ | 0.28 | |||||

|

Consolidated

Statements of Shareholders' Equity

|

|||||||||||||||||||

|

(In

thousands, except per share data)

|

|||||||||||||||||||

|

Additional

|

Total

|

||||||||||||||||||

|

Common

Stock

|

Paid-in

|

Retained

|

Shareholders'

|

||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Earnings

|

Equity

|

|||||||||||||||

|

Balance

at December 31, 2006

|

30,372 | $ | 304 | $ | -- | $ | 184,923 | $ | 185,227 | ||||||||||

|

Adoption of accounting for uncertainty in income taxes

|

-- | -- | -- | (977 | ) | (977 | ) | ||||||||||||

|

Net and comprehensive income for 2007

|

-- | -- | -- | 44,925 | 44,925 | ||||||||||||||

|

Exercise of stock options

|

57 | -- | 1,017 | -- | 1,017 | ||||||||||||||

|

Common stock issued under employee stock purchase plan

|

9 | -- | 259 | -- | 259 | ||||||||||||||

|

Share-based compensation

|

-- | -- | 3,710 | -- | 3,710 | ||||||||||||||

|

Dividends ($0.28 per share)

|

-- | -- | -- | (8,305 | ) | (8,305 | ) | ||||||||||||

|

Vesting of previously non-vested shares

|

42 | -- | -- | -- | -- | ||||||||||||||

|

Cash settlement of share-based awards for minimum tax

withholdings

|

(8 | ) | -- | (250 | ) | -- | (250 | ) | |||||||||||

|

Common stock repurchased under stock repurchase plan

|

(1,824 | ) | (18 | ) | (5,997 | ) | (49,119 | ) | (55,134 | ) | |||||||||

|

Income tax benefit from stock options exercised

|

-- | -- | 1,261 | -- | 1,261 | ||||||||||||||

|

Balance

at December 31, 2007

|

28,648 | 286 | -- | 171,447 | 171,733 | ||||||||||||||

|

Net and comprehensive income for 2008

|