0000912728PRE 14AFALSE00009127282023-01-012023-12-31iso4217:USDxbrli:pure00009127282022-01-012022-12-3100009127282021-01-012021-12-3100009127282020-01-012020-12-310000912728ecd:PeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310000912728ecd:PeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-01-012022-12-310000912728ecd:PeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-01-012021-12-310000912728ecd:PeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2020-01-012020-12-310000912728ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310000912728ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310000912728ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310000912728ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310000912728ecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310000912728ecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-012022-12-310000912728ecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-012021-12-310000912728ecd:PeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-01-012020-12-310000912728ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310000912728ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310000912728ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310000912728ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310000912728ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310000912728ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-01-012022-12-310000912728ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-01-012021-12-310000912728ecd:PeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2020-01-012020-12-310000912728ecd:PeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-01-012023-12-310000912728ecd:PeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2022-01-012022-12-310000912728ecd:PeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2021-01-012021-12-310000912728ecd:PeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2020-01-012020-12-310000912728ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000912728ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000912728ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000912728ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000912728ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310000912728ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310000912728ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310000912728ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310000912728ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310000912728ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310000912728ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310000912728ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310000912728ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000912728ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000912728ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000912728ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000912728ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000912728ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000912728ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000912728ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000912728ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-01-012023-12-310000912728ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2022-01-012022-12-310000912728ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2021-01-012021-12-310000912728ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2020-01-012020-12-31000091272812023-01-012023-12-31000091272822023-01-012023-12-31000091272832023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| ☒ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

| | |

| FORWARD AIR CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| | |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | | | | |

| (1) | | Title of each class of securities to which transaction applies: |

| | |

| | |

| (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | |

| (5) | | Total fee paid: |

| | |

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | | | | |

| (1) | | Amount Previously Paid: |

| | |

| | |

| (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | |

| (3) | | Filing Party: |

| | |

| | |

| (4) | | Date Filed: |

| | |

[ ], 2024

Dear Fellow Shareholder:

On behalf of your Board of Directors and management of Forward Air Corporation, you are cordially invited to attend the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) on [ ], 2024, beginning promptly at 8:00 a.m. EDT, at the Four Seasons Hotel Atlanta, 75 Fourteenth St., NE, Atlanta, GA 30309.

The attached Notice of 2024 Annual Meeting of Shareholders and Proxy Statement describe the business to be conducted at the Annual Meeting. Also included are a proxy card and postage-paid return envelope.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting in person, please vote and submit your proxy: (a) by telephone or the Internet following the instructions on the enclosed proxy card or (b) by signing, dating and returning the proxy card in the postage-paid envelope provided.

If you attend the meeting and desire to vote in person, you may do so even though you have previously submitted a proxy by following the instructions set forth on the enclosed proxy card.

Your vote is extremely important.

I hope you will be able to join us, and we look forward to seeing you at the meeting.

Sincerely yours,

Michael Hance

Interim Chief Executive Officer, Chief Legal Officer and Secretary

FORWARD AIR CORPORATION

1915 Snapps Ferry Road, Building N

Greeneville, Tennessee 37745

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD [ ], 2024

To the Shareholders of Forward Air Corporation:

The 2024 Annual Meeting of Shareholders (the “Annual Meeting”) of Forward Air Corporation (the “Company”) will be held on [ ], 2024, beginning at 8:00 a.m., EDT, at the Four Seasons Hotel Atlanta, 75 Fourteenth St., NE, Atlanta, GA 30309.

The purposes of this meeting are to:

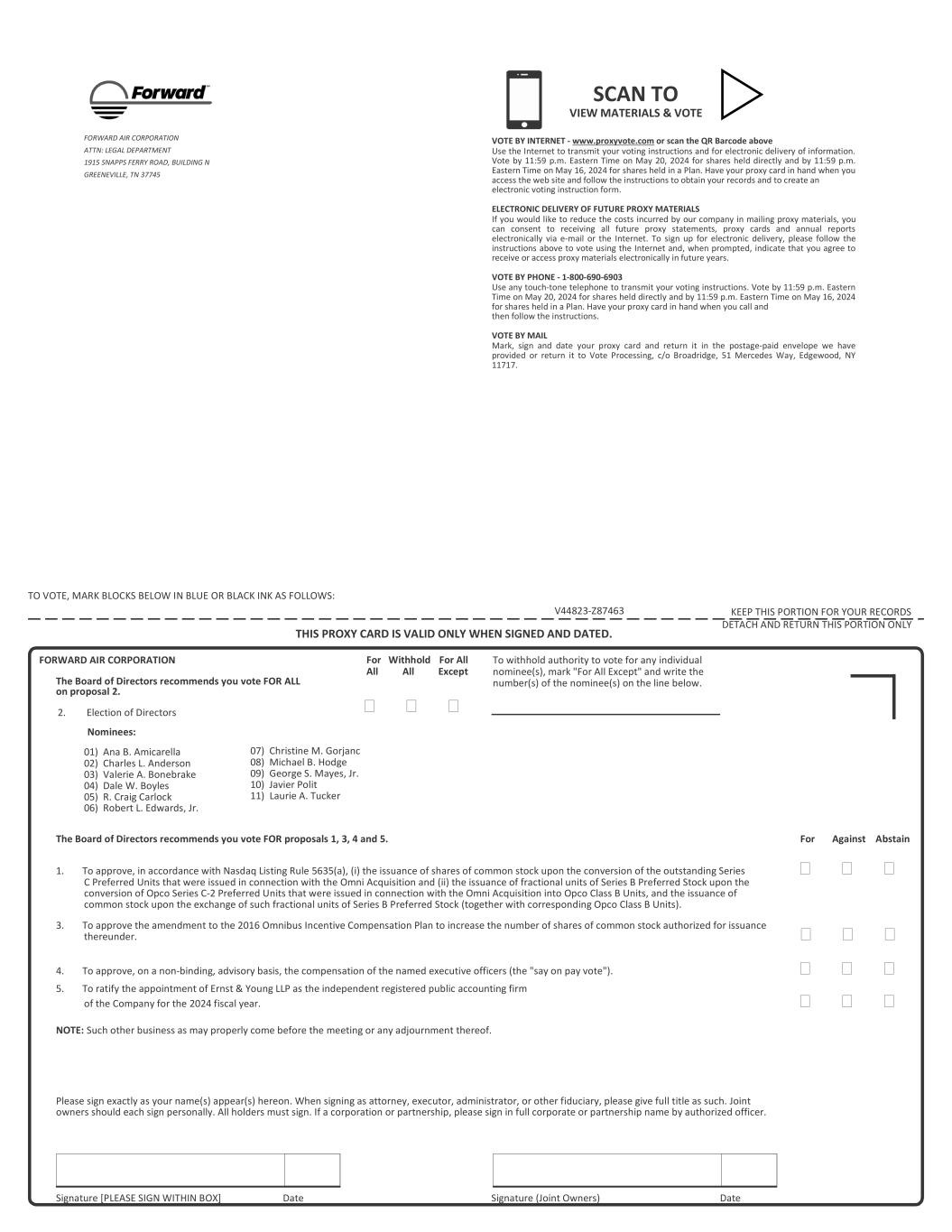

1. Proposal 1 - Approve, in accordance with Nasdaq Listing Rule 5635(a), (i) the issuance of shares of Company Common Stock (as defined in the Proxy Statement) upon the conversion of the outstanding Company Series C Preferred Units that were issued in connection with the Omni Acquisition and (ii) the issuance of fractional units of Company Series B Preferred Stock (as defined in the Proxy Statement) upon the conversion of Opco Series C-2 Preferred Units that were issued in connection with the Omni Acquisition into Opco Class B Units, and the issuance of Company Common Stock upon the exchange of such fractional units of Company Series B Preferred Stock (together with corresponding Opco Class B Units) (in each case, as defined in the Proxy Statement);

2. Proposal 2 - Elect eleven directors as set forth in the Proxy Statement with terms expiring at the 2025 Annual Meeting of Shareholders, or until their respective successors are elected and qualified;

3. Proposal 3 - Approve the amendment to the Company’s 2016 Omnibus Incentive Compensation Plan (the “2016 Plan”) to increase the number of shares of Company Common Stock authorized for issuance thereunder;

4. Proposal 4 - Approve, on a non-binding, advisory basis, the compensation of the named executive officers;

5. Proposal 5 - Ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for the 2024 fiscal year; and

6. Transact such other business as may properly come before the Annual Meeting and at any adjournment or postponement thereof.

We will make available a list of shareholders of record as of March 25, 2024, the record date for the Annual Meeting, for inspection by shareholders during normal business hours until [ ], 2024, at the Company’s principal place of business, 1915 Snapps Ferry Road, Building N, Greeneville, Tennessee 37745. The list will also be available to shareholders at the Annual Meeting.

Holders of Company Common Stock, par value $0.01 per share, or fractional units of the Company Series B Preferred Stock, in each case, at the close of business on March 25, 2024 are entitled to notice of and to vote at the Annual Meeting, except that, in accordance with Nasdaq listing rules votes in favor of or against the Conversion Proposal (as defined in the Proxy Statement) that correspond to shares of Company Common Stock or Company Series B Preferred Units issued by the Company as consideration for the Omni Acquisition will not count as votes cast with respect to the Conversation Proposal. Our Board of Directors recommends a vote “FOR” Proposals 1, 3, 4 and 5 and “FOR” each of the director nominees in proposal 2.

It is important that your shares be represented at the Annual Meeting. Whether or not you expect to attend the meeting, please vote and submit your proxy over the Internet, by telephone or by mail. Please refer to the enclosed proxy card for specific voting instructions.

| | | | | |

| By Order of the Board of Directors, |

| |

Greeneville, Tennessee [ ], 2024 | Michael L. Hance

Interim Chief Executive Officer, Chief Legal Officer and Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON [ ], 2024.

Our Proxy Statement and Annual Report are available online at www.proxyvote.com. The approximate date on which these materials will be first made available or sent to shareholders is [ ], 2024.

FORWARD AIR CORPORATION

1915 Snapps Ferry Road, Building N

Greeneville, Tennessee 37745

(423) 636-7000

PROXY STATEMENT

FOR

2024 ANNUAL MEETING OF SHAREHOLDERS

Questions and Answers about the Annual Meeting and Voting

1. WHY AM I RECEIVING THESE PROXY MATERIALS?

You are receiving these proxy materials because you held shares of Company Common Stock (as defined below) or fractional units of the Company Series B Preferred Stock (as defined below), in each case on March 25, 2024, the record date (the “Record Date”) for the 2024 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on [ ], 2024, beginning at 8:00 a.m. EDT, at the Four Seasons Hotel Atlanta, 75 Fourteenth St., NE, Atlanta, GA 30309. As a shareholder of record as of the Record Date, you are entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

The proxy materials include our Notice of 2024 Annual Meeting of Shareholders, Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2023. The proxy materials also include the proxy card for the Annual Meeting, which is being solicited on behalf of the Board of Directors of the Company (the “Board”). The proxy materials contain detailed information about the matters to be voted on at the Annual Meeting and provide updated information about the Company to assist you in making an informed decision when voting your shares.

The Company began furnishing the proxy materials to shareholders on or about [ ], 2024 and will bear the cost of soliciting proxies on behalf of the Company for the Annual Meeting.

2. WHAT AM I BEING ASKED TO VOTE ON?

At the Annual Meeting you will be asked to vote on the following five proposals. The Board recommendation for each of these proposals is set forth below.

| | | | | |

| Board Recommendation |

Proposal 1: Approve, in accordance with Nasdaq Listing Rule 5635(a), (i) the issuance of shares of Company Common Stock upon the conversion of the outstanding Company Series C Preferred Units that were issued in connection with the Omni Acquisition and (ii) the issuance of fractional units of Company Series B Preferred Stock upon the conversion of Opco Series C-2 Preferred Units that were issued in connection with the Omni Acquisition into Opco Class B Units, and the issuance of Company Common Stock upon the exchange of such fractional units of Company Series B Preferred Stock (together with corresponding Opco Class B Units) (in each case, as defined in the Proxy Statement) (the “Conversion Proposal”).

| FOR |

Proposal 2: Elect eleven directors as set forth in the Proxy Statement with terms expiring at the 2025 Annual Meeting of Shareholders, or until their respective successors are elected and qualified.

| FOR each director nominee |

Proposal 3: Approve the amendment to the Company’s 2016 Omnibus Incentive Compensation Plan (the “2016 Plan”) to increase the number of shares of Company Common Stock authorized for issuance thereunder (the “2016 Plan Proposal”).

| FOR |

Proposal 4: Approve, on a non-binding, advisory basis, the compensation of the named executive officers.

| FOR |

Proposal 5: Ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for the 2024 fiscal year.

| FOR |

We will also consider other business that properly comes before the meeting in accordance with Tennessee law and our Amended and Restated Bylaws (the “Bylaws”).

3. WHO IS PARTICIPATING IN THIS SOLICITATION?

The Company has retained Innisfree M&A Incorporated (“Innisfree”) to act as a proxy solicitor in conjunction with the Annual Meeting. The Company will bear the cost of soliciting proxies for the Annual Meeting. The Company will pay Innisfree a fee of $50,000 as compensation for its services and will reimburse it for its reasonable out-of-pocket expenses. Our officers and certain of our employees may also solicit proxies by mail, telephone, e-mail or facsimile transmission. They will not be paid additional remuneration for their efforts. Upon request, we will reimburse brokers, dealers, banks and trustees, or their nominees, for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of shares of Company Common Stock or fractional units of Company Series B Preferred Stock.

4. WHO IS ENTITLED TO VOTE AT THE MEETING?

Owners of Company Common Stock or fractional units of Company Series B Preferred Stock as of the close of business on the Record Date are entitled to vote at the Annual Meeting. Shares owned by you include shares you held on the Record Date (i) directly in your name as the shareholder of record (registered shareholder) and (ii) in the name of a broker, bank or other holder of record where the shares were held for you as the beneficial owner (in street name). Each share of Company Common Stock and each fractional unit of Company Series B Preferred Stock is entitled to one vote on each matter, except that, in accordance with Nasdaq listing rules, votes in favor of or against the Conversion Proposal that correspond to shares of Company Common Stock or Company Series B Preferred Units issued by the Company as consideration for the Omni Acquisition (as defined herein) will not count as votes cast with respect to the Conversion Proposal. As of the Record Date, there were 26,438,420 shares of Company Common Stock outstanding and entitled to vote and 4,435,301 fractional units of Company Series B Preferred Stock outstanding and entitled to vote. There are no other outstanding voting securities of the Company entitled to vote at the Annual Meeting. A complete list of registered shareholders entitled to vote at the Annual Meeting will be open to the examination of any shareholder during normal business hours from [ ], 2024 until [ ], 2024 at the Company’s principal place of business and at the Annual Meeting.

5. HOW DO I ATTEND THE ANNUAL MEETING?

Attendance at the Annual Meeting will be limited to shareholders, those holding proxies from shareholders and representatives of the Company. To gain admission to the Annual Meeting, you will need to bring identification and will need to show that you are a shareholder of the Company. If your shares are registered in your name and you plan to attend the Annual Meeting, please retain and bring the top portion of the enclosed proxy card as your admission ticket. If your shares are in the name of your broker or bank, or you received your proxy materials electronically, you will need to bring evidence of your stock ownership, such as your most recent brokerage account statement.

6. HOW DO I VOTE MY SHARES?

If you are a shareholder of record as of the Record Date, you may vote by any of the following methods:

•Voting by Internet. You may vote via the Internet by signing on to the website identified on your proxy card and following the procedures described on the website. Internet voting is available 24 hours a day, and the procedures are designed to authenticate votes cast by using a personal identification number located on your proxy card. The procedures permit you to give a proxy to vote your shares and to confirm that your instructions have been properly recorded. If you vote by Internet, you should not return your proxy card.

• Voting by Telephone. You may vote your shares by telephone by calling the toll-free telephone number provided on your proxy card. Telephone voting is available 24 hours a day, and the procedures are designed to authenticate votes cast by using a personal identification number located on your proxy card. The procedures permit you to give a proxy to vote your shares and to confirm that your instructions have been properly recorded. If you vote by telephone, you should not return your proxy card.

• Voting by Mail. If you choose to vote by mail, simply complete the enclosed proxy card, date and sign it, and return it in the postage-paid envelope provided. Your shares will be voted in accordance with the instructions on your proxy card.

• Voting at the Meeting. You may vote your shares at the Annual Meeting by completing, signing and dating a ballot in person at the Annual Meeting.

PLEASE NOTE THAT IF YOU ARE A BENEFICIAL OWNER OF SHARES HELD IN STREET NAME, SINCE YOUR SHARES ARE HELD BY A BANK, BROKER OR OTHER HOLDER OF RECORD, IF YOU WISH TO VOTE IN PERSON AT THE ANNUAL MEETING YOU MUST FIRST OBTAIN A LEGAL PROXY ISSUED IN YOUR NAME FROM THE HOLDER OF RECORD. OTHERWISE, YOU WILL NOT BE PERMITTED TO VOTE IN PERSON AT THE ANNUAL MEETING.

If your shares are held in street name, your broker or other nominee has enclosed a proxy card for you to use to direct it how to vote your shares and may also provide additional voting instructions. Please instruct your broker or other nominee how to vote your shares using the form of proxy card you received from it or otherwise in accordance with the voting instructions they provided. Please return your completed proxy card to your broker or other nominee or contact the person responsible for your account so that your vote can be counted. If your broker or other nominee permits you to provide voting instructions via the Internet or by telephone, you may vote that way instead. You are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote these shares at the meeting unless you follow the instructions below under “How do I obtain admission to the Annual Meeting?”

7. CAN I REVOKE MY PROXY OR CHANGE MY VOTE?

Yes. You may revoke your proxy at any time prior to completion of voting at the Annual Meeting. You may change your vote by either: (i) granting a new proxy bearing a later date (which automatically revokes the earlier proxy) whether made via the Internet, by telephone or by mail; (ii) if you are a shareholder of record, notifying the Corporate Secretary in writing at Forward Air Corporation, 1915 Snapps Ferry Road, Building N, Greeneville, Tennessee 37745 that you want to revoke your earlier proxy; or (iii) if you are attending the Annual Meeting, vote by ballot during the meeting. Your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote by ballot during the Annual Meeting.

If you hold your shares in street name, you may change your vote by contacting your broker or other nominee and following their instructions.

8. HOW WILL MY SHARES BE VOTED IF I SUBMIT A PROXY CARD BUT DO NOT SPECIFY HOW I WANT TO VOTE?

If you sign your proxy card and return it without marking any voting instructions, your shares will be voted at the Annual Meeting or any adjournment or postponement thereof:

• “FOR” Proposals 1, 3, 4 and 5;

• “FOR” the election of all director nominees recommended by our Board (Proposal 2); and

• in the discretion of the persons named as proxies on all other matters that may properly come before the Annual Meeting or any adjournment or postponement thereof in accordance with applicable law.

Despite this, our Board strongly urges you to mark your proxy card in accordance with our Board’s recommendations.

9. WHAT CONSTITUTES A QUORUM AT THE ANNUAL MEETING?

A majority of the outstanding shares of Company Common Stock and Company Series B Preferred Units, taken as a single class, entitled to vote at the Annual Meeting, present in person or by proxy, will constitute a quorum, which is the minimum number of such shares and units that must be present or represented by proxy at the meeting to transact business. Votes “FOR”, “AGAINST”, “ABSTAIN” and “BROKER NONVOTE” will all be counted as present to determine whether a quorum has been established.

10. WHAT IS THE VOTING REQUIREMENT TO APPROVE EACH OF THE PROPOSALS?

The approval of the Conversion Proposal will be approved by a majority of the votes cast. For the Conversion Proposal, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting. Abstentions and broker non-votes in respect of the Conversion Proposal will have no effect on the vote. In accordance with Nasdaq listing rules, votes in favor of or against the Conversion Proposal that correspond to shares of Company Common Stock or Company Series B Preferred Units issued by the Company as consideration for the Omni Acquisition (as defined herein) will not count as votes cast with respect to the Conversion Proposal. To comply with Nasdaq listing rules, we will instruct the inspector of elections to conduct a separate tabulation that subtracts the votes represented by such shares of Company Common Stock and Company Series B Preferred Units from the total number of shares voted on the Conversion Proposal to determine whether the Conversion Proposal has been adopted in accordance with Nasdaq listing rules.

Eleven directors will be elected at the Annual Meeting. The affirmative vote of a plurality of the votes cast by the shareholders entitled to vote at the Annual Meeting is required for the election of directors. Under the plurality voting standard, you may vote “FOR” or “WITHHOLD” authority to vote for each nominee.

In the event any director nominee, in an uncontested election, receives a greater number of votes “WITHHELD” from his or her election than votes “FOR” such election, he or she shall tender his or her resignation for consideration by the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee shall recommend to the Board the action to be taken with respect to the resignation. The Board will publicly disclose its decision within 90 days after the certification of the election results.

The ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year, the say on pay vote, the approval of the 2016 Plan Proposal and any other matter that properly comes before the Annual Meeting will be approved by a majority of the votes cast. For the ratification of Ernst & Young LLP, the say on pay vote, the approval of the 2016 Plan Proposal and any other matter that properly comes before the Annual Meeting, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting. Abstentions and broker non-votes will have no effect on the vote on these proposals.

11. WHAT HAPPENS IF I HOLD SHARES IN STREET NAME AND DO NOT SUBMIT VOTING INSTRUCTIONS? WHAT IS A BROKER NON-VOTE?

A broker non-vote occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker or nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Under applicable rules that govern brokers who are voting with respect to shares held in street name, brokers ordinarily have the discretion to vote on “routine” matters (e.g., ratification of the selection of independent public accountants) but not on non-routine matters (e.g., the Conversion Proposal, election of directors, advisory votes on executive compensation and the 2016 Plan Proposal).

12. WHOM SHOULD I CONTACT IF I HAVE ANY QUESTIONS OR NEED ASSISTANCE IN VOTING MY SHARES, OR IF I NEED ADDITIONAL COPIES OF THE PROXY MATERIALS?

If you have any questions or require any assistance, please contact the Company’s proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Shareholders Call Toll-Free: 877-750-5837 Brokers Call Collect: 212-750-5833

PROPOSAL 1 - NASDAQ CONVERSION PROPOSAL

Summary of the Proposal

The Board is asking shareholders to approve, in accordance with Nasdaq Listing Rule 5635(a), (i) the issuance of Company Common Stock (as defined below) upon the conversion of the outstanding Company Series C Preferred Units (as defined below) that were issued in connection with our acquisition of Omni Newco, LLC (the “Omni Acquisition”) and (ii) the issuance of Company Series B Preferred Units (as defined below) upon the conversion of Opco Series C-2 Preferred Units (as defined below) that were issued in connection with the Omni Acquisition into Opco Class B Units (as defined below) and the issuance of Company Common Stock upon the exchange of such Company Series B Preferred Units (together with corresponding Opco Class B Units).

Overview of the Omni Acquisition

On January 25, 2024, the Company, Omni Newco LLC, a Delaware limited liability company (“Omni”), and certain other parties completed the Omni Acquisition. Pursuant to the Agreement and Plan of Merger, dated as of August 10, 2023 (as amended by Amendment No. 1, dated as of January 22, 2024, the “Merger Agreement”), among the Company, Omni and the other parties thereto, the Company, through a series of transactions involving the Company’s direct and indirect subsidiaries, acquired Omni for a combination of (a) $20 million in cash and (b) (i) Common Equity Consideration (as defined below) representing 5,135,008 shares of the common stock of the Company, par value $0.01 per share (“Company Common Stock”) on an as-converted and as-exchanged basis and (ii) Convertible Preferred Equity Consideration (as defined below) representing, if the Company’s shareholders approve the Conversion Proposal, an additional 8,880,010 shares of Company Common Stock on an as-converted and as-exchanged basis.

As described below, prior to the consummation of the Omni Acquisition and to facilitate the issuance of the consideration in connection therewith, the Company completed a restructuring (the “Restructuring”), pursuant to which, among other things, the Company contributed all of its operating assets to Clue Opco LLC, a newly formed subsidiary of the Company that is a Delaware limited liability company (“Opco”). The limited liability company interests of Opco are represented by units (collectively, the “Opco Units”), comprised of Opco Units designated as: “Class A Units” (“Opco Class A Units”); “Class B Units” (“Opco Class B Units”); “Series C-1 Preferred Units” (“Opco Series C-1 Preferred Units”); and “Series C-2 Preferred Units” (“Opco Series C-2 Preferred Units”).

The “Common Equity Consideration” consists of (i) Company Common Stock and (ii) Opco Class B Units and corresponding fractional units of Company Series B Preferred Stock (as defined below), each representing one one-thousandth of a share of Company Series B Preferred Stock (“Company Series B Preferred Units”) which, together, are exchangeable into Company Common Stock. The “Convertible Preferred Equity Consideration” consists of (i) fractional units of Company Series C Preferred Stock (as defined below) each representing one one-thousandth of a share of Company Series C Preferred Stock (“Company Series C Preferred Units”) that will be converted into Company Common Stock upon receipt of the shareholder approval of the Conversion Proposal and (ii) Opco Series C-2 Preferred Units that will be converted into Opco Class B Units and corresponding Company Series B Preferred Units upon receipt of the shareholder approval of the Conversion Proposal and will then be exchangeable into Company Common Stock.

The Common Equity Consideration represents, as of the closing of the Omni Acquisition (the “Closing”) and before shareholder approval of the Conversion Proposal, approximately 16.5% of Company Common Stock and common stock equivalents, on a fully diluted, as-exchanged basis. If the Company’s shareholders approve the Conversion Proposal, the Convertible Preferred Equity Consideration will (i) in the case of Company Series C Preferred Units, convert into Company Common Stock and (ii) in the case of Opco Series C-2 Preferred Units, convert into Opco Class B Units and corresponding Company Series B Preferred Units (which together are exchangeable into Company Common Stock), which, together and together with the Common Equity Consideration will represent, as of the Closing, 35.0% of Company Common Stock and common stock equivalents on a fully diluted and as-exchanged basis.

Pursuant to the Merger Agreement, the Company is required to use its reasonable best efforts to obtain approval of the Conversion Proposal and to include in this Proxy Statement the Board’s recommendation that the

Company’s shareholders vote in favor of the Conversion Proposal. At a meeting of the Board held on April 2, 2024, the Board (i) determined that the Conversion Proposal is in the best interests of the Company’s shareholders and (ii) recommended that the Company’s shareholders vote in favor of the Conversion Proposal. Each of Michael B. Hodge, Christopher H. Schmachtenberger, Charles L. Anderson and Robert L. Edwards, Jr. (comprising all of the directors designated by the Major Shareholders pursuant to the Merger Agreement and the Shareholders Agreements, with the Major Shareholders having received substantial Convertible Preferred Equity Consideration subject to this Conversion Proposal in connection with the Omni Acquisition) recused himself from the Board’s consideration of the Conversion Proposal and from the recommendation made by the Board with respect to the Conversion Proposal.

Restructuring of the Company

General

Prior to the consummation of the Omni Acquisition, the Company completed the Restructuring, pursuant to which, among other things, the Company contributed all of its operating assets to Opco. Opco is structured as an umbrella partnership C corporation through which former direct and certain former indirect equityholders of Omni (“Former Omni Holders”) hold a portion of the Common Equity Consideration and Convertible Preferred Equity Consideration in the form of Opco Units that are exchangeable for Company Common Stock and Company Series C Preferred Units.

The portion of the transaction consideration paid to the Former Omni Holders that is Common Equity Consideration consists of (a) shares of Company Common Stock and (b) Opco Class B Units and corresponding Company Series B Preferred Units, which together are exchangeable at the option of the holders thereof into shares of Company Common Stock pursuant to the Opco LLCA (as defined below).

The portion of the transaction consideration paid to the Former Omni Holders that is Convertible Preferred Equity Consideration consists of (a) Company Series C Preferred Units, which will automatically convert into shares of Company Common Stock upon shareholder approval of the Conversion Proposal and (b) Opco Series C-2 Preferred Units, which are economically equivalent to the Company Series C Preferred Units and will automatically convert into Opco Class B Units and corresponding Company Series B Preferred Units upon the receipt of shareholder approval for the Conversion Proposal pursuant to the Opco LLCA. The Opco Class B Units and corresponding Company Series B Preferred Units issued upon the conversion of the Opco Series C-2 Preferred Units will be exchangeable at the option of the holders thereof into shares of Company Common Stock pursuant to the Opco LLCA.

The Company Common Stock issued at Closing and prior to any shareholder approval of the Conversion Proposal represents 19.99% of the voting power of the Company as of immediately prior to the Closing. The Convertible Preferred Equity Consideration has an aggregate liquidation preference of $976,801,100 (based on a liquidation preference per unit of $110.00) that, as described above, will convert if the Company’s shareholders approve the Conversion Proposal into (i) Company Common Stock and (ii) Opco Class B Units and corresponding Company Series B Preferred Units, which are exchangeable into Company Common Stock.

Opco LLCA

Effective as of the Closing, the Company operates its business through Opco, which indirectly holds all the assets and operations of the Company and Omni and is governed by an operating agreement (the “Opco LLCA”). Opco is managed by and under the direction of the Company, as the manager of Opco.

The limited liability company interests of Opco are represented by units (collectively, the “Opco Units”), comprised of Opco Class A Units, Opco Class B Units, Opco Series C-1 Preferred Units and Opco Series C-2 Preferred Units. All Opco Units are non-voting unless otherwise required by law and except for certain amendments and a limited number of other matters.

As of the date of this Proxy Statement, (a) the Company and Clue Parent Merger Sub LLC, a subsidiary of the Company, hold all of the Opco Class A Units and all of the Opco Series C-1 Preferred Units and (b) the Former Omni Holders hold (i) a portion of the Common Equity Consideration in the form of Opco Class B Units and corresponding Company Series B Preferred Units and (ii) a portion of the Convertible Preferred Equity Consideration in the form of units of Opco designated as Opco Series C-2 Preferred Units.

Subject to certain exceptions permitted under the Opco LLCA, the number of Opco Class A Units outstanding from time to time will equal the number of shares of Company Common Stock outstanding, the number of Opco Class B Units held by the Former Omni Holders from time to time will equal the number of Company Series B Preferred Units outstanding and the number of Opco Series C-1 Preferred Units from time to time will equal the number of Company Series C Preferred Units outstanding. An Opco Class B Unit, together with a corresponding Company Series B Preferred Unit, generally is equivalent economically and in respect of voting power to one share of Company Common Stock. The Opco Series C-2 Preferred Units have substantially the same terms as the Company Series C Preferred Units described below, except Opco Series C-2 Preferred Units will automatically convert upon shareholder approval of the Conversion Proposal into Opco Class B Units and corresponding Company Series B Preferred Units instead of Company Common Stock (but which are then, together, exchangeable for Company Common Stock pursuant to the Opco LLCA as further described herein). In addition, the Opco Series C-1 Preferred Units, which are held solely by Clue Parent Merger Sub, LLC, a subsidiary of the Company, will automatically convert to Opco Class A Units upon receipt of the shareholders’ approval of the Conversion Proposal.

Pursuant to the Opco LLCA, (a) Opco Class A Units are not exchangeable or convertible and (b) a holder of Opco Class B Units (other than the Company or its affiliates) has the right to exchange all or a portion of its Opco Class B Units (together with a corresponding number of Company Series B Preferred Units) for, at the Company’s option (in its capacity as the manager of Opco), an equal number of shares of Company Common Stock or cash. Prior to shareholder approval of the Conversion Proposal, Opco Series C-2 Preferred Units are exchangeable by the holders thereof for an equivalent number of Company Series C Preferred Units. Immediately after shareholder approval of the Conversion Proposal, Opco Series C-2 Preferred Units will automatically convert to Opco Class B Units based on liquidation preference of such units and the same Conversion Price as the Company Series C Preferred Units (as increased by any accrued and unpaid dividends on such Opco Series C-2 Preferred Units) and the Company will issue the holder thereof corresponding Company Series B Preferred Units on a one-for-one basis for each such Opco Class B Unit. As of the date of the Annual Meeting, there will be no such accrued and unpaid dividends.

Description of Company Series B Preferred Units

Issuance and Conversion

Pursuant to the Articles of Amendment to the Restated Charter of the Company filed with the Secretary of State of the State of Tennessee at the Closing (the “Charter Amendment”), at the Closing the Company issued a new series of preferred stock of the Company designated as “Series B Preferred Stock” (the “Company Series B Preferred Stock”), and, also at the Closing, certain Former Omni Holders received Company Series B Preferred Units, each representing one one-thousandth of a share of Company Series B Preferred Stock. Each Company Series B Preferred Unit, together with a corresponding Opco Class B Unit, is exchangeable at the option of the holder thereof into one share of Company Common Stock, or, at the Company’s election, cash.

Voting Rights

Holders of Company Series B Preferred Units and holders of Company Common Stock vote together as a single class on all matters to be voted on by the Company’s shareholders, subject to limited exceptions (as described in the section titled “Shareholder Vote Requirement” below). Each holder of record of Company Series B Preferred Units is entitled to cast one vote for each such unit.

Dividends

Company Series B Preferred Units are not entitled to receive any dividends independent of their corresponding Opco Class B Units.

Liquidation Preference

Pursuant to the Charter Amendment, the Company Series B Preferred Units have a liquidation preference of $0.01 per unit.

Transfer

A Company Series B Preferred Unit and its corresponding Opco Class B Unit may only be transferred together as a single, combined unit.

Description of Company Series C Preferred Units

Issuance and Conversion

Pursuant to the Charter Amendment, the Company issued convertible preferred stock of the Company designated as “Series C Preferred Stock” (the “Company Series C Preferred Stock”), and, at the Closing, certain Former Omni Holders received Company Series C Preferred Units each representing one one-thousandth of a share of Company Series C Preferred Stock.

If the Conversion Proposal is approved, each Company Series C Preferred Unit will automatically convert into a number of shares of Company Common Stock equal to the quotient of the aggregate Liquidation Preference (defined below) of such Company Series C Preferred Unit ($110.00 at Closing) and a conversion price of $110.00 (subject to certain customary anti-dilution adjustments, the “Conversion Price”). If the Conversion Proposal is approved prior to the first anniversary of the Closing, each Company Series C Preferred Unit is expected to automatically convert into one share of Company Common Stock.

The Company Series C Preferred Units are perpetual and rank senior to Company Common Stock with respect to dividend rights and with respect to rights on liquidation, winding-up and dissolution.

Voting Rights

The Company Series C Preferred Units are generally non-voting, except that certain matters adversely affecting the rights and privileges of the Company Series C Preferred Units require the consent of the holders of a majority of the outstanding Company Series C Preferred Units, voting as a separate class.

Dividends

The Company Series C Preferred Units are entitled to receive dividends declared or paid on Company Common Stock on an as-converted basis.

In addition, the Company Series C Preferred Units accrue on each anniversary of issuance a cumulative annual dividend (without any interim accrual) equal to the product of (a) 14.0% multiplied by (b) the Liquidation Preference (the “Series C Annual Coupon”). The Series C Annual Coupon will be paid, at the Company’s option, in cash or in-kind by automatically increasing the Liquidation Preference in an equal amount. For so long as the Company Series C Preferred Units remain outstanding, subject to certain limited exceptions, the Company will not be able to declare, make or pay dividends or distributions unless all accrued and unpaid dividends have been paid in cash or in kind on the Company Series C Preferred Units.

Liquidation, Dissolution and Call Option

The liquidation preference of a Company Series C Preferred Unit is equal to $110.00 per unit, subject to adjustment for any in-kind payment of the Series C Annual Coupon as described above (the “Liquidation Preference”).

In the event of any liquidation, dissolution or winding-up of the Company, each holder of Company Series C Preferred Units will be entitled to receive an amount equal to the sum of (a) the greater of (i) the aggregate Liquidation Preference attributable to such holder’s Company Series C Preferred Units, and (ii) the product of (x) the amount per share that would have been payable upon such liquidation, dissolution or winding-up to the holders of shares of Company Common Stock or such other class or series of securities into which such holder’s Company Series C Preferred Units is then convertible (assuming the conversion of each Company Series C Preferred Unit), multiplied by (y) the number of shares of Company Common Stock or such other securities into which the Company Series C Preferred Units are then convertible, plus (b) an amount of all declared and unpaid dividends with respect thereto.

Commencing on the sixth anniversary of the Closing (and, thereafter, only during the 60-day period following any anniversary of Closing), the Company Series C Preferred Units will be callable at the Company’s option in whole (and not in part), at a call price per Company Series C Preferred Unit equal to (a) the product of (i) the greater of (A) the outstanding liquidation preference of such Company Series C Preferred Unit and (B) the product of (x) the number of shares of Company Common Stock into which such Company Series C Preferred Unit would be convertible upon receipt of shareholder approval of the Conversion Proposal, and (y) the 20-day volume-weighted average price per share of Company Common Stock during a defined period prior to the call, and (ii) 103%, plus (b) the amount of all declared and unpaid dividends in respect of such Company Series C Preferred Unit.

Why Shareholder Approval is Required for Conversion

The Company Common Stock is listed on Nasdaq, and as a result, we are subject to Nasdaq’s listing rules, including Nasdaq Listing Rule 5635. Pursuant to Nasdaq Listing Rule 5635(a), shareholder approval is required prior to the issuance of common stock of an acquiror (or securities convertible into or exercisable for common stock of an acquiror) in connection with the acquisition of the stock or assets of another company if such securities are not issued in a public offering for cash and (i) have, or will have, voting power equal to or in excess of twenty percent (20%) of the voting power outstanding before the issuance of such common stock (or securities convertible into or exercisable for common stock); or (ii) the number of shares of common stock to be issued is, or will be, equal to or in excess of twenty percent (20%) of the number of shares of common stock outstanding before the issuance of common stock or securities. If the conversion of the Company Series C Preferred Units and Opco Series C-2 Preferred Units is completed, the total number of shares of Company Common Stock (or securities convertible into or exchangeable for Company Common Stock) issued under the Merger Agreement in connection with the Omni Acquisition will (x) constitute more than twenty percent (20%) of the voting power outstanding prior to such issuance and (y) exceed twenty percent (20%) of the total number of shares of Company Common Stock issued and outstanding prior to such issuance.

Effects if the Conversion Proposal is Approved

If the Conversion Proposal is approved, the issuance of shares of Company Common Stock and Company Series B Preferred Units would dilute, and thereby reduce, each existing shareholder’s proportionate voting power in Company Common Stock on an as-converted, as-exchanged basis. In addition, the sale into the public market of the shares of Company Common Stock could materially and adversely affect the market price of Company Common Stock. Such issuances could also dilute the voting power of a person seeking control of us, thereby deterring or rendering more difficult a merger, tender offer, proxy contest or an extraordinary corporate transaction opposed by us.

The Conversion Price is $110 per share of Company Common Stock, which exceeded the closing price of a share of Company Common Stock of [ ] on [ ], 2024.

Effects if the Conversion Proposal is Not Approved

If shareholders do not approve the Conversion Proposal prior to January 25, 2025 (one year after the Closing), then the Company will be required to pay the Series C Annual Coupon, which will continue to accrue on each subsequent anniversary of the Closing, and we will not be able to declare, make or pay dividends or distributions unless all accrued and unpaid dividends have been paid in cash or in kind on the Company Series C Preferred Units.

If the Company does not obtain shareholder approval for the Conversion Proposal at this Annual Meeting, then, so long as any Company Series C Preferred Units or the Opco Series C-2 Preferred Units remain outstanding, the Company will be required to continue to use its reasonable best efforts to obtain shareholder approval for the Conversion Proposal at each annual meeting of shareholders hereafter until the Conversion Proposal is approved, which will be costly and time-consuming and would also divert management’s time and attention away from managing the business.

Beneficial Ownership Limitations

We are not seeking shareholder approval of a potential “change in control” under Nasdaq Listing Rule 5635(b), which generally prohibits Nasdaq-listed companies, without shareholder approval, from issuing Company Common Stock to a shareholder in a transaction that would cause the holder to beneficially own 20% or more of the then-outstanding Company Common Stock or otherwise result in change of control (subject to certain exceptions). At the Closing, the Company entered into the Shareholders Agreements. The Shareholders Agreements provide the Major Shareholders the right to nominate their respective director nominees, subject to terms and conditions related to ongoing ownership of equity securities of the Company by each respective Major Shareholder. Each Shareholders Agreement, among other things, (a) requires the applicable Major Shareholders to vote such Major Shareholders’ voting securities of the Company in favor of directors nominated by the Board and against any other nominees, (b) provides that each of the applicable Major Shareholders is subject to standstill restrictions, subject to certain exceptions, and (c) prohibits the applicable Major Shareholders from transferring equity securities of the Company, subject to certain exceptions, to certain competitors of the Company and to other shareholders of the Company beneficially owning more than 10% of the Company’s voting power. REP and the EVE Related Holders are anticipated to beneficially own, on a fully-diluted basis and assuming the receipt of the Conversion Approval, equity securities following the Closing each representing approximately 13% and 5%, respectively, of the Company’s voting power. Certain other indirect holders of Omni, which will represent approximately 7% of the Company’s voting power assuming receipt of the Conversion Approval, are also subject to the voting obligations, standstill restrictions and transfer restrictions of the EVE Shareholders Agreement until the first anniversary of Closing.

In addition, at the Closing, the Company entered into a separate investor rights agreement (the “Investor Rights Agreement”) with the Major Shareholders and certain other Former Omni Holders, pursuant to which the Major Shareholders and such other Former Omni Holders have customary registration rights, including certain demand and piggyback registration rights, and are subject to a lock-up preventing transfers of the Company’s equity securities, subject to certain exceptions, for up to one year following the Closing. Assuming that shareholders approve the Conversion Proposal, certain transfer restrictions provided in the Shareholders Agreements and the Investor Rights Agreement, including restrictions on transfers made by the Major Shareholders, will continue to apply.

Based on the foregoing, a “change of control” under Nasdaq Listing Rule 5635(b) did not occur by virtue of the Omni Acquisition and, accordingly, we are not seeking shareholder approval for such purpose under Nasdaq Listing Rule 5635(b).

Shareholder Vote Requirement

The approval of the Conversion Proposal will be approved by a majority of the votes cast. For the Conversion Proposal, you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting. Abstentions and broker non-votes in respect of the Conversion Proposal will have no effect on the vote. In accordance with Nasdaq listing rules, votes in favor of or against the Conversion Proposal that correspond to shares of Company Common Stock or Company Series B Preferred Units issued by the Company as consideration for the Omni Acquisition (as defined herein) will not count as votes cast with respect to the Conversion Proposal. To comply with Nasdaq listing rules, we will instruct the inspector of elections to conduct a separate tabulation that subtracts the votes represented by such shares of Company Common Stock and Company Series B Preferred Units from the total number of shares voted on the Conversion Proposal to determine whether the Conversion Proposal has been adopted in accordance with Nasdaq listing rules.

Recommendation of the Board of Directors

The Board recommends a vote “FOR” the Conversion Proposal.

PROPOSAL 2 - ELECTION OF DIRECTORS

Our Bylaws permit the Board to fix the size of the Board. At the date of this Proxy Statement, our Board is currently comprised of fifteen directors, all of which are non-employee directors. Immediately following the Annual Meeting, the Board’s size will be set at eleven directors.

The Board is committed to recruiting and nominating directors for election who will collectively provide the Board with the necessary diversity of experiences, skills and characteristics to enhance the Board’s ability to manage and direct the affairs and business of the Company and to make fully informed, comprehensive decisions. In recommending candidates for election to the Board, in the context of the perceived needs of the Board at that time, the Corporate Governance and Nominating Committee evaluates a candidate’s knowledge, experience, skills, expertise and diversity, and any other factors that the Corporate Governance and Nominating Committee deems relevant. In particular, the Board and the Corporate Governance and Nominating Committee believe that the Board should be comprised of a well-balanced group of individuals.

In 2024, the Corporate Governance and Nominating Committee has unanimously recommended to the Board, and the Board unanimously approved, the nominations of Ana B. Amicarella, Charles L. Anderson, Valerie A. Bonebrake, Dale W. Boyles, R. Craig Carlock, Robert L. Edwards, Jr., Christine M. Gorjanc, Michael B. Hodge, George S. Mayes, Jr., Javier Polit and Laurie A. Tucker, each to hold office until the 2025 Annual Meeting of Shareholders or until a successor has been duly elected and qualified. Each nominee has consented to serve if elected.

Director Nominees

At the closing of our acquisition of Omni Newco, LLC, the Company entered into (i) a shareholder agreement (the “REP Shareholders Agreement”) with affiliates of Ridgemont Equity Partners (“REP”) that provides, among other things, that REP has the ongoing right to nominate two directors to the Board and (ii) a shareholders agreement (the “EVE Shareholders Agreement” and, together with the REP Shareholders Agreement, the “Shareholders Agreements”) with certain former indirect equity holders of Omni related to EVE Omni Investor, LLC (the “EVE Related Holders” and, together with REP, the “Major Shareholders”) that provides, among other things, that the EVE Related Holders have the ongoing right to nominate one director to the Board. The Shareholders Agreements provide the Major Shareholders the right to nominate their respective nominees, subject to terms and conditions related to ongoing ownership of equity securities of the Company by each respective Major Shareholder.

Pursuant to the Shareholder Agreements, the Major Shareholders have nominated Charles L. Anderson, Robert L. Edwards and Michael B. Hodge to serve on our Board. Our Board has determined that all of the director nominees are qualified to serve as directors of the Company. In addition to the specified business experience listed below, each of the directors has the background skills and attributes that the Board believes are required to be an effective director of the Company, including experience at senior levels in areas of expertise helpful to the Company, a willingness and commitment to assume the responsibilities required of a director of the Company and the character and integrity the Board expects of its directors. In addition, each Shareholders Agreement, among other things, (a) requires the applicable Major Shareholders to vote such Major Shareholders’ voting securities of the Company in favor of directors nominated by the Board and against any other nominees, (b) provides that each of the applicable Major Shareholders is subject to standstill restrictions, subject to certain exceptions, and (c) prohibits the applicable Major Shareholders from transferring equity securities of the Company, subject to certain exceptions, to certain competitors of the Company and to other shareholders of the Company beneficially owning more than 10% of the Company’s voting power.

The following persons are our Board’s nominees for election to serve as directors. There are no family relationships between any of the director nominees. Certain information relating to our Board’s nominees, furnished by the nominees, is set forth below. The ages set forth below are accurate as of the date of this Proxy Statement.

| | | | | | | | |

| ANA B. AMICARELLA | | Director since 2017

Age 57 |

Ms. Amicarella is the Chief Executive Officer of EthosEnergy, an independent service provider of rotating equipment services and solutions to the global power, oil and gas and industrial markets. Prior to joining EthosEnergy in December 2019, Ms. Amicarella served as Managing Director for the Latin America business of Aggreko PLC, a rental business of mobile power plants and temperature control solutions, after serving as Vice President of various business units from 2011 to April 2019. Previously, she was general manager of GE Oil & Gas Services for North America. Ms. Amicarella began her career as a field engineer with GE in 1988, and during her tenure, she served in various professional capacities within the areas of services, sales, strategy and P&L leadership. Ms. Amicarella was elected to the board of Warrior Met Coal, Inc. in August 2018 and serves as a member of its audit, nominating and governance, and environmental health and safety committees. Ms. Amicarella received a B.S. in electrical engineering from The Ohio State University and an MBA from Oakland University. She competed in the 1984 Olympics in synchronized swimming for Venezuela and was an All-American while at The Ohio State University.

Qualifications. The Board believes that Ms. Amicarella’s extensive business, prior management experience and diversity, including her Hispanic background, bring sound guidance to our Board. The Board believes that Ms. Amicarella utilizes that experience in her service as a member of both the Audit Committee and the Corporate Governance and Nominating Committee.

| | | | | | | | |

| CHARLES L. ANDERSON | | Director since 2024

Age 40 |

Mr. Anderson serves as a Partner at Ridgemont Equity Partners, a private equity firm that provides buyout and growth capital to industry-leading companies, since 2019. As part of Mr. Anderson’s portfolio involvement, he also serves on the boards of several private companies which provide business and tech-enabled services. Prior to joining Ridgemont in 2014, Mr. Anderson was also Vice President and an associate of Crestview Partners from 2012 until 2014 and 2008 until 2010, respectively. Mr. Anderson was also a financial analyst at J.P. Morgan Securities, Inc. from 2006 until 2008. As more fully discussed above, Mr. Anderson was selected as a designee of REP to join our Board pursuant to the REP Shareholders Agreement. Mr. Anderson holds an M.B.A. from Harvard University and a B.A. in Economics from Washington and Lee University.

Qualifications. The Board believes that Mr. Anderson’s board and investment management experience will provide the Board significant insight into the Company’s strategy and investment decisions. Mr. Anderson was nominated to the Board by a security holder.

| | | | | | | | |

| VALERIE A. BONEBRAKE | | Director since 2018

Age 72 |

Ms. Bonebrake retired as a Senior Vice President of Tompkins International, a global supply chain consulting firm, in March 2018 and has more than 30 years of industry experience in logistics services. In her role at Tompkins, she consulted with an array of companies and industries in North America and across the globe. Prior to joining Tompkins in 2009, she was the Executive Vice President, COO North America, and a cofounder of the YRC Worldwide subsidiary, Meridian IQ (now Noatum Logistics), a global third-party logistics company. Ms. Bonebrake spent 19 years at Ryder System, Inc. in various leadership roles of increasing responsibility in the company’s supply chain solutions segment. She also has been recognized by Ingram Magazine as one of the Top Ten Female Executives in Kansas, and was a 2010 recipient of Supply & Demand Chain Executive’s Pros to Know award. She holds a M.S. in International Logistics from the Georgia Institute of Technology. Ms. Bonebrake has served from 2018 to present as a member of the Board for UC San Diego Rady School of Management, Institute for Supply Excellence and Innovation (ISEI). She received her NACD Directorship Certification in 2021.

Qualifications. The Board believes that Ms. Bonebrake contributes strategic insight to our Board based on her extensive experience in the transportation industry. The Board believes that Ms. Bonebrake utilizes that experience in her service as a member of the Compensation Committee.

| | | | | | | | |

| DALE W. BOYLES | Director Nominee

Age 63 |

Mr. Boyles has served as the Chief Financial Officer of Warrior Met Coal, Inc., a U.S.-based environmentally and socially minded supplier of metallurgical coal since his appointment in January 2017. From November to December 2016, he provided consulting services to Warrior Met Coal, LLC. Mr. Boyles was the Chief Financial Officer of Noranda Aluminum Holding Corporation (formerly NYSE listed under “NOR”), a primary aluminum and aluminum coil manufacturer, from November 2013 to November 2016. While in that role, he oversaw the voluntary reorganization under Chapter 11 of the Bankruptcy Code of Noranda in 2016. From 2006 to June 2012, Mr. Boyles served in several capacities for Hanesbrands, Inc. (NYSE listed under “HBI”), an apparel company, including Operating Chief Financial Officer from October 2011 to June 2012, Interim Chief Financial Officer from May 2011 to October 2011, and Vice President, Controller and Chief Accounting Officer from 2006 to May 2011. From 1997 to 2006, he served in various capacities for KPMG LLP, most recently as Audit Partner, Consumer & Industrial Markets. Mr. Boyles was Corporate Division Controller for Collins & Aikman Corporation from 1993 to 1996. Mr. Boyles holds a B.S. in Accounting from University of North Carolina - Charlotte. Mr. Boyles is a certified public accountant.

Qualifications. The Board believes that Mr. Boyles is qualified to serve on the Board because of his extensive experience serving in various leadership roles at several companies and his knowledge of accounting principles, financial reporting and internal controls. Mr. Boyles was nominated to the Board by a non-management director.

| | | | | | | | |

| R. CRAIG CARLOCK | | Director since 2015

Age 57 |

Mr. Carlock served as the Company’s Lead Independent Director from May 2019 until February 2024. He serves as the Chief Operating Officer of The Carroll Companies and assumed that position in March 2023. Prior to The Carroll Companies, he served as the Chief Executive Officer and a director of Omega Sports, Inc. (“Omega”) from April 2017 to March 2023. Prior to Omega, he served as the President and Chief Executive Officer of The Fresh Market from January 2009 to January 2015 and as a member of its board of directors from June 2012 to January 2015. He began his career with The Fresh Market in 1999 and served in various capacities culminating with the position of President and Chief Executive Officer. During his time with The Fresh Market, Mr. Carlock served as its Executive Vice President and Chief Operating Officer as well as its Senior Vice President-Store Operations, Vice President-Merchandising and Marketing, and Director of Merchandising & Marketing Strategy. Prior to joining The Fresh Market, Mr. Carlock was Financial Manager, Fabric Care Category, at Procter & Gamble Company.

Qualifications. The Board believes that Mr. Carlock’s leadership experience is invaluable to management and the Board in, among other things, the areas of strategy, development and corporate governance. The Board believes that Mr. Carlock utilizes that experience in his service as Lead Independent Director and Chair of the Compensation Committee.

| | | | | | | | |

| ROBERT L. EDWARDS, JR. | Director since 2024

Age 57 |

Mr. Edwards co-founded and began serving as a Partner of Ridgemont Equity Partners, a private equity firm that provides buyout and growth capital to industry-leading companies, in 2010 and has served as a Managing Partner since 2021. As part of Mr. Edwards’ portfolio involvement, he also serves on the board of several private companies which provide business and tech-enabled services. Prior to co-founding Ridgemont in 2010, Mr. Edwards was a Managing Director at Banc of America Capital Investors (predecessor to Ridgemont), a Management Consultant at McKinsey & Co., Inc. and served as an investment banker at Allied Capital and Bowles Hollowell Conner & Co, Inc. As more fully discussed above, Mr. Edwards was selected as a designee of REP to join our Board pursuant to the REP Shareholders Agreement. Mr. Edwards holds an M.B.A. from Harvard University and a B.A. in Economics from the University of North Carolina at Chapel Hill.

Qualifications. The Board believes that Mr. Edwards’ board, investment management and industry experience will provide the Board significant insight into the Company’s management and investment decisions. Mr. Edwards was nominated to the Board by a security holder.

| | | | | | | | |

| CHRISTINE M. GORJANC | | Director Nominee

Age 67 |

Ms. Gorjanc currently serves as an independent director for various public companies, including as a member of the board of directors of Shapeway Holdings, Inc., a publicly-traded digital manufacturing platform since April 2023. Since November 2015, Ms. Gorjanc has served on the board of directors of Invitae, Inc., a genetic testing and services company, where she serves as a chairman of the audit committee as well as a member of the compensation committee. Ms. Gorjanc briefly served as the Interim Chief Executive Officer of Invitae, Inc. from July until August 2023. Following her time as Interim Chief Financial Officer, Invitae, Inc. entered into Chapter 11 of the Bankruptcy Code in February 2024. In May 2019, Ms. Gorjanc joined the board of Juniper Networks, Inc., a leader in secure AI driven networks where she is the lead director and serves on the audit committee. From March 2021 to October 2022, Ms. Gorjanc also served on the board of directors of Zymergen, Inc., a biotechnology company, where she served on the compensation committee and audit committee. Ms. Gorjanc served as the Chief Financial Officer of Arlo Technologies, Inc., an intelligent cloud infrastructure and mobile app platform company, from August 2018 to June 2020. She previously served as the Chief Financial Officer of NETGEAR, Inc., a provider of networking products and services from January 2008 to August 2018, where she also served as Chief Accounting Officer from December 2006 to January 2008 and Vice President, Finance from November 2005 through December 2006. Prior to joining NETGEAR, Inc., Ms. Gorjanc served in a number of roles including Vice President, Controller, Treasurer, Tax Director and Assistant Secretary for Aspect Communications Corporation, a provider of workforce and customer management solutions, from September 1996 through November 2005. Ms. Gorjanc served as the Manager of Tax for Tandem Computers, Inc., a provider of fault-tolerant computer systems from October 1988 through September 1996, Ms. Gorjanc served in management positions at Xidex Corporation, a manufacturer of storage devices, and spent eight years in public accounting. Ms. Gorjanc has also received her director certification from the NACD (National Association of Certified Directors).

Qualifications. The Board believes that Ms. Gorjanc is well qualified to serve on the board because of her extensive experience in finance and accounting as well as her executive experience serving in positions that she has held at various public companies. Ms. Gorjanc was nominated to the Board by a non-management director.

| | | | | | | | |

| MICHAEL B. HODGE | | Director since 2024

Age 51 |

Mr. Hodge has served as a Principal at EVE Partners, a private equity firm focused on logistics, since October 2011 and is the Co-Founder of EVE Atlas, a venture capital firm focused on logistics. Mr. Hodge currently serves as the Chairman of Energy Transport Logistics and Point Dedicated Services and serves as a board member of Integrity Express Logistics and Rothschild Investment Corporation. Prior to joining EVE Partners in 2011, Mr. Hodge was the Founder and Managing Partner of Hilliard Street Capital, a long/short equity hedge fund where he served as its Chief Investment Officer from 2008 until 2011. Mr. Hodge was also the Chief Executive Officer and Chief Financial Officer of Skybus Airlines from 2007 to 2008. From 2002 to 2007, Mr. Hodge was the Co-Head of Tiger Management, a multi-billion-dollar family office managing the assets of Julian H. Robertson, Jr. From 1997 to 2000, he was also a Managing Director at Tiger Management. From 1994 to 1997, Mr. Hodge was a foreign currency trader at Bankers Trust. As more fully discussed above, Mr. Hodge was selected as a designee of EVE to join our Board pursuant to the EVE Shareholders Agreement. Mr. Hodge graduated magna cum laude from Princeton University in 1994 with an A.B. degree in Economics and a certificate in Politics. Mr. Hodge also holds an M.B.A. from the Harvard Business School.

Qualifications. The Board believes that Mr. Hodge’s industry and investment management experience will provide the Board significant insight into the Company’s management, strategy and investment decisions. Mr. Hodge was nominated to the Board by a security holder.

| | | | | | | | |

| GEORGE S. MAYES, JR. | | Director since 2021; Chairman since 2024

Age 65 |

Mr. Mayes was appointed to the position of independent Chairman of the Board on February 6, 2024. Mr. Mayes also serves as Founder and Chief Executive Officer for LeanVue, LLC, which provides strategic analysis for global supply chain design and strategy development for managing complex global supply webs. From 2013 to 2015, Mr. Mayes was Chief Operating Officer for Diebold, Inc., a global leader in automated teller machine manufacturing and service. He was selected to serve as interim Chief Executive Officer in 2013. From 2005 to 2012, Mr. Mayes held leadership roles in global operations and supply chain management at Diebold. Prior to that role, he was Chief Operating Officer for Tinnerman Palnut Engineered Products, LLC. He also served as Vice President of Manufacturing for Stanley Fastening Systems. Mr. Mayes is currently a board member for Stoneridge, Inc. Mr. Mayes served in the United States Army from 1980 to 1985. He holds a bachelor’s degree in Engineering from the United States Military Academy at West Point.

Qualifications. The Company believes that Mr. Mayes provides in-depth knowledge of operations, business acumen and leadership to the Board, which strengthens the Board’s collective qualifications, skills and experience. The Board believes that Mr. Mayes utilizes that experience in his service as a member of the Corporate Governance and Nominating Committee.

| | | | | | | | |

| JAVIER POLIT | | Director since 2021

Age 59 |

Mr. Polit is an experienced Fortune 100 Chief Information Officer, with extensive experience across consumer goods, retail and financial services. In December 2023, Mr. Polit was appointed as Executive Vice President, Chief Information Officer - Information Technology of Costco Wholesale Corporation. From 2020 until 2023, Mr. Polit served as Chief Information Officer for Mondelez International (formerly Kraft Foods). From 2017 to 2020, he was Chief Information Officer for Procter & Gamble Company. Prior to that role, he served as Group Chief Information Officer for Coca Cola Bottling from 2007 to 2017 and as Global Director Customer Solutions, Business Intelligence and Distributions for the Coca Cola Company from 2003 to 2007. Mr. Polit was also Vice President, Global Corporate Systems for Office Depot and Vice President Information Technology for NationsBank NA. Mr. Polit is a member of the University of Miami President’s Advisory Board and the Professional Advisory Board of ALSAC/St. Jude Children’s Research Hospital. Mr. Polit is a graduate of the Advanced Management program at Harvard Business School. He holds a Master of Science from Barry University, a Masters of International Management from Budapest University of Technology and Economics and a Masters in International Business Management from TiasNimbas Business School. He also holds an MBA from Purdue University and a bachelor’s degree in Business Administration from the University of Miami.

Qualifications. The Board believes that Mr. Polit brings deep B2B technology expertise including cybersecurity, data, digitization across multiple industries and complex organizations. He has helped drive digital transformation in large scale and has operated at the highest levels of Fortune 100 global companies where he contributed to technology strategy. The Board believes that Mr. Polit utilizes that experience in his service as a member of the Audit Committee.

| | | | | | | | |

| LAURIE A. TUCKER | | Director since 2019

Age 67 |

Ms. Tucker has served as the Founder and Chief Strategy Officer of Calade Partners LLC, a marketing consultancy firm, since January 2014. She previously served as the Senior Vice President, Corporate Marketing of FedEx Services, Inc. (“FedEx”), a subsidiary of FedEx Corporation, from 2000 until she retired in December 2013. She was employed by FedEx in various capacities of increasing experience and responsibilities since 1978. Ms. Tucker has served as a director of publicly traded companies, such as, Bread Financial Holdings, since May 2015 and Iron Mountain Incorporated from May 2007 to May 2014. Ms. Tucker holds a B.B.A. in Accountancy and an M.B.A. in Finance from the University of Memphis.

Qualifications. Ms. Tucker’s 35 years of experience at FedEx provide the Board with valuable insight with respect to corporate marketing strategies and large-scale operations. The Board believes that her experience overseeing finance, pricing, and customer technology will benefit her as the Chair of the Corporate Governance and Nominating Committee.

Shareholder Vote Requirement

The affirmative vote of a plurality of the votes cast by the shareholders entitled to vote at the Annual Meeting is required for the election of directors. Under the plurality voting standard, you may vote “FOR” or “WITHHOLD” authority to vote for each nominee. Votes to “WITHHOLD” with respect to any nominee and broker non-votes are not votes cast and will result in the applicable nominee(s) receiving fewer votes cast “FOR” such nominee(s).

In the event any director nominee receives a greater number of votes “WITHHELD” from his or her election than votes “FOR” such election, he or she shall tender his or her resignation for consideration by the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee shall recommend to the Board the action to be taken with respect to the resignation. The Board will publicly disclose its decision with respect to such resignation within 90 days of the certification of the election results.

Recommendation of the Board

Our Board recommends that shareholders vote “FOR” the eleven nominees recommended by the Board.

CORPORATE GOVERNANCE

Independent Directors

The Company Common Stock is listed on The Nasdaq Stock Market LLC (“Nasdaq”). Nasdaq requires that a majority of the Company’s directors be “independent directors,” as defined in Nasdaq Marketplace Rule 5605. Generally, a director does not qualify as an independent director if, among other reasons, the director (or in some cases, members of the director’s immediate family) has, or in the past three years has had, certain material relationships or affiliations with the Company, its external or internal auditors, or other companies that do business with the Company. The Board has affirmatively determined that all of the Company’s current directors are “independent directors” on the basis of Nasdaq’s standards and a review of each director’s responses to questionnaires asking about any material relationships or affiliations with us.