EXECUTION VERSION [[6275894]] RELEASE AND SEPARATION AGREEMENT This Release and Separation Agreement (“Agreement” or “Release”) is entered into between Thomas Schmitt (“Employee”), and FORWARD AIR CORPORATION (“Forward”) on behalf of itself, its parent, affiliates, subsidiaries, (current and former), successors, predecessors, assigns, and any and all other related persons, firms, corporations and other legal entities and any and all of their respective officers, agents, employees, shareholders, directors and managers (current and former) (herein singularly and collectively called the “Company”). WHEREAS, Employee and the Company are party to the Employment Agreement and Participation and Restrictive Covenants Agreement, entered into as of June 6, 2018 and May 27, 2022, respectively (the “Employment Agreement” and the “Restrictive Covenants Agreement”, respectively); WHEREAS, Employee participates in the Company’s Executive Severance and Change in Control Plan (the “Severance Plan”); WHEREAS, Employee and the Company agree that Employee has undergone a Company-initiated Involuntary Termination (as defined in the Severance Plan); and WHEREAS, Employee and the Company have agreed that Employee would and did remain an employee without a formal title through February 9, 2024 to ensure a smooth transition period. NOW THEREFORE, in consideration of the promises made herein, the Company and Employee hereby agree as follows: 1. Transition Work, Payment of Accrued Wages, Vested Benefits, COBRA, and Amounts Otherwise Required by Law. Beginning on February 6, 2024, Employee will be removed from the position of President and Chief Executive Officer and will no longer be a member of the Board. The last day of Employee’s employment with the Company (the “Termination Date”) was on February 9, 2024, and that, regardless of whether Employee signs this Agreement: (a) The Company shall pay Employee’s regular wages, earned and certified 2023 annual bonus in the amount of $123,080, and other compensation due, less all applicable withholding and payroll taxes, through the Termination Date, and these amounts shall be paid no later than the first scheduled pay day following the Termination Date. (b) Employee shall be eligible for all fringe benefits in which Employee participated through the Termination Date, and as otherwise provided pursuant to the terms of any applicable benefit plans. (c) Employee shall receive notice of Employee’s right to elect continued coverage under the Company’s group health care plan in accordance with the provisions of the Consolidated Omnibus Budget and Reconciliation Act (“COBRA”), provided that Employee has coverage under such group health plan. (d) The Company shall pay Employee any amounts otherwise required by law, less any applicable withholding and payroll taxes, no later than the first scheduled pay day following the Termination Date.

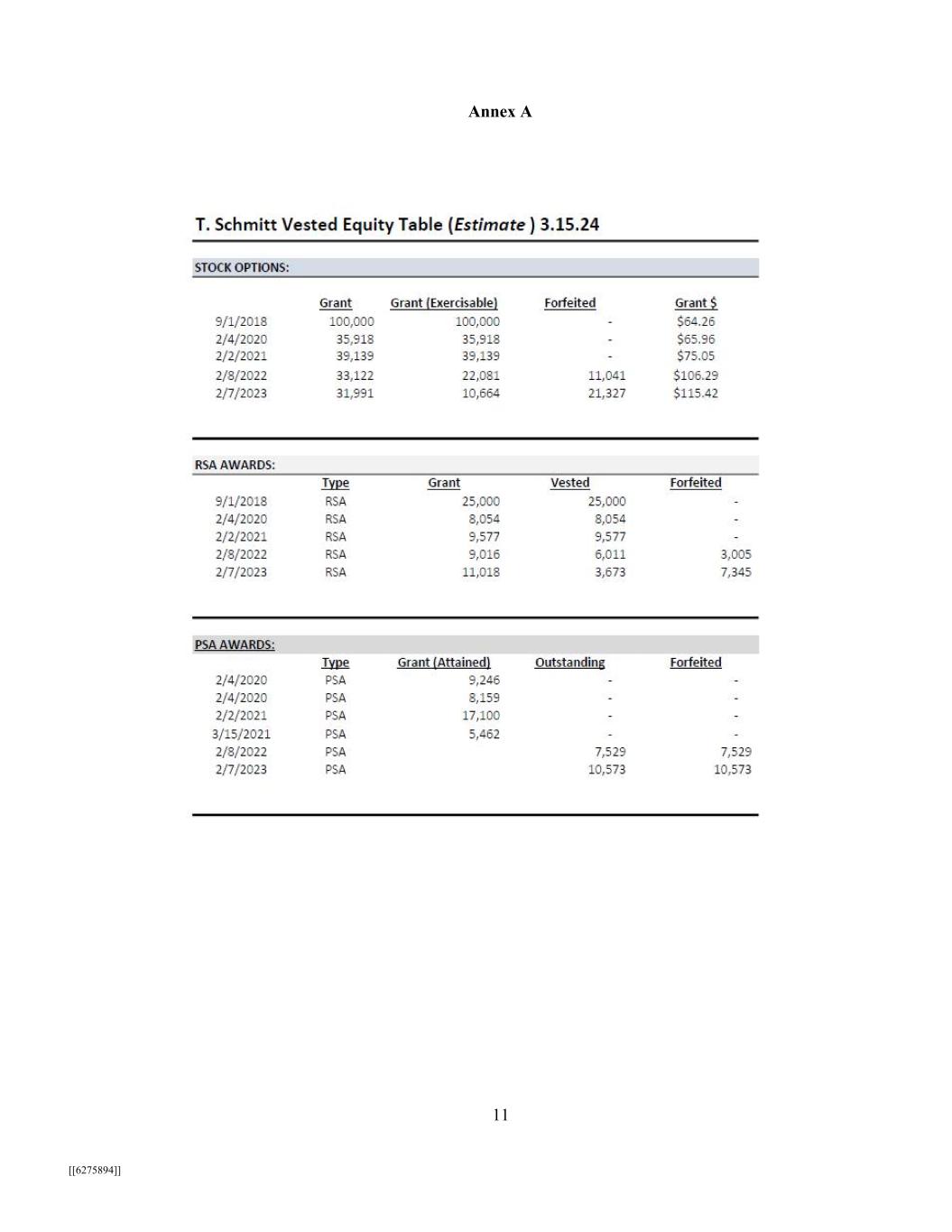

[[6275894]] 2 2. Severance and Consideration. ( a ) In addition to the amounts the Company shall pay Employee under Paragraph 1 of this Agreement, the Company, as consideration for this Agreement, agrees to pay Employee, and subject to the Release becoming effective and irrevocable pursuant to Paragraph 8 (such date, the “Release Effective Date”) (i) $1,810,000, less required deductions, which represents 104 weeks of pay at Employee’s current salary, which shall be paid in equal installments for a period of twenty-four (24) months in accordance with Section 2 of the Restrictive Covenants Agreement, plus (ii) subject to Employee’s eligibility for and timely election of COBRA coverage under the applicable Company plans, the amount of COBRA premium assistance for a period of twenty four (24) months (as contemplated by the Severance Plan), to be paid in a lump sum on the Company’s first normal payroll date following the Release Effective Date, plus (iii) an annual incentive amount based on actual performance in respect of the 2024 fiscal year, subject to certification by the Board in February 2025, equal to the product of (I) the actual annual incentive amount that would have been payable to Employee had Employee remained employed by the Company through the payment date applicable to then-current employees, and (II) a fraction, the numerator of which equals forty (40) days and the denominator of which is three hundred and sixty-six (366) days, which resulting amount shall be paid in a lump-sum payment at the same time as other amounts under such annual incentive are paid to participating executive officers of the Company (but not later than March 15, 2025), plus (iv) $20,000 in respect of the required outplacement service amount under the Severance Plan, to be paid in a lump sum on the Company’s first normal payroll date following the Release Effective Date. (b) Additionally, subject to the Release becoming effective and irrevocable pursuant to Paragraph 8, (i) Employee’s EBITDA and TSR performance share awards granted in 2021, which are otherwise scheduled to vest on or around March 14, 2024 and for which the Compensation Committee of the Board certified performance in February of 2024, shall accelerate and vest on the Termination Date at the actual level of performance as certified by the Compensation Committee of the Board and shall otherwise remain subject to their original terms and conditions and (ii) any of Employee’s stock options that, as of the Termination Date, have vested pursuant to their terms shall remain exercisable until the earlier of (x) their original Expiration Date, as set forth in such award agreements, and (y) five (5) years from the Termination Date. At Employee’s request, an illustrative estimate of the general treatment of Employee’s vested equity-based awards is attached hereto as Annex A, which has been modeled based on information available to the Company (including the assumption of Employee’s compliance with this Agreement and the Release becoming effective and irrevocable pursuant to Paragraph 8) and which shall not constitute a guarantee by the Company of any specific number of awards set forth therein. (c) In no event shall Employee be obligated to seek or obtain other employment after the date of termination, or take any other action by way of mitigation of the amounts payable to Employee under any of the provisions of this Agreement, and such amounts shall not be reduced, whether or not Employee obtains other employment. (d) The payments set forth in this Paragraph 2 are subject to applicable withholding and payroll taxes. Employee acknowledges that but for Employee’s execution of this Agreement, Employee would not be entitled to the amounts being paid to Employee under this Paragraph 2. 3. Termination of Benefits. As of the Termination Date and except to the extent Employee is otherwise eligible or qualified to participate, Employee shall cease to be an active participant under the Company’s medical, retirement, or other benefit plans, pursuant to the terms of those plans, subject to any

[[6275894]] 3 rights to elect continued coverage under COBRA or applicable state or local law. No additional benefits shall accrue to Employee and Employee waives any claim to such benefits beyond the Termination Date, with the exception of any participation rights the law precludes Employee from waiving by agreement. 4. Return of Property. Employee and Forward will comply with Section 4 of the Restrictive Covenants Agreement regarding the return of property and materials; provided that Employee may retain his Company-provided iPhone, iPad and two BlackBerry devices (the “retained devices”); provided further that all Company-owned information has been removed from each retained device and any and all related backups and external storage (whether cloud-based or physical media). 5. Neutral Reference. If contacted by a bona fide potential subsequent employer, Company’s Human Resources Department shall provide a neutral reference only for Employee, stating dates of employment and position held. 6. Release. (a) Employee, individually, and on behalf of Employee’s heirs, executors, administrators, and assigns, agrees not to sue, acquits, releases, and forever discharges the Company, as collectively defined above, of and from all actions and causes of action, suits, debts, claims, and demands which may legally be waived by private agreement, in law or in equity, which Employee ever had, or may now have, with respect to any aspect of Employee’s employment by, and/or separation of employment from, the Company, whether known or unknown to Employee at the time of execution of this Agreement, including, but not limited to, claims for breach of contract (express or implied), personal injury, defamation and wrongful discharge; claims based on any oral or written agreements or promises, contract, constitutional provision, common law, public policy, and tort; claims for retaliation, and/or discrimination or harassment in employment; and claims for compensatory, actual, special, consequential, reliance, punitive, exemplary and/or other damages for personal injuries, pain and suffering, emotional distress, health care expenses, back pay, front pay, separation pay, wages, benefits, attorney’s fees, costs, interest or other monies, from the beginning of time through the date that Employee signs this Agreement with the exceptions of: (i) any action the law precludes Employee from waiving by agreement; (ii) any claim that the Company breached its commitments under this Agreement; (iii) any claim relating to directors’ and officers’ liability insurance coverage or any right of indemnification under the Company’s organizational documents or otherwise; (iv) Employee’s rights as an equity or security holder in the Company or its Affiliates; (v) Employee’s rights under any equity awards that survive termination of employment; or (vi) Employee’s rights to accrued benefits only under any retirement plan that is “qualified” under Section 401(a) of the Internal Revenue Code of 1986. (b) Employee agrees that, with the exception of any action the law precludes Employee from waiving by agreement, Employee’s covenants and releases, as set forth in this Agreement, include a waiver of any and all rights or remedies under any present and/or future federal, state, local or foreign statute, law and/or regulation, including, but not limited to: state and U.S. Constitutions; state common law; Title VII of the Civil Rights Act of 1964; the Civil Rights Act of 1866; the Civil Rights Act of 1991; the Americans with Disabilities Act; the Equal Pay Act; the Family and Medical Leave Act; the Employee Retirement Income Security Act; the Age Discrimination in Employment Act; the Older Workers Benefit Protection Act; the Genetic Information Non-Discrimination Act; the Occupational Safety and Health Act; the National Labor Relations Act; the federal Worker Adjustment and Retraining Notification Act; the Consolidated Omnibus Budget Reconciliation Act; the False Claims Act; and any similar federal, state or local statute or law applicable to Employee’s employment, all as amended. This Agreement is

[[6275894]] 4 also intended to and shall release the Company from any and all wage and hour related claims arising out of or in any way connected with Employee’s employment with the Company, to the maximum extent permitted by federal and state law. Nothing in this Agreement, the Employment Agreement or the Restrictive Covenants Agreement shall prevent Employee from the disclosure of confidential information or trade secrets that: (i) is made; (x) in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney; and (y) solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal; or (iii) is permitted under the terms and conditions contained in the Restrictive Covenants Agreement. In the event that Employee files a lawsuit alleging retaliation by the Company for reporting a suspected violation of law, Employee may disclose confidential information or trade secrets related to the suspected violation of law or alleged retaliation to Employee’s attorney and use the confidential information or trade secrets in the court proceeding if Employee or Employee’s attorney: (i) files any document containing confidential information or trade secrets under seal; and (ii) does not disclose the confidential information or trade secrets, except pursuant to court order. The Company provides this notice in compliance with the Defend Trade Secrets Act of 2016. Additionally, nothing in this Agreement, the Employment Agreement or the Restrictive Covenants Agreement is intended to limit or restrict, and shall not be interpreted in any manner that limits or restricts, Employee from exercising any legally protected whistleblower rights (including pursuant to Section 21F of the Securities and Exchange Act of 1934 (“Section 21F”)) or receiving an award for information provided to any government agency under any legally protected whistleblower rights. Notwithstanding anything herein to the contrary, nothing in or about this Agreement, the Employment Agreement or the Participation and Restrictive Covenants Agreement prohibits Employee from: (i) filing and, as provided for under Section 21F, maintaining the confidentiality of a claim with the U.S. Securities and Exchange Commission (the “SEC”); (ii) providing Confidential Information (as defined in the Participation and Restrictive Covenants Agreement) to the SEC, or providing the SEC with information that would otherwise violate Section 2 of the Participation and Restrictive Covenants Agreement, to the extent permitted by Section 21F; (iii) cooperating, participating or assisting in an SEC investigation or proceeding without notifying the Company; or (iv) receiving a monetary award as set forth in Section 21F. (c) Employee intends that this Agreement shall bar each and every claim, demand and cause of action hereinabove specified, whether known or unknown to Employee at the time of execution of this Agreement, other than the Excluded Claims. As a result, Employee acknowledges that Employee might, in the future, discover claims or facts in addition to or different from those which Employee now knows or believes to exist with respect to the subject matters of this Agreement and which, if known or suspected at the time of executing this Agreement, may have materially affected this settlement. Nevertheless, Employee hereby waives any rights, claims, or causes of action that might become known as a result of such different or additional claims or facts. (d) Nothing in this Agreement shall be construed to prohibit Employee from filing a charge with or participating in any investigation or proceeding conducted by any government agency, such as the Equal Employment Opportunity Commission or National Labor Relations Board. Notwithstanding the foregoing, with the exception of any relief the law precludes Employee from waiving by agreement, Employee agrees to waive Employee’s right to recover monetary damages or other individual relief in any charge, complaint, demand, or lawsuit against the Company by Employee, anyone on behalf of Employee, any governmental agency, or any other third party. 7. Acknowledgements and Reporting. Employee acknowledges and agrees that Employee: (a) has

[[6275894]] 5 been properly paid for all hours worked at the Company or will be so paid under the terms of this Agreement; (b) has not suffered any on-the job injury at the Company for which Employee has not already filed a claim; (c) has not suffered any unreported workplace injury at the Company through the Termination Date or re-aggravated any job injury Employee has already reported or for which Employee has already filed a worker’s compensation claim; (d) has been properly provided any leave of absence at the Company because of Employee’s or a family member’s health condition; and, (e) has not been subjected to any improper treatment, conduct or actions by the Company due to or related to Employee’s request for, or taking of, any leave of absence because of Employee’s own or a family member’s health condition. 8. Older Worker Benefits Protection Act and Age Release Acknowledgment. (a) Employee understands and acknowledges that Employee has the right to consult with an attorney, and Employee acknowledges that Employee is hereby advised to consult with an attorney prior to executing this Release. (b) Employee understands and acknowledges that for a period of at least twenty one (21) days from the date Employee receives this Release, Employee has the right to deliberate upon whether to sign this Release and agree to the terms of this Release. Employee also understands that any modifications, material or otherwise, made to this Release do not restart, extend or affect in any manner the original twenty-one (21) day deliberation period. (c) Employee understands that, for this Release to be effective, Employee must sign and submit to the Company this Release within thirty five (35) days of Employee’s receipt of the Release. This signed Release must be submitted to the Company via electronic mail to: aabel@forwardair.com. (d) Employee understands that Employee is not waiving any claims that may arise after the execution of this Agreement under the ADEA. (e) Employee understands that the severance payments under Paragraph 2 of this agreement exceed the amount to which Employee would have otherwise been entitled from the Company absent executing this Release. (f) Employee declares that Employee freely and willingly gives this Release and was not forced in any manner to sign it. Employee understands that if Employee wishes to revoke this Release, Employee has seven (7) days from the date Employee signs the Release in which to make such a revocation, and the Release is not effective or enforceable until the seven (7) day revocation period has expired. Employee agrees that in order to make this revocation, Employee shall do so in writing, by delivering it via electronic mail to: aabel@forwardair.com. (g) Employee acknowledges that Employee has received the Statement of Rights under the ADEA that is attached hereto. 9. Modification and Waiver. This Agreement shall not be changed, modified, terminated, canceled or amended except by a written instrument signed by Employee and the Company. The failure to exercise, or a delay in exercising, any right, remedy or power under this Agreement shall not operate as a waiver thereof, nor shall any single or partial exercise of any right, remedy or power under this Agreement preclude any other or further exercise thereof.

[[6275894]] 6 10. Severability. If any provision of this Agreement is judicially declared to be invalid or unenforceable for any reason, in whole or in part, only such provision or provisions shall be invalid or unenforceable without invalidating or rendering unenforceable or otherwise affecting the remaining provisions of this Agreement, which shall remain in full force and effect to the fullest extent permitted by law. 11. Headings. The headings used in this Agreement are descriptive only, are for the convenience of identifying provisions, and are not determinative of the meaning or effect of any provision. 12. Counterparts and Execution. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement, binding on all parties, notwithstanding that all parties are not signatories to the same counterpart. Execution by facsimile or by an electronically transmitted signature shall be fully and legally binding on the parties. 13. Entire Agreement. With the exception of the Restrictive Covenants Agreement, which shall specifically survive this Agreement and remain in full force and effect, the parties agree that this Agreement constitutes the entire agreement between Employee and the Company regarding Employee’s Company-initiated Involuntary Termination (as defined in the Severance Plan) and supersedes any previous agreement or understandings between them, whether written or oral. [signature page to follow]

[[6275894]] 7 WHEREFORE, Employee and the Company have read all of the foregoing, understand the foregoing, and agree to all of the provisions contained in this Agreement. FORWARD AIR CORPORATION Thomas Schmitt By Michael L. Hance Interim Chief Executive Officer, Chief Legal Officer and Secretary Employee Signature Date of Employee’s Signature (invalid if signed before the Termination Date)

[[6275894]] 8 STATEMENT OF RIGHTS UNDER THE ADEA Note: This statement is being furnished to you in conjunction with an offer to provide you with extra benefits, to which you are not otherwise entitled, in exchange for, among other things, your agreement to release or waive claims under the Age Discrimination in Employment Act and certain other laws. Please read this statement carefully and acknowledge receipt on the enclosed Acknowledgment of Receipt form. The Age Discrimination in Employment Act (“ADEA”) (29 U.S.C. § 621 et seq.) prohibits an employer from discriminating against any employee age 40 or over because of that individual’s age. The ADEA prohibits discrimination in all terms and conditions of employment, including hiring, promotions, transfers, demotions, salary or terminations. The ADEA also provides employees and former employees with certain rights in connection with any release or waiver of claims under the ADEA. Specifically, in order for such a release or waiver to be valid, the waiver must be knowing and voluntary. A waiver may not be considered knowing and voluntary unless at a minimum: (1) The release or waiver must be part of an agreement between the individual and the employer that is written in a manner that can be understood by the individual or by an average individual eligible to participate. (29 U.S.C. § 626(f)(1)(A)). (2) The waiver must specifically refer to rights or claims arising under the ADEA. (29 U.S.C. § 626(f)(1)(B)). (3) The individual is not required to waive rights or claims that arise after the date the waiver is executed. (29 U.S.C. § 626(f)(1)(C)). (4) The individual may waive rights or claims only in exchange for consideration in addition to anything of value to which the individual is already entitled. (29 U.S.C. § 626(f)(1)(D)). (5) The individual must be advised in writing to consult with an attorney before signing the agreement. (29 U.S.C. § 626(f)(1)(E)). (6) The individual must be given a period of at least twenty one (21) days in which to consider the agreement. (29 U.S.C. § 626 (f)(1)(F)). (7) The agreement must provide for a period of at least seven (7) days after the agreement’s execution in which the individual may revoke the agreement. Furthermore, the agreement must not become effective or enforceable until this revocation period has passed. (29 U.S.C. § 626(f)(1)(G)). (8) If a waiver is requested in connection with an exit incentive or other

[[6275894]] 9 employment termination program offered to a group or class of employees, the employer must inform the individual in writing in a manner calculated to be understood by the average individual eligible to participate as to: (a) any class, unit, or group of individuals covered by such program, any eligibility factors for such program, and any time limits applicable to such program; and (b) the job titles and ages of all individuals eligible or selected for the program, and the ages of all individuals in the same job classification or organizational unit who are not eligible or selected for the program. (29 U.S.C. § 626(f)(1)(H)). This statement has been provided to you in conjunction with a request or offer for you to enter into an agreement that provides, among other things, that you release or waive your rights to make claims under the ADEA. In conformance with the requirements set forth above, Forward Air Corporation and all of its parent companies, subsidiaries, divisions, related companies, affiliates, shareholders, directors, officers, managers, employees, agents, attorneys, successors and assigns (hereinafter collectively referred to as “FAS” or the “Company”) hereby: a. Advises you that you have the right to consult an attorney before you sign the Release & Separation Agreement (“Release”). b. Offers you thirty five (35) days from your receipt of the Release and this statement to consider and sign the Release. The Release must be returned to the Company’s Legal Department via electronic mail to: aabel@forwardair.com, with your signature no later than thirty five (35) days from the date you receive the Release. To be eligible for benefits under the employment termination program, you must sign the Release provided by the Company that is enclosed herewith. c. Allows you seven (7) days after the date you sign the Release to revoke the Release. If no revocation is made within that period, the Release will become effective and enforceable and you will become entitled to receive benefits under the employment termination program. If you revoke the Release, you will no longer be eligible for benefits under the program.

[[6275894]] 10 IF YOU DO NOT UNDERSTAND ANYTHING IN OR ABOUT THIS STATEMENT OF RIGHTS, THE PROPOSED AGREEMENT, OR THE RELEASE OR WAIVER OF RIGHTS CONTAINED IN THE PROPOSED AGREEMENT, PLEASE LET US KNOW SO THAT WE CAN PROVIDE CLARIFICATION. WE WILL ASSUME, AND ASK ANY COURT OR TRIER OF FACT TO ASSUME, THAT YOU HAVE UNDERSTOOD EVERYTHING ON WHICH CLARIFICATION HAS NOT BEEN SOUGHT. This Statement of Rights Under the ADEA is yours to keep. Please direct all correspondence or inquiries to: Kyle Mitchin, Chief People Officer, at kmitchin@forwardair.com.

[[6275894]] 11 Annex A